[Updated April 23] This week’s announcement by the US Trump administration of tariffs on global imports is more wide-ranging that Trump 1.0 and ’tariff stacking’ could mean vehicle makers and parts suppliers face much higher costs.

Last updated April 23

Global carmakers and auto parts suppliers are trying to gauge what the US Trump administration’s enforcement of 25% tariffs on vehicle imports will cost and how that will accrue when tariffs on parts are added no later than May 3, alongside ‘reciprocal’ tariffs on trade from countries like China, Mexico and Canada.

Some of these tariffs may be stacked on top of each other, compounding the effect on automakers and the risk to automotive supply chains. Automotive Logistics has broken down what can be stacked and when, according to our latest understanding of the tariff enforcement. We will update this article as more information becomes available.

Which vehicle parts face tariff stacking?

Once the 25% tariff on vehicle parts comes into play on May 3, the below products face tariff stacking:

- Chassis and drivetrain parts

- Electrical and electric components in vehicles

- Engines and their parts

- Tyres and tubes

- Miscellaneous parts, such as brake fluid, radiator parts, and vibration control systems.

Which vehicle parts cold be exempt from tariff stacking?

Exemptions to the tariffs currently include parts that are used in the automotive industry but not directly classified as auto parts, such as:

- Electrical connectors that may be classed differently from typical automotive parts

- Battery packs, which could fall under a different tariff code

- Components for autonomous vehicle technology.

Parts such as semiconductors still face tariffs which, at the time of publishing, have not yet been announced.

For more detail on what could be exempt from automotive tariff stacking, see the table below.

Can automotive tariffs and USMCA tariffs be stacked?

As of 23 April, these are the stackable tariffs facing the automotive industry affecting vehicle imports from Canada and Mexico:

- 25% tariff on all imported vehicles

- 25% tariff on all imported goods to the US (Also referred to as the International Emergency Economic Powers Act tariff, or IEEPA tariff, or fentanyl tariff), which is stacked onto the vehicle tariff, equalling 50% total tariff

- If non-compliant with USMCA rules, additional 2.5% tariff stacked on top of the IEEPA 25% tariff, and 25% vehicle tariff equalling 52.5% in total

- If USMCA-compliant, 25% auto import tariff still applies.

Overview of the application of US tariffs since ’Liberation Day’

The impact of the new US trade policy includes the potential cumulative effects of ‘tariff stacking’, which relates to other tariff proposals, the range and variety of the parts covered from next month, and the multiple border crossings made as vehicle subassemblies come together. That would increase the price of complex systems, such as the powertrain, even if they are assembled in the US.

The picture is further complicated by the wider application of US ‘reciprocal’ tariffs on international trading partners (although most have now been rolled back since ‘Liberation Day’) and the fact that those tariffs are applied so unevenly across countries.

The new tariffs remain high for China, with Trump adding additional tariffs of 145% to imports from China. When combined with previous tariffs on imports from the country, the total for Chinese imported goods now stands at 245%. China has also retaliated with 125% tariffs on US goods being imported to China.

For the latest in the tariff timeline, see our infographic here

According to managing director and head of supply chain advisors at Drewry maritime analyst, Philip Damas, much higher tariffs on Chinese goods will prompt favoured south-east Asian neighbours to prepare an influx of factories relocating if these tariffs are permanent. “Malaysia, Indonesia and the Philippines were already positioning themselves to attract investments, particularly in electronics and automotive manufacturing,” said Damas.

Product groupings

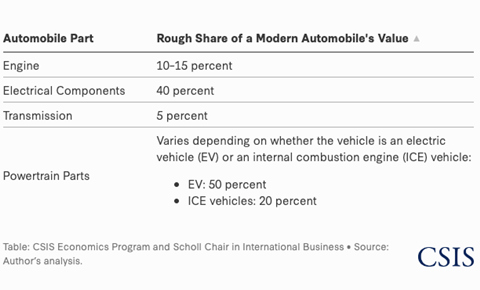

The articles subject to the tariffs include those covered by the Harmonised Tariff Schedule and the six product groupings established by the Office of Transportation and Machinery covering bodies and parts, chassis and drivetrain parts, electrical and electric components, engines and their parts, tyres and tubes and those grouped under miscellaneous parts, including everything from brake fluid and radiator parts to vibration control systems. Broadly the tariffs on engines, transmissions, powertrain parts and electrical components will have major impacts on vehicle prices because they make up the large majority of a finished vehicle’s value.

| Tariff exemption categories (subject to review) | Possible examples | |

|

1. Parts used in the automotive industry but not directly classified as auto parts |

|

|

|

2. Parts that don’t fall within the specific tariff codes |

|

|

|

3. Parts deemed not significantly related to motor vehicles |

|

|

Source: US government/AIAG

In addition to the tariffs on vehicles and parts, the US Trade Representative is also proposing a specific tariff of $1m+ on ocean carriers’ based in China or carriers operating a vessel made at a Chinese shipyard. Carriers are also subject to penalties if they have one or more vessels on order in China.

Exemptions to the tariffs currently include parts that are used in the automotive industry but not directly classified as auto parts, those that don’t fall within the tariff codes, or those deemed not significantly related to motor vehicles.

Those parts categorised as not falling under the tariff codes include automotive components such as electrical connectors that may be classified differently from typical automotive parts, according to the Automotive Industry Action Group (AIAG). Importantly for the production of electric vehicles that can include battery packs, which could be classified under a different tariff code (such as for electric storage components. It also includes alternative parts, such as components for autonomous vehicle technology, which may not fall under traditional auto part codes (see table below).

According to Drewry, the new tariffs will reshape international trade and transport. “Carriers, shipping lines and airlines alike will need to rethink their strategies and business models, adapting to new realities, prioritising protectionism, regional trade and strategic alliances, over the previously unfettered flow of goods and services across borders,” said Damas.

Section 232 investigation

The application of the tariffs on vehicles and parts follows an investigation by US Secretary of Commerce Howard Lutnick which concluded in February that finished vehicles and certain parts imports threatened to impair national security of the US under section 232 of the Trade Expansion Act. On March 26, Trump stated that supply chain problems experienced by US automotive manufacturers in recent years coincided with “unfair subsidies and aggressive industrial policies” abroad, which resulted in only half of the vehicles sold in the US being manufactured domestically. That situation jeopardised the US industrial base and national security, according to Trump, stagnating automotive production since 2019.

Those tariff rates imposed as a response could be cumulative, according to the Center for Strategic and International Studies (CSIS). It said automotive imports would not simply face a 25% import rate but would likely face the accumulation of the existing most favoured nation (MFN) rates, reciprocal tariff rates, the 25% vehicle import rate, and whatever additional barrier the Trump administration may decide to implement in the future.

The CSIS provided an example scenario of the estimated value shares and cumulative impact of tariff-affected auto components adding up to more than 100% (see table).

In a statement issued on April 3, Dr Ngozi Okonjo-Iweala, director-general of the World Trade Organization, the tariff announcements will have “substantial implications for global trade and economic growth prospects”.

Okonjo-Iweala said that while the situation is rapidly evolving, initial WTO estimates suggest that the measures so far introduced in 2025 could lead to an overall contraction of around 1% in global merchandise trade volumes this year and a downward revision of nearly four percentage points from previous projections. “I’m deeply concerned about this decline and the potential for escalation into a tariff war with a cycle of retaliatory measures that lead to further declines in trade,” he said.

Trump tariffs: A timeline of impacts on automotive logistics

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

Currently reading

Currently readingImpact of the new US trade policy includes the potential cumulative effects of ‘tariff stacking’

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

No comments yet