Now in its 15th year, BMW’s joint venture with Brilliance China Automotive – BMW Brilliance Automotive (BBA) – is adopting a more multimodal approach to its outbound vehicle logistics in the country, and there are a number of reasons for that, according to the company’s vice-president of logistics and strategy, Franz Decker.

One reason is the enforcement of China’s new regulation on semi-trailer equipment used to haul vehicles. The GB1589 (2016) rule limits the length of such semi-trailers to 17.1 metres, which includes flat truck and trailer (long head trucks and trailers are limited to 18.1 metres), with a maximum permissible width of 2.55 metres and a maximum height of 4 metres. Central axle trucks are allowed to be 22 metres long.

BMW indicates that the regulation, being phased in over two stages, will result in a loss per transporter of between six and eight units from a previously typical load of 12-14 passenger vehicles.

BBA was previously moving 100% of the vehicles assembled at its Dadong and Tiexi plants in Shenyang by road – totalling 386,500 last year. The loss in capacity because of the regulation means alternatives must be now be sought, however.

“GB1589 means you take around 30%, more or less, out of the market from a capacity point of view,” says Decker. “The overall capacity of train and ship can probably make it up but in some areas it will be tight and in some timeframes it will be tight as well. This phase is one which could be exciting!”

However, BBA has been ahead of the game in its plans for adopting a more multimodal approach. According to Decker, the carmaker was talking about the transition three years ago and now just 35% of vehicles are going exclusively by truck from the plant to local regions in the north. Rail, meanwhile, now accounts for a much greater percentage of overall movement from the plant.

“If you look at what we take out of Shenyang, about three-quarters goes out by train, exactly 76.6% in fact,” says Decker.

More than half of the vehicles leaving by rail (50.3%) are moved onto ocean vessel from the port of Dalian for onward transport down the coast to the ports of Shanghai, Ningbo and Guangzhou.

“Overall, 50% of BBA’s volume is for the provinces,” confirms Decker. “Vehicles are transferred to truck again out of the ports, with last mile distribution all by truck.” Nevertheless, the big distances are now being covered by train or by ship, he says.

As far as vehicle imports by rail are concerned, BMW is only moving 10% of the volume from European plants to China by this mode, though its parts and CKD imports are sizeable and it has been running inbound shipments from Leipzig in Germany to Shenyang since 2011 with DB Schenker.

Quality improvementsThe move to rail and ocean has resulted in an improvement in quality because it removes several handover stages that road hauliers made when distribution over China’s vast distances was exclusively handled by truck. Reloading vehicles at multiple hub operations is where the main danger of damage to vehicles lies, says Decker.

He says the move to rail did not require significant expenditure by the carmaker, though at the same time it is not a big cost saving, he admits. In fact, the cost of rail transport for finished vehicles in China is going to increase as more carmakers turn to it in the wake of the GB1589 regulation and volumes rise.

BBA is using China Rail Special Cargo as its rail provider, though it does so through intermediate logistics providers which contract the services. That is because China Rail still needs to come up to BMW’s supplier standard, according to Decker.

“It isn’t that we are not talking with [China Rail]. We sometimes even talk about prices with them. But at the end of the day, if you want normal procedures – for example, so the supplier knows where the cars are or what to do if the handling goes wrong – China Rail is not yet flexible enough; they are on the way but not there yet.”

Ports of entryHowever, capacity is a more pressing issue at the ports, many of which are not developed enough yet to handle China’s increasing domestic and import/export trade. BMW is the biggest importer of vehicles (followed by Mercedes-Benz and Lexus) and Germany is the top country of origin.

The flow of vehicles to and from China, as well as a growing number of domestic moves along its coast, pose multiple challenges. Previously, the Chinese government allowed only a few ports to import vehicles into the country: Shanghai, Tianjin, Guangzhou, Qinzhou and Dalian. Over the last decade, licences have been granted to the ports of Fuzhou, Ningbo Zhoushan, Qingdao and Zhangjiagang, but adequate infrastructure for multimodal transfer lags behind.

BBA’s Ningbo DDA will provide storage for more than 5,000 vehicles, along with PDI services

BBA’s Ningbo DDA will provide storage for more than 5,000 vehicles, along with PDI servicesAccording to BMW Brilliance Automobiles, 51% of the vehicles handled through its decentralised distribution facilities, such as the Meixi ro-ro terminal, will be dispatched on multimodal routes combining rail and water, while 14% will be sent exclusively by rail and the remainder by road.

BBA has said that transport channels using rail and water reduce the amount of carbon emitted, making its outbound logistics more environmentally friendly.

The Ningbo DDA will work with BBA’s first distribution facility in Shanghai port to support the complete network of transport and storage along China’s eastern coast. Covering 136,475 sq.m, it will provide storage for 5,000-plus vehicles and its pre-delivery inspection (PDI) building will provide maintenance, washing and quality checking services. Value-added services include a reduction in the lead time for distribution by starting pre-haul dispatch while the vehicle is waiting for financial release.

Huatong Logistics set up the distribution facility along with Ningbo Zhoushan Port Group and Zhejiang Haigang Investment and Operation Group. It is the first project to be completed as part of a strategic agreement on East China regional logistics warehousing that Huatong has signed with its partners to support multimodal transport in China. The company said it expected to attract more car brands to use the Meixi ro-ro terminal for foreign and domestic trade and develop it into a distribution centre for finished vehicles in east China as part of the ‘One Belt, One Road’ trade link initiative being promoted by the Chinese government.

That said, BBA is now at the biggest ports in China, something it never was in the past except for import volumes through the port of Dalian. Decker says that being in those ports gave the company a totally different connection than in other areas of China, based on a closer relationship with the local economic network.

This development has come out of BBA’s switch to a more decentralised strategy for distribution in China, as seen most recently in the opening of its facility at Ningbo Zhoushan port, the world’s busiest port in terms of cargo tonnage.

The company opened the facility at the Meixi ro-ro terminal in April this year. More accurately, BBA refers to the facility as a decentralised distribution area (DDA) and it is the fifth such facility that it has opened in China. There are two others at the ports of Shanghai and Guangzhou, as well as inland DDAs at Xi’an and Chengdu. There are plans under discussion to open another such facility in Zhengzhou and the number is expected to continue growing as sales of BMWs increase.

Around 95% of BMW sales in China are from stock, and with the company’s emphasis on speed of delivery to custom specifications, these DDAs allow dealers and customers to receive vehicles more quickly.

[mpu_ad]In terms of the greater cohesion with the economic network, Decker says that with the previous centralised distribution network, the carmaker did not have contact with the regions and that it was simply a case of putting the cars on a truck and sending them off.

“Now, with the decentralised structure there is much more contact with the regions, which means much closer contact with the dealers, but also with the surrounding economy and development,” he says. “It is more about being somewhere in the whole of China, not just in the north, and being closer to what is happening regionally.”

The main advantages of establishing a decentralised network of distribution facilities relate to delivery times to dealers and the ability to develop logistics services around China. Decker says the DDAs have halved delivery time to dealers versus centralised distribution from Shenyang.

“There are also pure logistics advantages because with a decentralised area you have your overall warehouse spread around the country,” he points out. “A central warehouse would be much too big. You would have to split it anyhow and by splitting it in the areas where [vehicles] are already close to the customer, there is an advantage.”

LSP supportThe latest DDA in Ningbo is being managed by Huatong Logistics and is storing and processing vehicles shipped by coastal vessel from Dalian. Onward distribution is by truck to dealers in the Zhejiang and Fujian provinces in China, and Huatong is also doing some of the transport to the hinterland. The logistics provider has said it expects to eventually handle 100,000 vehicles through the facility each year for the carmaker (see box, above).

Huatong Logistics is one of eight logistics service providers which BBA is working with for its decentralised approach to vehicle distribution, and there is a good mix of domestic and international companies involved. They include Beijing Changjiu Logistics, Gefco and NYK amongst others.

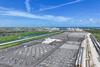

China’s GB1589 rule has limited the length and width of car transporters, with the result that BMW Brilliance is looking to increase multimodal carriage

China’s GB1589 rule has limited the length and width of car transporters, with the result that BMW Brilliance is looking to increase multimodal carriage“For every new DDA, we do a normal tendering process and, of course, there is a quality gate at the beginning to see whether the companies applying are qualified to be in the process; not everybody is,” explains Decker.

From there, the normal tendering process applies, looking at quality, cost and additional services.

“Normally we bundle services for things like warehousing and certain parts of the transport by using a 4PL principle to make sure the quality on the different transport legs is not just measured by us, but by somebody else who has stringent quality standards,” says Decker.

The carmaker has a contract with Beijing Changjiu Logistics to move vehicles between Shenyang and Shanghai. In turn, Beijing Changjiu has a partnership with Lingang Modern Logistics to move BBA volumes down the coast. CDC International Logistics, a subsidiary that is owned 70% by Changjiu and 30% by the port of Dalian, will be responsible for the sea voyage by ro-ro vessel via its wholly owned Kingfour Marine, with three 2,100-unit capacity vessels.

Tracking via mobile phonesAs was made clear at the opening of the Ningbo DDA in April this year, digitalisation is playing its part in BBA’s outbound logistics strategy in China – and this is being helped by the willingness among personnel to embrace handheld technology in a way not seen in Europe.

Tracking is obviously crucial to the efficient and quality-led distribution of vehicle volumes over such a vast country and this is done almost exclusively by using the mobile devices the truck drivers carry combined with the latest technology to bring this information together. Decker says that in China, it is possible to achieve transparency on shipments purely based on mobile applications.

“In China you don’t need a GPS in every truck because it is enough to have the driver’s mobile and [the driver] has no problem with that,” says Decker, suggesting that drivers there are generally not as sensitive to issues of privacy. “There are differences between Europe and China in the way you do the digitalisation. The normal consumer or associate here is used to doing a lot with a mobile phone that we would never think of in Europe, or wouldn’t dare to.”

For Decker, the exciting bit is integrating the information and gradually moving to the point where BBA will have real end-to-end transparency from production to dealer.

"With the decentralised structure there is much more contact with the regions, which means much closer contact with the dealers, but also with the surrounding economy and development… There are also pure logistics advantages. A central warehouse would be much too big. You would have to split it anyhow and by splitting it in the areas where [vehicles] are already close to the customer, there is an advantage." - Franz Decker, BBA

Last year’s production at the Dadong and Tiexi plants hit 386,500 units

Last year’s production at the Dadong and Tiexi plants hit 386,500 unitsWhile last year’s production at the Dadong and Tiexi plants hit 386,500 units, total BMW vehicle sales in China were around 560,000 with imports from BMW plants around the world, including the X5 from Spartanburg in the US.

At the same time, BBA has been looking at trial exports out of China, and while this is not viable at the moment, China has made significant moves recently to open up trade on more equitable terms than in the past (or than an increasingly protectionist US). What is more, its partner in China, Brilliance Automobile, is the fourth-biggest exporting carmaker.

These moves include a recent announcement that China will relax equity restrictions for foreign carmakers over the next five years, something that will have a major impact on the country’s position as an exporter of vehicles. For the last two decades, it has restricted foreign carmakers wishing to manufacture in the country to doing so only as part of a joint venture in which they may own a maximum of 50%, something that led BMW to set up with Brilliance Automobile.

These restrictions, which have resulted in foreign automotive manufacturers making cars mainly for the domestic market, are now being removed following a policy proposal introduced last year by the National Development and Reform Commission (NDRC) in China.

Another major factor is China’s One Belt, One Road economic and trade plan, which is designed to boost infrastructure and trade links with Europe, Central Asia and Africa. It has already led to rapid growth in exports. Last year, the country exported 923,000 vehicles, an increase of more than 30% year-on-year, according to figures from the China Automotive Technology and Research Centre (CATRC). Notably, Iran was one of the more significant export locations last year, followed by Chile and Mexico. CATRC forecasts that by 2025 there could be 5m vehicles exported from China.

Xi Jinping has also said the country will greatly reduce its current 25% import duty on foreign-made cars as part of wider efforts to increase imports and reduce its trade surplus with other countries.

Automotive Logistics questioned Franz Decker on the significance of import and export trade for BMW and its joint venture in China in this context…

BMW Brilliance’s vice-president of logistics and strategy, Franz Decker

BMW Brilliance’s vice-president of logistics and strategy, Franz DeckerQ&A: Franz Decker, BMW Brilliance

China has been exporting small volumes of the 1-Series from China to Mexico since January this year, as part of a so-called enabling project. It will move 1,000 this year. Are there long-term plans to grow this?This project is for us to understand how export is working from China to the rest of the world, so it is an enabling project in its true sense. To be frank, at the moment, there is not really a business case. The focus is on enabling, and not just for export but how the custom imports side works.

We now have bonded areas in Shenyang, Shanghai and Tianjin, and the whole process involves parts imports to exporting the cars and all the intermediate processes. We now know how it works and what you can and cannot do, and yes – we have had discussions about what we can export in future but at the moment nothing is decided.

More generally, do you think that the more open policy on trade being shown by the Chinese government, along with the Belt and Road initiative, is likely to benefit BMW’s export of vehicles in the future?It very much depends on whether it leads to corresponding action with the other trade partners. For example, exports are also a question of customs duties, especially from China to the rest of the world – it is not just a question that China has high duties but other countries have high import duties on Chinese cars as well. Every opening-up will lead to a better situation on the import and the export side.

[related_topics align="right" border="yes"]China is to phase out its equity restriction on foreign carmakers setting up production in the country. Will BMW establish a standalone plant alongside its existing joint venture?This is only speculative because nobody really knows what the specific laws of this regulation will be. For us, we have a very successful partnership with our partner and there is no real reason to do it differently.

It is definitely different for companies who are not in China yet. For them, it makes a difference – no question. For the established joint ventures, all of us see the benefits of having the joint venture partners besides the pure business case logic and we don’t want to jeopardise that.

What about the promise of lower tariffs on imports?I am not sure in the end whether it would have a positive or a negative effect for Chinese production as a whole because I believe it would actually be a win-win in terms of the overall volume [which would] increase. Obviously, if you take the customs or duties out of the system you will have a more attractive offer for the customers that will have an effect on demand…[but] it very much depends whether it leads to corresponding action with the other [trade] partners.