Following a week of negotiations and trade wars, Automotive Logistics looks at what has changed for the automotive supply chain globally, and what effects are already being seen in regional supply networks.

Trade negotiations and retaliatory measures have been in full swing after US president Donald Trump’s tariff sweep, and subsequent reelback on some tariffs. While the situation is constantly changing, the effects of the tariff announcements on supply chains has been huge. Even as reciprocal tariffs have been paused for 90 days and replaced with a 10% global tariff (aside from China, which at the time of publishing is expecting tariffs on imports to the US of 145%), the uncertainty alone has caused OEMs to shift supply chain networks, re-evaluate production volumes, and even pause exports to the US.

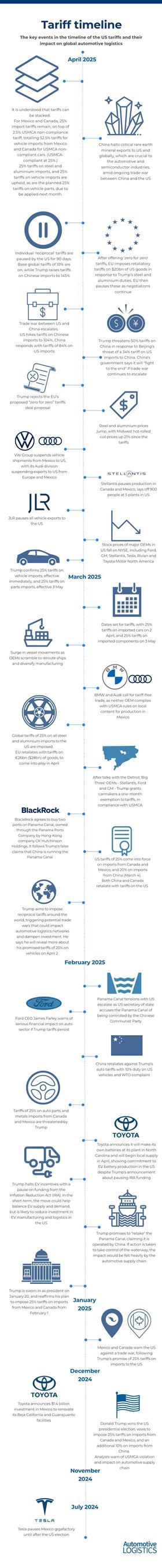

Explore the full tariff timeline in our infographic

While the dust settles for the next three months on reciprocal tariffs, the tariffs of 25% on steel and aluminium, vehicle imports, and soon vehicle parts, we can assess what the affect has been for regional automotive logistics and supply chain networks across the globe.

What has changed for the automotive supply chain?

On what US president Donald Trump called “Liberation Day”, 2 April, he announced 25% tariffs placed on all vehicle imports from the US, effective immediately, and confirmed the 25% tariffs on imports of vehicle parts to the US from next month on 3 May. The list of parts that will be affected includes engines, powertrains and electrical components. Vehicles that comply with USMCA trade rules will be exempt temporarily, with importers only having to pay the 25% tariff on the non-US content. So far, this hasn’t changed.

At the same time, Trump announced a tariff of at least 10% on all imports globally, taking effect on 5 April. However, vehicles, car parts, and steel and aluminium imports already subject to tariffs will not be subject to the additional reciprocal tariffs. He then added higher individualised reciprocal tariffs, which came into effect on 9 April. After much negotiating and trade talks, these higher individualised tariffs were scrapped – aside from those placed on China. These have only increased, and at the time of publishing now stand at 145% for Chinese imports to the US.

The impact on OEMs and suppliers in Mexico and Canada

Following Trump’s tariff announcement, stock prices of major OEMs in the US fell across the board on the NYSE, including Ford, GM, Stellantis, Tesla, Rivian and Toyota Motor North America.

OEMs began to take action to mitigate risk, with JLR pausing all vehicle exports to the US, Stellantis halting production in Canada and Mexico and laying off 900 people at 5 plants in the US, and VW Group suspending vehicle shipments from Mexico to US, with its Audi division suspending exports to the US from Europe and Mexico.

As it stands now, US tariffs on Mexico and Canada of 25% will still stand, despite the 90 day pause. Canada has now retaliated, placing 25% tariffs on US-produced vehicles that are not USMCA-compliant, as well as non-Canadian and non-Mexican content of USMCA-compliant vehicles. This leaves GM, Ford and Stellantis at risk, as vehicles imported to Canada from the US that are compliant with the USMCA may still be taxed on their parts. The Canadian government left some room for relief in the form of remissions, where OEMs could potentially mitigate tariffs by investing in Canada.

Europe pushes back against rising US metal duties

While Europe can breathe a careful sigh of relief now that reciprocal tariffs have been paused, its supply chains are still being massively affected by Trump’s tariffs on steel and aluminium.

Following Trump’s announcement of 25% tariffs on the metals, steel and aluminium prices jumped, with Midwest hot-rolled coil prices up 21% since the tariffs of 25% were placed on the materials.

This is something that the European Commission is fighting against, and this week it voted to approve a proposal to introduce trade countermeasures against the US steel and aluminium tariffs, following a meeting with automotive industry representatives including BMW, VW Group and Stellantis.

However, automotive supply chains in Europe, and indeed the US, are still at risk due to the tariffs on China and China’s rising retaliatory tariffs.

China trade war escalates, threatening EV supply chains

Trade negotiations between the US and China are tense and ramping up. Earlier this week, Trump hiked tariffs on Chinese imports up to 104%, and China responded with tariffs on US imports of 84%. Now, China faces 145% tariffs on all imported goods to the US, and China has responded with tariffs of 125% on US goods.

The escalations threaten the automotive industry in America, as customs data shows the US shipped around $3.1 billion worth of vehicles to China last year. The move has caused Tesla to halt new orders in China on US imported models.

Europe may be affected by the trade war between China and the US too, as its EV supply chain is closely linked and reliant on Chinese imports to the continent. However, it may be more insulated against risk due to Europe’s growing self-reliance and localised EV supply chain networks.

We will update this story as more information becomes available.

Topics

- Analysis

- Audi

- BMW

- Contract Compliance & Risk Assessment

- Cross-Border Logistics

- Editor's pick

- Electric Vehicles

- EV & Battery Production

- features

- Finished Vehicle Logistics

- Fleet & Route Optimisation

- Ford

- GM

- JLR

- Nearshoring

- North America

- OEMs

- Ports and processors

- Risk Management

- Shipping

- Stellantis

- Supply Chain Planning

- Supply Chain Purchasing

- Tesla

- Trade & Customs

Trump tariffs: A timeline of impacts on automotive logistics

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

Currently reading

Currently readingHow Trump’s changing tariffs are disrupting automotive supply chains across China, Mexico, Canada and the EU

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

No comments yet