This year’s IAA motor show in Frankfurt, Germany was notable for the continued focus on vehicle electrification, with carmakers committing to more electric vehicle (EV) models and options in the coming years. Governments, meanwhile, from the UK and France to China, have recently announced plans to shift away from combustion engines in the coming decades. EV production and sales are expected to increase markedly in the short and medium term.

This year’s IAA motor show in Frankfurt, Germany was notable for the continued focus on vehicle electrification, with carmakers committing to more electric vehicle (EV) models and options in the coming years. Governments, meanwhile, from the UK and France to China, have recently announced plans to shift away from combustion engines in the coming decades. EV production and sales are expected to increase markedly in the short and medium term.

For the supply chain, EV growth presents a number of challenges and opportunities, notably in the handling, transport and storage of lithium cells and batteries, which are used to power most EV batteries. These products are classified as hazardous goods and strictly regulated by transport mode, with limited opportunities to combine or use standard freight options.

About 80% of the supply of these products comes from Japan, South Korea and China, requiring long supply chains for the manufacture and distribution of batteries and EVs in Europe and North America, for example.

In response, Swiss-based logistics provider Kuehne + Nagel (KN) has used the IAA to launch a new service, KN BatteryChain, that includes international certifications for handling lithium-ion goods. The service, which has begun from Japan and South Korea to several locations in Germany, offers automotive manufacturers, cell and battery producers, as well as other high tech clients, a standard process to transport and pack these products across transport modes, warehousing as well as end-of-life recycling.

Dr Detlef Trefzger, chief executive officer at KN, described the offering as an industry first, combining certifications for dangerous goods together with international ISO quality standards for the automotive industry. While the logistics chain for these products remains bespoke to standard freight flows, the certifications mean that KN’s established transport partners, including airlines, have agreed to ship lithium-ion products handled by the logistics provider.

Such agreements are not so easy to come by. The average lithium-ion vehicle battery weights 300kg, equivalent to about 1,500 smart phone battery packs, with airlines and other freight providers strictly limited in how much they are able to carry.

“Recent incidents, such as fires aboard airplanes caused by lithium batteries, have brought to life the risk when these batteries are not adequately packed, labelled or stored,” said Trefzger, speaking at a press conference at the IAA. “Burning lithium cells cannot be extinguished, it’s impossible, and therefore they are a power source that faces strict dangerous goods regulations for transport and non-compliance for fines and penalties.”

Certified for the future [mpu_ad]

Establishing the certification and processes across the supply chain has been around a year in the making, Trefzger added. KN has partnered with a packaging provider to use a fire-resistant cover for batteries and cells that will contain a fire for up to six hours, giving aeroplanes enough time to make an emergency landing. Every KN employee expediting a lithium-ion consignment has also received special training along with legally required dangerous goods training.

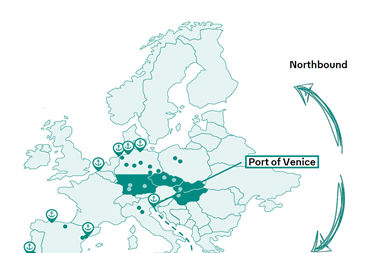

The service has begun with shipments available out of Tokyo, Japan and Seoul, South Korea, to Frankfurt, as well as two other locations in Germany, with plans to certify more locations in the pipeline, said Trefzger.

Transport and storage processes have been certified by international organisations for ocean, air freight and land transport. The KN processes have also been certified according to the automotive international quality standard ISO16949, and German VDA standard 6.2.

“Lithium batteries can be transported and stored safely it they are handled with the right process and care,” said Trefzger. “If you deviate, the danger increases.”

The expected volumes for EVs in the coming years will mean that manufacturers won’t be able to afford delays or penalties in the battery supply chain, according to Trefzger, who pointed to forecasts by the International Energy Agency that the global fleet of EVs will rise from around 2m today to 9m by 2020. PwC Autofacts, a forecasting consultancy, predicts that global sales of all alternative propulsion vehicles, including mild hybrids, plug-in hybrids, fully electric and fuel cell vehicles will rise from fewer than 4m units in 2016 to more than 13m per year by 2023.

With this growth, aftermarket requirements will also rise substantially, including for recycling of lithium batteries, which also must follow specific international standards for hazardous materials. “A lithium-ion battery that has lost charge is no less dangerous and still represents a fire risk. Carmakers and consumers need to know that the products are disposed of safely,” said Trefzger.

He said that he expects EVs to represent the fastest growing segment of the automotive industry, and thus to drive further growth in the supply chain. The automotive sector already represents 10% of KN’s global revenue.