Explaining EU vehicle emissions targets: can OEMs avoid heavy fines?

The new average fleet targets that came into force in Europe on January 1st 2020 are having big impacts on the supply chain, pushing OEMs to produce and sell more hybrids and EVs. But the rules are complex and varied by brands, volume and sales. Here we provide a summary of the key rules and terminology.

If carmakers’ vehicle fleets in the EU are not able to meet the new targets of 95 grams of CO2 per kilometre starting from this year, many will face stiff fines that could run into the billions of euros. That would take a painful bite out of already thinning margins across the sector both for carmakers and automotive suppliers.

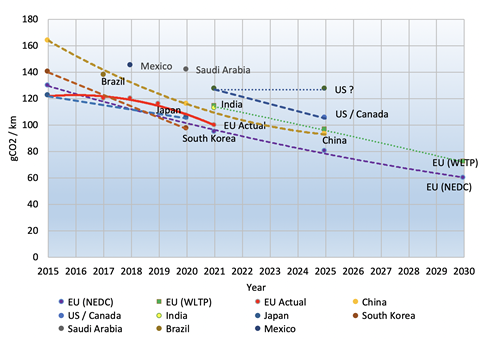

OEMs have been preparing for the stricter targets for years, which will be the strictest in the world. Many have launched new hybrids, plug-in hybrid and battery electric vehicles to coincide with them. However, emissions data will be based upon actual registrations, not production – and there is simply no guarantee that consumers will purchase these models.

Indeed, in the last few years many brands in Europe have seen sales skew towards higher-emitting vehicles. The UK Energy Research Centre recently published research showing that SUVs are now outselling EVs by 37 to 1 in the UK. The decline in diesel sales following Volkswagen’s ‘Dieselgate’ scandal has also had the unintended consequence of increasing CO2 emissions; although diesels emit more particulate matter, they are more fuel efficient than equivalent petrol engines.

Other factors are also outside the control of OEMs. Different levels of charging infrastructure, purchase or tax incentives across EU markets, for example, contribute significantly to EV take up.

To that end, OEMs might do better to make incremental improvements to emissions on current vehicles rather than spend billions to bring to market a few zero emissions EVs that consumers may not purchase. For example, applying stop-start ‘micro-hybrid’ technology across the whole range may yield greater overall emission reductions in sold vehicles.

The clock is already running on which cars consumers actually purchase in 2020. If OEMs don’t see their vehicle sales mix reaching their prescribed emissions targets as the year progresses, some may even withdraw high-emitting vehicles from the market, or apply heavy discounts on low emission hybrid, plug-ins and EV models.

There are, however, carmakers and suppliers ahead of the curve, while others are accelerating investment and partnerships to catch up – the PSA and FCA merger is a case in point. Despite the challenges, the regulations could also have longer-term benefits; for example, EVs in Europe might achieve total cost of ownership parity with standard internal combustion engine (ICE) vehicles faster than elsewhere. And although the EU is set to have targets stricter than anywhere else, it is setting standards that many other regions – including China – are following.

What is clear is that there will be big implications across the industry, and executives needs to understand the rules.

Who will be the winners and losers?

Winners

- Battery suppliers for hybrids and EVs, many of whom are now ramping up production in Europe. Companies planning or expanding battery factories in Europe include CATL, LG Chem, Samsung SDI, as well as newcomers including Northvolt, Freyr and Farasis

- Automotive suppliers specialising in hybrid and EV powertrains and motors, which includes Bosch, Magna, Valeo and others.

- Automotive tier 1 suppliers specialising in technology that helps emissions. Along with electrified powertrains, this includes suppliers who optimise ICE vehicles, such as BorgWarner in turbos and dual clutch transmissions.

- Tesla’s pooling deal with FCA benefits Tesla to the tune of €1.8 billion (although the FCA-PSA merger will put that into question after 2020).

Losers

- The majority of OEMs selling into the European market, especially those who are behind the curve in electrification. One of the primary drivers for the FCA-PSA merger is in having to pool resources to electrify their products ranges to meet the emissions targets. OEMs that sell large numbers of SUVs are also at greater risk of fines.

- Tier suppliers specialising in internal combustions engine powertrain, especially in diesel. Suppliers who are already seeing impacts to their bottom lines include Denso and Continental – although large, diversified business will be better able to manage these declines.

- Tier suppliers providing ancillary engine components including exhausts, filters, fuel tanks etc.