The US aims to impose reciprocal tariffs around the world, triggering potential trade wars that could impact automotive logistics networks and dampen investment.

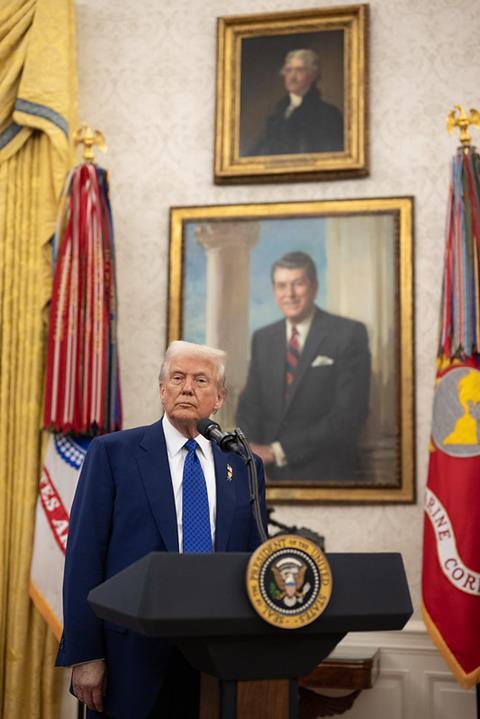

US president Donald Trump has signed a Presidential Memorandum ordering a plan to be made for global reciprocal trade agreements and tariffs.

A White House statement said the reciprocal tariffs make it clear that the US “will no longer tolerate being ripped off”, adding: “The US has one of the most open economies in the world, yet our trading partners keep their markets closed to US exports, and reciprocal trade will finally correct that imbalance.” An example in the White House’s Fact Sheet said: “The EU imposes a 10% tariff on imported cars. Yet the US only imposes a 2.5% tariff.”

The US administration will look at nonreciprocal trade deals and taxes or tariffs imposed on the US, including differences in value-added tax (VAT), which Trump sees as an unfair trade barrier and indirect tariff. Administration staff will be asked to report back for a plan within 180 days.

How the tariffs could impact European and global automotive logistics

The task to discover how goods are taxed and where there are government subsidies will be monumental, especially for the automotive industry.

For example, the European Union (EU) has a 10% tariff on imported vehicles, and between 3-4.5% for most imports of automotive parts, while the US tariff on vehicle imports is 2.5% (25% on light-duty trucks). On top of this, VAT rates vary across countries, with most near 20% and some taxed even higher. While the US has no federal VAT system, different states have different sale tax rates ranging from 0-10%.

The US previously set tariffs through the World Trade Organization (WTO), but Trump’s announcement marks a departure from this norm, and instead sets the precedent that the US can determine its own trade agreements and higher tariffs.

It is likely to trigger a host of global trade negotiations, which could cause chaos among the automotive supply chain and hurt investment and long-term planning in automotive logistics.

Trump also called for a 25% tax to be imposed on all imports of steel and aluminium into the US – more than half of which come from Canada. In combination with the US’ tariffs on Canada and Mexico (currently on hold until March) and China, the US president’s decisions could reshape the flows and networks of the global automotive supply chain quickly and massively.

Read more: How Trump’s proposed tariffs could threaten the North American supply chain

It will also likely increase costs for OEMs, at a time when they are already struggling with overheads and cutting costs where they can. Carmakers including Ford and GM have both warned that the steel and aluminium tariffs would add around $1 billion to each OEM’s costs.

Reciprocal and counter-tariffs could unravel global trade flows

Trade relations are already changing. In response to the reciprocal tariffs announcement, the European Commission has pledged to respond “firmly and immediately”, calling the tariffs “a step in the wrong direction”.

The Commission added: “For decades, the EU has worked with trading partners like the US to reduce tariffs and other trade barriers worldwide, reinforcing this openness through binding commitments in the rules-based trading system – commitments that the US is now undermining.”

Daniel Harrison, in-house automotive analyst at Automotive Logistics, said the move would reverse the success story of decades of globalisation and relatively tariff-free trade, creating chaos and uncertainty, and increasing retaliatory measures, trade barriers and the cost of doing business. The result will be a reduction in investment, raised prices for consumers, and slowed economic growth.

“Despite the overwhelmingly negative response to Trump’s tariff threats, he does have a point about reciprocal tariffs, but the point is that for everyone’s benefit those tariffs should be as low as possible to achieve free-trade – not to increase tariffs, so the EU considering lowering its tariff rate across the board from 10% closer to the US level is actually a step in the right direction,” Harrison said.

He added: “However, President’s Trump false belief that VAT functions like a tariff is fundamentally incorrect. He has deliberately conflated VAT and trade tariffs. VAT is usually paid on all (non essential) products sold, whether it is produced domestically or imported, and so VAT does not function like a tariff or a protectionist trade barrier that discriminates against imported goods.”

China has retaliated against Trump’s tariffs with a 10% duty on US vehicles and has also lodged a complaint with the World Trade Organization (WTO).

Likewise, the Mexican and Canadian governments have promised they will retaliate against any tariffs imposed on them. Claudia Ávila Connelly, international trade, nearshoring & economic development expert previously told Automotive Logistics that a trade war “would be terrible not only for the North American region but also for the world”. She added that we could enter into a new era of protectionism which would be “very dangerous for the world”.

Topics

- Analysis

- Cross-Border Logistics

- Data Analysis & Forecasting

- Editor's pick

- Finished Vehicle Logistics

- Fleet & Route Optimisation

- Ford

- GM

- Inbound Logistics

- Inventory & Demand Forecasting

- Just-in-Sequence

- Lean Logistics

- Logistics Management

- Logistics service provider

- Nearshoring

- News

- North America

- OEMs

- Service Part Logistics

- Shipping

- Suppliers

- Supply Chain Planning

- Trade & Customs

US election: A timeline of impacts on automotive logistics

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

Currently reading

Currently readingTrump’s reciprocal trade tariffs set to reshape global automotive supply chains and disrupt industry investment

- 9

- 10

- 11

- 12

1 Reader's comment