[Updated June 17] Vehicle shipments to the US and Canada have been subject to disruption over the last year, culminating in March with the Baltimore bridge collapse. However, as our annual review of activity at the top-performing vehicle ports shows, that has only tested the mettle of agile cooperation between ports and inland logistics providers. Marcus Williams reports

Developments at the North American ports has been overshadowed since March 26 by the fatal collapse of the Francis Scott Key bridge in Baltimore, which has since led to disruption at the port and to one of the busiest shipping routes in the US, resulting in the rerouting of vehicle and container traffic to other east coast ports.

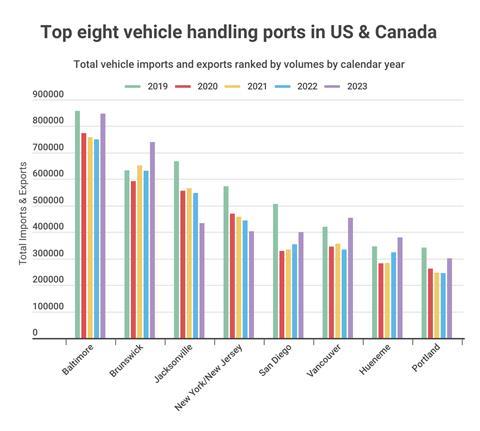

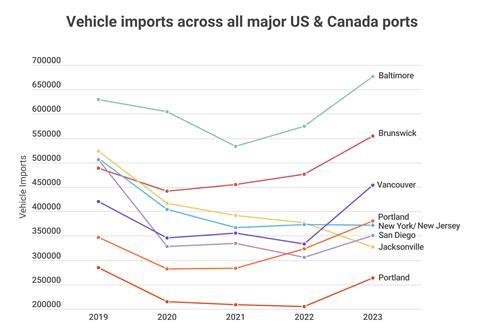

Baltimore is the busiest US vehicle-handling port in the US, with its vehicle terminals, including Dundalk and Fairfield, having moved 847,158 vehicles in 2023. A percentage of the finished vehicle traffic is now going through ports in New York and New Jersey, Norfolk and Philadephia.

That disaster has galvanised cooperation between ports authorities, terminal operators and providers of inland road and rail transport services. The ability to respond with agility across the sector to the unforeseen disaster is built on ongoing investment in portside capacity, improved hinterland logistics services and the latest digital technology of which there were good examples over the last year. It is also built on experience.

At Baltimore, Maryland Port Authority (MPA) has been working with Tradepoint Atlantic, a private terminal operator located at Sparrow’s Point, on the south side of the Key Scott Bridge and therefore with access out of the port through Chesapeake Bay. For the month following the disaster it was the only working terminal at the port of Baltimore. Tradepoint Atlantic has been moving some volumes that were stuck at the Dundalk Martine terminal.

“Vehicles arriving at TPA have been transported to our processing facilities inside the port area blocked by the collapsed Key Bridge,” says Susan Serrano, manager of automotive business development at MPA. “We have been able to employ International Longshoremen’s Association labour during these moves as well.

On April 25, the US Coast Guard opened a 10.6 metre-deep (35 ft) temporary channel that allowed some vessels to transit, depart and arrive at Baltimore’s public marine terminals. The Army Corps of Engineers will have a permanent, 15.2-metre deep main channel opened by the end of May, says Serrano.

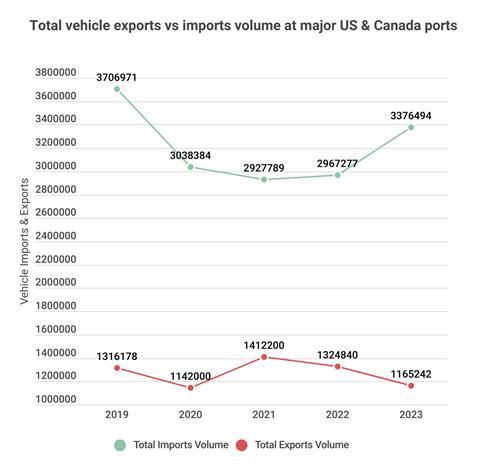

Providers of maritime and port services for volume finished vehicle movements have been dealing with disruption since 2020 and the Covid pandemic. There continues to be a shortage of capacity on vehicle-carrying ships as new vessels are built to meet post Covid demand for vehicles and as the automotive sector rebuild inventory. This is likely to continue into 2025. Added to which, deep-ocean schedules have been impacted by geopolitical disruption in the Red Sea, as well as by drought in the Panama Canal. There has been an increase in imports from China and the number of vehicles shipped in containers has gone up significantly, though it remains a comparatively niche alternative to conventional volume shipments by ro-ro vessel.

Room to manoeuvre

The North American ports have spent 2023 investing in infrastructure and the expansion of storage space to mitigate any congestion spikes and to maintain a smooth throughput.

Baltimore has been moving forward with a berth revitalisation project at the Dundalk Marine Terminal.

“This is strengthening our berths to better handle vehicles as well as high and heavy machinery cargo,” says Serrano. “The Howard Street Tunnel project that will allow for double-stack rail car transit on CSX Railroad is also progressing.”

The charging infrastructure in place at the individual processing facilities is sufficient to handle those electric vehicles (EVs) that do require additional charging, though Serrano points out that EVs arrive in general with an adequate charge level that allows for speedy processing and drayage out.

“Should the terminal operator feel they need to add charging stations, MPA ensures that the port’s electrical grid supports the addition,” says Serrano.

MPA has another project due to start later this summer at Dundalk Marine Terminal. The project will construct a new box culvert with new lateral drains to handle the more intense rainfalls associated with climate change, says Serrano. In addition, MPA is constructing a Sea Curb around the perimeter of DMT and installing tidal gates/backflow preventers on the stormwater drains to protect against a rise in sea levels and storm surges.

Building out at Brunswick

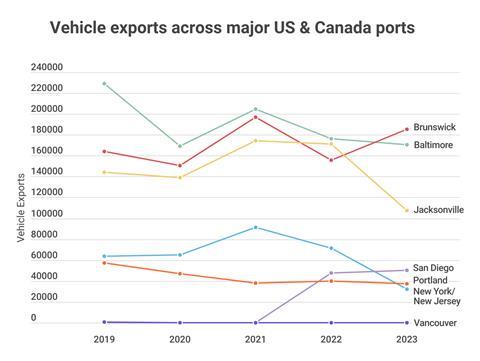

The port of Brunswick continues to see a growth in ro-ro volumes, with a 17% growth in volumes last year to 740,000 passenger and light trucks. To support this growth, it is investing more than $260m to develop approximately 40 hectares (100 acres) of additional property while also making other upgrades to its terminal facilities.

“We have cleared another 100-acre parcel to move it closer to full buildout. Looking forward, we are expanding our gate infrastructure, terminal roadways, building a new on-terminal rail yard and adding a fourth berth,” says Bruce Kuzma, senior director of trade development for ocean carrier and non-container sales at Georgia Ports Authority (GPA).

The fourth berth will more efficiently accommodate modern vessels capable of carrying 7,000-plus vehicles, says Kuzma.

Outbound logistics provider Wallenius Wilhelmsen is also expanding at the port of Brunswick and has signed a 20-year lease agreement with GPA. It is developing its existing terminal and vehicle processing centre (VPC). That includes a new equipment processing centre (EPC) for storage, assembly and distribute machinery for equipment makers and their dealers.

“These state-of-the-art facilities allow us to work on our customers’ products in factory-like conditions that stand above any on-port setting,” says Mike Hynekamp, chief operating officer of logistics services at Wallenius Wilhelmsen. “The upgraded facilities are purpose built to allow for the safe and efficient completion, storage, inspection and distribution of our customers’ products without the need to dray to an off-site location,” adds Hynekamp.

Toyota flows through Jaxport

The port of Jacksonville (Jaxport), a short distance south from Brunswick, reports no significant disruption caused by the problems to shipping in the Red Sea or drought with the Panama Canal outside of minor schedule modifications. Its tenant terminal operators are making adjustments if and when additional capacity is needed.

One of those terminal operators is Southeast Toyota Distributors and the company is working on a 25-hectare VPC at Blount Island due for completion in 2025. Jaxport is expanding two vehicle berths there to more efficiently accommodate vehicle-carrying vessels. It also has an agreement with terminal operator Enstructure to expand its existing footprint at the Talleyrand Marine Terminal for breakbulk cargo.

Jaxport’s director of cargo and cruise development, Alberto Cabrera, says that when construction is complete, Southeast Toyota Distributors will relocate operations from its 20-hectace facility at Jaxport’s Talleyrand Marine Terminal and an adjacent 9-hectare private facility into a single 35-hectare property at Blount Island. Combining operations at Blount Island will create operational efficiencies and additional space for Southeast Toyota to accommodate more vehicles, according to Jaxport.

At the same time, large investments are being made to accommodate an increase in vehicle volumes at Jaxport’s Blount Island Marine Terminal. In partnership with the Florida Department of Transportation (FDOT), the port authority is completing a $45m investment in existing berth upgrades to increase efficiency and accommodate additional vehicle vessel calls. Vehicle Berth 20 is being expanded to accommodate two larger vehicle ships simultaneously instead of one, due for completion in 2026. Vehicle Berth 22 is being enhanced to accommodate larger vehicle ships calling the terminal more efficiently, due for completion in 2025.

OEM Snapshot – Toyota Logistics Services

In 2023, Toyota Motor North America exported nearly 194,000 vehicles from the US to 42 countries and regions around the world. TMNA imported approximately 660,000 vehicles from Japan. Last year its North American plants produced 2m vehicles – 1.22m in the US, all of which were handled by Toyota Logistics Services (TLS). As for main challenge, TMNA says it was the ramp up of handling vehicles.

Toyota’s supply was constrained in 2022 and early 2023, and its logistics team needed to prepare to handle more vehicles to meet strong customer demand while ensuring high safety, high quality and timeliness. This was coordinated by the TLS team with the carmaker’s manufacturing plants and the ports.

TLS is now befitting from a Tri-Gen renewable hydrogen and electricity system at its vehicle processing centre (VPC) at the US port of Long Beach – its biggest port VPC handling around 200,000 vehicles a year.

The Tri-Gen system can generate up to 1,200kg of hydrogen a day for fuel cell electric vehicles. That means supplying hydrogen for imported vehicles, such as the Toyota Mirai, which is exclusively imported through Long Beach, and for supplying hydrogen to the truck refuelling station at the TLS port facility. The hydrogen generation also produces up to 5,300 litres (1,400 gallons) of usable water as a byproduct. That is being repurposed for Toyota’s car wash operations, helping to reduce the demand on local water supplies by approximately half a million gallons per year.

Gateways and corridors

Also on the east coast, the Port Authority of New York and New Jersey (PANYNJ) continues to invest in infrastructure projects, such as the Port Street Corridor Improvement initiative to rebuild Newark port’s northern entrance, which it says will enhance the efficiency and safety of the gateway. The ongoing Southbound Connector Project will also add further flexibility for the on-dock ExpressRail system by allowing trains to exit to the south out of the Port Newark-Elizabeth complex.

In total the ports of New York and New Jersey processed over 403,000 vehicles, 92% of which were imports. That is a decrease of 9.2% on the 444,000 moved the previous year. However, through February, there port moved more than 60,100 vehicles, a 14.5% increase from the same timeframe last year.

BMW and Toyota have terminals at the port and terminal operator FAPS also has a facility for processing vehicles for Ford, GM, Nissan, Polaris and Polestar, among others.

PANYNJ is also taking in vehicles diverted from Baltimore following the collapse of the Francis Scott Key bridge.

“With the Port of Baltimore being the nation’s busiest for handling vehicles, some cars and trucks that would’ve been destined for Baltimore will instead be offloaded at New York/New Jersey and trucked to Baltimore via car carrier,” said a spokesperson for the port. “There, auto processors will be able to continue their usual work, adding accessories and other customisations to the new vehicles.”

For containers, both Class 1 railroads servicing the New York and New Jersey freight ports – CSX and Norfolk Southern – have added a service to and from Baltimore following the collapse of the bridge. While that service is for single stack container freight, the new service is supporting onward transport of containers that are now coming to the Port of New York and New Jersey and need to get back into the Baltimore area.

Additionally, PANYNJ’s Truck Service Center has assisted over 450 Baltimore trucks get registered in the Port’s Truck Registry through its PortTruckPass platform, according to the port authority’s spokesperson.

Fluid in Philly

The nearby port of Philadelphia (Philaport) says it has been has been working with its terminal operator DVR and that firm’s logistics provider Glovis at the SouthPort Auto Terminal to ensure that car operations are as smooth as possible.

Philaport is building a new berth at the terminal and has secured a $50m Department of Transport Infra grant to build it, as well as and a $70m grant from the Commonwealth of Pennsylvania. It is now completing the funding package for a second berth.

“In total, we will have two new berths totalling over 2,000 linear feet,” says a spokesperson for Philaport. “This will be completed by 2027. We are also working on obtaining additional land in this area for extra capacity.”

Additional land has been obtained, including from CSX and Norfolk Southern, to accommodate additional volumes, as well as third party land. Those rail providers, along with road haulage firms, have been contributing to the smooth running.

|

Philaport |

2023 |

2022 |

|

Imports |

257,709 |

|

|

Exports |

1,339 |

|

|

Total |

259,048 (+17.2%) |

221,000 |

“All of our haulaway auto carriers and the Class 1 railroads have performed excellently, keeping everything fluid,” says a spokesperson for Philaport. “Our labour force, in conjunction with terminal operator Glovis, has exceeded some of the best KPIs in the industry, which ensures the overall fluidity of the system.”

With regard to ro-ro capacity issue, Philaport says that carriers have chosen additional ocean routes with shorter transit times that give them more ship turns per year, something that has led to more mini land-bridge volumes coming to into the port.

| Port of Long Beach | 2023 | 2022 |

|---|---|---|

|

Imports |

249,105 |

227,849 |

|

Exports |

22,078 |

23,243 |

|

Total |

271,183 (+8.0%) |

251,092 |

Faster turnaround in the west

US west coast ports have been inundated with ex-Asia volumes destined for the mid-west and east coast because of the vessel capacity shortage, which necessitated faster vessel turnaround times, and congestion and rate increases through the Panama Canal. Last year that required the rapid set up of a land-bridge between the west coast ports and inland destinations to the east.

The port of San Diego says it has avoided any consequent congestion in large part because of its labour allocation orders, as well as more efficient terminal planning through the efforts of its vehicle terminal operator Pasha Automotive Services. In fact, San Diego has been able to handle diverted vessels from other ports to help alleviate their congestion problems.

The port has also noted a steady increase in short-sea volumes from Mexico as carmakers continue to invest in manufacturing there for export.

San Diego predominantly handles vehicle imports and that includes Pasha Hawaii ‘west-bound’ volume from San Diego, equal to approximately 100,000 vehicles last year. Vehicle makers using the National City Marine Terminal are Hyundai/Genesis, Toyota, Volkswagen, Audi, Lamborghini, Bentley, Ford, GM, Stellantis, Itochu, Honda and Porsche.

Up at the port of Portland, in the US west coast state of Oregon, is continuing with its services for GM, which last year consolidated the number of gateways it was using for vehicle imports in the US and made Portland its primary location.

GM has been using Portland for 30 years, previously processing between 10,000-15,000 vehicles per year, but the new business has increased this.

According to a spokesperson for Portland port, GM is pushing as much as it can through the port. “The biggest issue is vessels getting backed up so you might have 5 vessels in 5 days discharging 20,000 units.

Those vehicles are being processed by Auto Warehouse Company and moved inland primarily by rail providers BNSF and Union Pacific.

Portland has also seen a large increase in vehicle imports from China, and is expecting volumes to continue.

The port has avoided several of the issues affecting deep-ocean transit and in fact has seen a positive outcome. “Our origin and destination connections avoid the Red Sea and the Panama Canal, and require fewer vessel transit days than most other auto gateways.” Added to which, Portland has seen increased land brige volumes of auto imports heading to the US east coast.

| Port of Portland Q1 2024 | |

|---|---|

|

Imports |

93,355 |

|

Exports |

5,450 |

|

Total |

98,805 (+105%) |

High volumes at Hueneme

The US west coast port of Hueneme saw a 31% increase in vehicle handling last year compared to 2022, with 90% of the 375,000 vehicles processed as imports, making it the port’s best year so far for vehicle processing. Volume continued to grow in the first quarter of 2024, up 12% on the same quarter last year. Hueneme is a strategic port of entry for carmakers including BMW, GM, Hyundai, JLR, Kia, Mitsubishi, Subaru, Tesla and Volvo. Leading markets for import trade through Hueneme include South Korea, Germany, United Kingdom and Japan, and a spokesperson for the port said that there had been an increase in GM shipments from Mexico.

Hueneme port has continued to see fluid throughput, thanks to its 24-hour gate and the quality of its vehicle processing centres (VPCs), which move vehicles through in less than five days, according to the spokesperson. Vehicle processing is also supported by terminal logistics and drayage providers who move vehicles outside of the gate to the VPCs.

Glovis America, BMW North America and Wallenius Wilhelmsen manage facilities at the port and carry out pre-delivery inspection, technical services and coordination of inland transport to regional dealerships.

“The heavy weight corridor provides access to major California transport routes, US Highway 101 and Interstate 5, generating faster time to market,” said the spokesperson for the port. “In addition, the port owns the ramp to the Ventura County Railway, a Class III short-line railroad, as well as a 21km loop of track operated by Genesee & Wyoming Railroad.”

The Ventura railway is integral to the movement of vehicles through the port and interchange with Union Pacific, providing an important intermodal link.

The port and its processors have continued to develop digital technology to improve throughput. Port Hueneme has an IT team works on day-to-day operations and systems while collaborating across departments and with partners.

“The Port Information Technology Department is continually taking an aggressive lead in data and cybersecurity measures [using] a combination of best-of-class tools, encryption, access controls and regular security audits to safeguard critical data from potential threats,” said Hueneme port’s spokesperson.

Presently, the port of Hueneme is spearheading an initiative called Smart Port, aimed at expediting data collection and enhancing interoperability with partners and stakeholders. This involves the replacement of the current outdated in-house database and frontend used for data aggregation and reporting purposes, according to the spokesperson.

“This initiative aligns with the current trends of digital transformation in the maritime industry, offering the potential for significant efficiency gains and improved collaboration,” she said. “The integration of cutting-edge technology will likely position the port of Hueneme as a leader in smart port operations.”

Growth in Canada

The west coast Canadian port of Vancouver, Canada’s biggest port, has also accommodated a consistent flow of vehicles from Mexico and does not report any congestion on ex-Asia shipments, which form the majority of vehicles processed through its terminals, which are run by Wallenius Wilhelmsen. Last year it registered an increase in vehicle imports from China, which accounted for 10% of import volume compared to 2% in 2022. A spokesperson tells Automotive Logistics that this was because of new Tesla import volumes from China since the first half of 2023, a significant contribution to growth last year.

Overall, automotive volume growth through the port in 2023 was stronger than expected, according to the spokesperson, increasing by 36% to more than 454,000 because of strong demand combined with growth in vehicle production.

“In 2024, a more moderate pace of vehicle growth is expected as pent-up demand subsides, while macro-economic headwinds exert some pressure on consumer spending,” says the spokesperson. “As a result of this balancing of factors, the port authority expects 2024 volume to remain in line with 2023 levels or to rise by single-digit levels of roughly 5%.”

Supporting that stable throughput of volumes and preparing for increased trade, Vancouver Fraser Port Authority is partnering with industry and stakeholders on a data stewardship project and implementing a shared digital infrastructure called Connect+.

“One of the initiatives underway is the Active Vessel Traffic Management (AVTM) program,” says a spokesperson for the port authority. “That includes the development and implementation of a multi-part active vessel traffic management system to enable the efficient flow of goods to and from the port, helping to reduce the environmental and social impacts, such as noise, light, and air emissions, of commercial ship traffic in the region.”

In terms of infrastructure developments, Vancouver Fraser Port Authority is working with Wallenius Wilhelmsen on an optimisation project at the Annacis vehicle processing facility, which is expected to be completed in 2024. That project consolidates two existing port automobile terminals into one and the Richard Auto Terminal is being repurposed. Concrete was poured into the foundations of the new facility in January this year and infrastructure work is proceeding.

Rise in containerised shipments

The tightness of capacity in the ro-ro sector has led to a rise in the number of finished vehicles shipped in containers to certain ports on the US east coast. The Port Authority of New York and New Jersey (PANYNJ) handled more than 35,000 containerised vehicles in 2023, ten times the amount it handled in the previous year.

The increase in the number of cars in containers registered by PANYNJ is a switcharound from two years ago when a shortness of container ship capacity led to automakers moving containers of parts on ro-ro vessels through the FAPS terminal.

Georgia Ports Authority said containerised vehicle shipments through Savannah port had been minimal in 2023 but that it was seeing a sizable increase this year.

While containerised vehicle shipments have not grown on the west coast, or have not been recorded, the Vancouver Fraser Port Authority in Canada noted that the tonnage of containerised vehicles increased by 9.2% in 2023 compared to 2022 from just around 137,000 vehicles then to nearly 150,000 vehicles in 2023.

Efficiency cuts emissions

The efforts made in achieving greater efficiency in throughput to manage sporadic port calls and mitigate congestion are also bringing sustainable benefits.

On the US east coast GPA is making improvements to its road and rail infrastructure, including expanded gates which is also helping to reduce emissions. All the new buildings under the infrastructure expansion conform to Leadership in Energy and Environmental Design (Leed) certification, including the use of LED lighting.

The construction of the additional berth promises to minimise vessel delays and unnecessary emissions waiting for a berth, according to the port authority. Plus, all of the new land under development is being built at an elevation that improves resilience to potential flooding.

Resident port processors at Brunswick port are working closely with Georgia Power and GPA’s engineering team to ensure that there is adequate charging infrastructure to manage the increasing throughput of EVs.

At Jacksonville, the Jaxport Express project is a $47m public-private partnership by the port authority and two of its port tenants, SSA Jacksonville and Crowley. The project supports sustainability initiatives at the port’s Blount Island and Talleyrand marine terminals. According to Jaxport’s Alberto Cabrera, the project is one of the first large-scale investments in emission cutting cargo-handling equipment technologies in Florida. The first round of low and zero-emission cargo handling equipment is currently on order, with the first pieces arriving in summer 2024.

Jaxport has also announced the introduction a battery-powered locomotive to serve the Talleyrand Marine Terminal, one of eight being converted from diesel to battery power by Watco Rail Services, supported by a USDoT Federal Railroad Administration grant.

“The new electric zero-emissions locomotive will arrive in 2026 and replace an older diesel-powered unit,” says Cabrera. “The Jacksonville Port Terminal (JXPT) railroad team will operate it like the current locomotive it is replacing – to move several cargo types between Jaxport’s Talleyrand Marine Terminal and nearby rail yard operated by Class I rail providers.

In New York and New Jersey the port authority has established a new interim target to reduce emissions under the its direct operational control of 50% by 2030. That builds on its established target to reduce direct emissions by 35% by 2025, and net zero by 2050 under its Net Zero Roadmap plan, which was published in September last year and contains more than 40 actions. Specifically, Strategy 10 outlines steps being taken to achieve zero emissions in seaport operations.

Capturing emissions in the west

On the west coast, San Diego port continues on its development of vessel emission capture. The Marine Exhaust Treatment System (Mets) involves a bonnet being placed over the vessel’s stack to capture and treat exhaust emissions while the ship is at berth. The system supports San Diego port’s Maritime Clean Air Strategy, and is certified by the California Air Resources Board. It is expected to be in place by the beginning of 2025.

In addition, Carb regulations require that vehicle-carrying vessels reduce emissions while at-berth at California seaports beginning in 2025 by using either shore power or bonnet technology.

The total cost of the project is approximately $11.5m, with $4.9m coming from grant funds received from the California Transportation Commission and the rest coming from Clean Air Engineering – Maritime, a provider of environmental technology for the shipping industry.

The port has invested heavily in forecasting the utility needs for EV throughput and has worked closely with local utility provider, SDG&E, to ensure that there is sufficient power at the National City Marine Terminal. Pasha Automotive Services has already installed several charging units to further support the EVs destined to come through the facility.

The port of Hueneme is moving forward with the planning for a new system of shoreside power to provide clean-grid power to vessels berthing at its North terminal, which typically includes pure truck and vehicle carriers (PCTCs) and ro-ro vessels.

To manage the 23% of EV imports it receives, Hueneme port is planning to construct a temporary outdoor vehicle facility, to be operated for a maximum of 3-5 years on a 14-hectare project site situated at the southeast corner of Hueneme and Perkins roads. “The Project site will accommodate up 4,944 vehicles as overflow storage and consolidate auto movement to reduce diesel truck trips through neighborhoods near the port, significantly reducing truck emissions,” said the port’s spokesperson.

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet