Ford has unexpectedly ended its agreement with North American vehicle hauler Jack Cooper mid-contract.

Ford has dropped its contract with vehicle hauler Jack Cooper, giving a 30-day notice of the contract break on January 2, before the agreed contract expiration date. The two companies have worked together for more than four decades, making the news even more unprecedented.

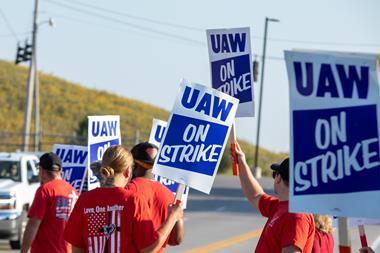

The Teamsters union, which has more than 1,000 members within Jack Cooper’s employment, urged Ford to reverse the decision, suggesting it was a strategic move to cut costs. Ford told Automotive Logistics that it does not comment on contracts or relationships with individual suppliers, and added: ”We manage supplier relationships in line with our sourcing strategy, designed to enable us to best serve our customers.”

A source close to the decision told Automotive Logistics that Ford may have been concerned about Jack Cooper’s finances, implying the company may have been facing financial distress.

In a statement, Sean O’Brien, general president of Teamsters said: “Ford, a once iconic American brand, wants to boost its own bottom line by walking away from a family-owned company and into the arms of second-rate third parties that will pay workers less money and far fewer benefits to haul Ford vehicles.

“We have seen time and again that there are no winners when corporations sell out workers to the lowest bidder,” he continued. “Corporate executives refuse to look past the short-term, setting their sights on an extra bonus as they race to the bottom to ruin lives, hollow out communities, and decimate the middle class. It must stop.”

O’Brien went on to say that the Teamsters urged Ford to reverse its decision and said it is prepared to use “the full force” of the union to defend its members and their jobs.

Automotive Logistics’ inhouse automotive analyst, Daniel Harrison, said the move “highlights wider logistics costs pressures we are witnessing, as the Teamster-unionised Jack Cooper is likely to be more expensive than alternative non-unionised 3PLs Ford will now deploy”.

Harrison added: “In terms of Jack Cooper’s immediate prospects, their major FVL [finished vehicle logistics] clients were Ford, GM and Stellantis, and the loss of a major client like Ford means there is a very real prospect of major job losses, restructuring or potentially even bankruptcy – and this won’t be the first time for Jack Cooper.”

Back in 2019, Jack Cooper reorganised its business under Chapter 11 proceedings following an underfunded Teamster pension that was leading to almost certain insolvency. The company exited bankruptcy proceedings in the same year, extinguishing around $250m of debt and permanently removing $2 billion of underfunded pension liability.

Harrison added that Ford’s move also “highlights the risk of mergers and acquisitions to grow fleet capacity”, as it was only in 2023 that Jack Cooper acquired Moore Transport and its 240 car carrier trucks.

There was, however, no immediate indication that the acquisition had led to financial difficulties. The move was meant to “significantly enhance” Jack Cooper’s footprint along the East Coast and within the Midwest region, according to the company. Moore Transport’s CEO Gary Moore had previously owned multiple Ford dealerships in North Texas and Oklahoma before starting the company.

Jack Cooper had also been attempting to acquire less-than-truckload (LTL) provider Yellow, which filed for bankruptcy in August 2023. However, Jack Cooper dropped its bid for Yellow eight months after the filing in April 2024 after a lack of engagement from Yellow.

As well as making moves in acquisitions, Jack Cooper has also been expanding its footprint in Mexico in recent years. Its executive chair Sarah Amico told Automotive Logistics in 2023 that the company had opened five locations in Mexico in 2022 and added 12 customers, and continued to expand its reach by developing a fleet of car carriers in Mexico for intra-Mexico car haulage services, along with further 3PL activities in vehicle logistics in the country.

Jack Cooper has been contacted for comment. Stay posted for updates…

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet