While much focus is put on OEM plans to launch more electric vehicles, a great deal of the technology, value, production and services will come from both existing and emerging suppliers across the value chain. We expect many new opportunities for these companies over the next decade.

OEMs have been grabbing headlines of late with the launch of new electric vehicles. The recent start of production of the Volkswagen ID. 3 in Zwickau, Germany, for example, featured no less a guest than the German chancellor, Angela Merkel.

This focus on the manufacturer and the brand, however, belies the fact that OEMs mostly source the technology behind electrification from tier suppliers, many of whom are investing billions of dollars to develop and manufacture these cutting-edge powertrains.

Where attention is paid to EV supply chains, it tends to revolve around battery technology. This is understandable given that batteries often represents around one-third the final cost of an electric vehicle, and involve a complex set of cell, electrical, mineral and energy technology. On the other hand, electric vehicles have fewer moving parts and components compared to those with internal combustion engines and gearboxes, for example.

Nevertheless, an electric vehicle powertrain contains many other crucial elements that are both complex and expensive to develop, design and produce – and which are essential to the zero or low emissions technology of electrified powertrains. Along with batteries, these include an electric motor, transmission and motor controller (comprising a battery management system and power inverter). Within these and other modules are many high-value components including circuit boards, sensors, semi-conductors, electric control units, computer chips and many million lines of software code.

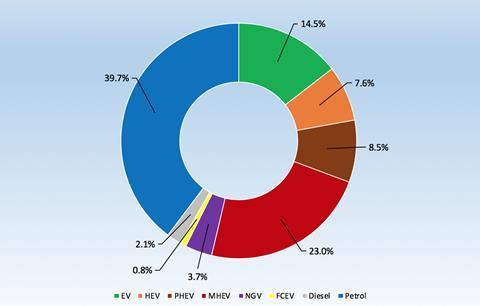

We expect more than half of vehicle powertrains to be electric or hybridised to some degree by 2030 (download our full powertrain forecast and report here), which will create enormous opportunities for suppliers across the value chain, including established powertrain specialists who have made gains or are poised to benefit. We believe the alliances these companies form with OEMs will be pivotal to the success of any electrification strategy. Equally, new providers of niche technology in batteries, energy, charging and more will have more opportunities than ever to disrupt and achieve market penetration.

EV suppliers: ones to watch

Both familiar and new names have significant opportunities as EV and hybridised vehicle sales and production grow over the next decade. The most significant expansion is likely to be among powertrain, battery and software providers. Some suppliers – including Bosch, Denso, Continental and Panasonic – are already leading players in multiple areas.

Powertrain suppliers are already playing key roles, including Borg Warner, Bosch, Denso, Delphi, GKN, ZF, Schaeffler, Univance, Mitsubishi Electric, Magna, Valeo, Mahle, Magtec, Dana TM4, AVID, Continental and Yasa.

Battery pack, cell and module suppliers are set to be future kingmakers, with carmakers forming key ventures with new and emerging players, including A123 Systems, BYD, CATL, Panasonic, LG Chem, Samsung SDI, Toshiba, JTEKT, Toyota Boshoku, XALT Energy, NTK and SK Innovation.

Embedded software providers will also see substantial growth opportunities, notably within the motor controller. Leading players in this area include Siemens, Bosch, Panasonic, Continental, Toshiba, Denso, Mitsubishi Electric Corporation, Aptiv, Texas Instruments, Harman International, NXP Semiconductors and Johnson Electric.

EV and AVs converge

Furthermore, many automotive executives and engineers see electric vehicle development as strongly coupled with that of autonomous vehicles, a technology in which investment has so far totalled more than $100 billion. EV powertrains are considered easier to automate and the trend to developEVs with more connectivity and software is already evident.

Although we don’t expect AVs to be commercialised until well after EVs achieve a higher market share – with level 4 or 5 autonomy unlikely to be widely available until beyond 2030 – manufacturers and suppliers are already bundling EV and AV activities. This was evident in Ford and Volkswagen’s recent alliance on both electric vehicles and autonomous technology, in which Volkswagen will invest $2.6 billion in Argo AI, an autonomous vehicle start-up that Ford had previously invested $1 billion into in 2017.

Beyond the car

The growth in EVs is also set to drive opportunities in the aftermarket. For example, there will be growth in battery recycling and re-use specialists that repurpose EV batteries when they become less efficient (typically deemed to be below 70%-75% capacity), including for home energy or grid-level energy storage systems, for example to use in levelling supply for intermittent renewable energy sources such as wind, wave and solar power.

Already carmakers like Tesla and Nissan have ventured into these areas, and new value chains are emerging. Used batteries from the Renault Zoe EV, for example, will be used to power electric riverboats in France.

Beyond the vehicle itself, there is the broader charging infrastructure to consider. Rather than coming before EV sales, more charging points are being gradually rolled out through a mixture of public and privately financed schemes. Nonetheless, with no clear established incumbent players in this nascent market, there are considerable opportunities for dynamic new start-ups with innovative schemes is considerable. For example, Germany startup Ubitricity converts existing lampposts, where most of the electrical power infrastructure is already in place, into EV charging points, avoiding the cost and planning hurdles associated with creating new charging infrastructure.

The growth of the EV market will not only encourage but will depend upon such innovations and disruptions. And it won’t all come from OEMs. Suppliers, both familiar and new, have everything to play for.

Download our latest global powertrain forecast and report below.

Automotive Intelligence

This analysis is from the business intelligence unit of Automotive from Ultima Media, which also publishes Automotive Logistics. Download our latest powertrain forecast below, and keep up with analysis on other industry trends here.

For more information contact:

Daniel Harrison, automotive analyst

Christopher Ludwig, editor-in-chief

Downloads

Automotive Powertrain Forecast 2020-2030_Automotive Logistics

PDF, Size 2.95 mb

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet