Economic competition between China, the EU and the US intensifies with protectionist policies expanding to counter China’s EV ‘dumping’ strategies into broadly western regions that upset ‘fair’ competition

International trade is a complex affair, and the move from laissez-faire economics towards protectionist trade policies is becoming more pronounced, with mounting implications for automotive logistics. The US recently fired a major salvo in its ongoing trade war with China, unveiling a sweeping plan to sharply increase import duties on a range of strategic goods from the Asian giant. At the heart of the move is a more than 100% tariff hike on EVs; displaying Washington’s determination to curb the influx of Chinese EVs and nurture its domestic industry. But the fiscal measures are not confined to EVs alone, encompassing the wider electrification ecosystem, with tariff increases also slated for lithium batteries, semiconductors, critical minerals, solar cells and even steel and aluminium over the next two years.

In a White House speech on 14 May, President Biden commented on the fiscal gambit, saying: “China heavily subsidised all these products, pushing Chinese companies to produce far more than the rest of the world can absorb and then dumping the excess products onto the market at unfairly low prices, driving other manufacturers around the world out of business.”

Implemented under Section 301 of the US Trade Act, the duties are expected to impact $18 billion worth of Chinese imports, reflecting US resolve to protect domestic supply chains and industries from perceived unfair competition. But while American businesses brace for potential price hikes, the long-term ramifications of the trade offensive on bilateral economic ties, global supply chains and vehicle logistics remain uncertain.

Europe moves to mirror US protectionist policies against China

Towards the end of last year, the European Commission formally launched an anti-subsidy investigation into the imports of battery electric vehicles from China.

The investigation was launched for key economic reasons, which Ursula von der Leyen, President of the European Commission, outlined at the time, saying: “The electric vehicle sector holds huge potential for Europe’s future competitiveness and green industrial leadership. EU car manufacturers and related sectors are already investing and innovating to fully develop this potential.

But as with any protectionist measure, it serves as a temporary restraint and cannot ultimately stop the flow of trade” - Daniel Harrison, Automotive Analyst, Ultima Media

”Wherever we find evidence that their efforts are being impeded by market distortions and unfair competition, we will act decisively. And we will do this in full respect of our EU and international obligations - because Europe plays by the rules, within its borders and globally. This anti-subsidy investigation will be thorough, fair, and fact-based.”

Valdis Dombrovskis, Executive Vice-President and Commissioner for Trade, added: “Electric battery vehicles are crucial for the green transition and to meet our international commitments to reduce CO2 emissions. This is why we have always welcomed global competition in this sector, which means more choice for consumers and more innovation. But competition must be fair. Imports must compete on the same terms as our own industry. Fairness is also the watchword for this investigation: we will consult all relevant parties, and we will adhere rigidly to domestic and international rules. We hope for full cooperation from all relevant parties. The outcome will be based on facts.”

China saturating the European market with its EVs

“Then on the 5th of March, 2024, the European Commission enacted a policy following this 6 month investigation, which found that China was also dumping EVs into Europe,” said Namrita Chow, Business Analyst, ECG, speaking at the organisation’s spring conference 2024, in Baveno.

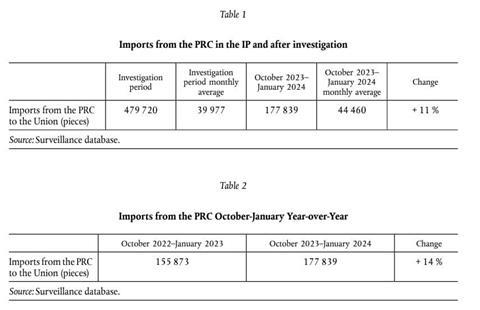

These findings attest that China’s dumping of EVs is not confined to the US, and seems clearly targeted at China’s competitor markets. The EU Investigation found that EV models from China increased by 11%, and 14% for the previous period.

“Following the investigation’s findings,” said Chow, “Europe has ruled that from March 7th onwards, all new battery electric passenger vehicles coming in from China must now be registered.” Oddly though, the rules only specify a nine month registration period. But beyond this, the move isn’t simply one of record-keeping.

The Commission has also specified retroactive charges to be imposed, backdated to March 7th, 2024, following the date of entry, marking the emergence of state tariffs against Chinese EVs pouring into the region. Some deem this retroactivity to be unfair or disproportionate. But according to this new European “basic regulation”, the commission found “that the collection of countervailing duties on registered imports may be deemed appropriate to preclude the recurrence of [economic] injury.”

But will this be enough to curb the tide? China already imposes a 15% tariff on imported passenger cars from the European Union, (with the exclusion of the UK), and has recently announced that it could raise this to an unforgiving 25%. And if this happens, there will be a difficult decision to be made concerning whether the fiscal increase will ultimately be absorbed by OEMs or imposed on consumers.

The question European OEMs and vehicles LSPs are asking is, ‘how much of a solution is this European protectionism against China’s manoeuvring into Europe’s EV space?’, and ‘will it have an impact?’ A recent report from data analysis, policy and research provider, Rhodium Group, found commentators voting in the negative: “We expect the European Commission to impose duties in the 15-30 per cent range. But even if the duties come in at the higher end of this range, some China-based producers will still be able to generate comfortable profit margins on the cars they export to Europe because of the substantial cost advantages they enjoy.”

Rhodium added: “Duties in the 40-50 per cent range - arguably even higher for vertically integrated manufacturers like BYD - would probably be necessary to make the European market unattractive for Chinese EV exporters.”

“But as with any protectionist measure, it serves as a temporary restraint and cannot ultimately stop the flow of trade,” says Daniel Harrison, Automotive Analyst, Ultima Media.

“There is also the argument that tariffs are self-defeating because affordable EVs are what the EU and US need to achieve higher goals, such as net zero emissions. So, while tariffs may protect parts of the EU’s automotive industry, they may also hinder progress toward decarbonising the EU fleet.”

What will China’s next move be for Europe?

“All OEMs will be affected,” added Chow. Now, many are wondering whether China will attempt to work around these tariffs by simply producing its EVs in Europe itself. But ‘localisation’ has many faces.

“But none of this is new,” says Chow. She points to the Chinese ‘50:50’ rule (active from 1994 until 2022), which once meant that any joint ventures with China required the local (Chinese) partner of the JV to own a majority share. But this rule eventually became defunct.

Mexico serves as an example of how China might just attempt to circumvent tariffs by localising their production, with BYD for example, announcing that it had its eye on Mexico for local production. But BYD, Geely, and other Chinese OEMs have much more ambitious plans to expand their presence in the European automotive market. These companies aim to push the market share of Chinese brands across Europe towards 10% by 2030.

Chinese automaker Chery, for example, has finalised plans to open its first European plant in Barcelona, Spain through a joint venture deal. But the company’s ambitions extend far beyond this initial Spanish facility, with the company considering building a second manufacturing site in the United Kingdom, and indications that it may be eyeing a third factory somewhere in mainland Europe

“Many OEMs, such as VW and Renault are already creating joint ventures with Chinese EV manufacturers to help produce lower-cost EVs for export back to the EU and US”

- Daniel Harrison, Automotive Analyst, Ultima Media

Chinese EV powerhouse BYD has also announced its European plans to establish local production capabilities, with ambitious plans to construct a manufacturing base in Hungary. Head of BYD Europe, Michael Shu, has spoken about the importance of the OEMs localisation strategy, stating: “shipping cars from China to Europe is not going to be long-term.” Instead, the company envisions a future where its European operations are truly “Europe for Europe.”

Harrison says: “Within Europe, it seems likely that Chinese OEMs will indeed try to circumvent trade tariffs by establishing production facilities within the EU, with BYD in Hungary being a primary example. However, this cannot happen overnight. Estimates vary, but it will likely take two to three years for Chinese companies to establish more EU plants, set up supply chains, and build logistics relationships. Additionally, there is a lack of established dealer networks.

“Ultimately, tariffs are intended to buy the US and the EU some time to produce vehicles that are somewhat competitive with domestically produced equivalents. However, that is all they do—buy time.”

Another strategic possibility that Chow points to, aside from Chinese acquisitions of European players, would be Chinese OEMs leveraging European joint ventures. “Such a move could mark a major turning point in this trade war,” she says.

Harrison adds: “Many OEMs, such as VW and Renault, are already creating joint ventures with Chinese EV manufacturers to help produce lower-cost EVs for export back to the EU and the US. Tesla already does this from its plant in Shanghai. Therefore, tariffs may jeopardise these alliances.”

Whatever the outcome, the EU has decided to postpone its decision on imposing provisional anti-subsidy tariffs on Chinese electric vehicles until after the European Parliament elections, scheduled for June 6-9, 2024. The timing is believed to be an effort to keep the contentious issue of Chinese EV tariffs out of the election campaign; but with elections so close, all eyes are now on Europe.

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet