Electric cars could revolutionise transport by providing a cheaper, safer and more environmentally friendly way to travel. The International Energy Agency forecasts that there will be 13m electric vehicles (EVs) on the road globally by 2020, while PwC Autofacts predicts that 55% of all new vehicle sales will be fully electrified vehicles by 2030.

Electric cars could revolutionise transport by providing a cheaper, safer and more environmentally friendly way to travel. The International Energy Agency forecasts that there will be 13m electric vehicles (EVs) on the road globally by 2020, while PwC Autofacts predicts that 55% of all new vehicle sales will be fully electrified vehicles by 2030.

One area that threatens the faster adoption of EVs, however, is the battery. Finding one that is a viable alternative to petrol in terms of energy density, cost and convenience has posed problems.

Lithium batteries are one current solution, with investment bank Goldman Sachs calling lithium “the new gasoline”.

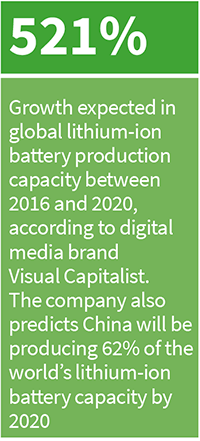

Global lithium-ion battery production capacity is set to increase by 521% between 2016 and 2020, according to digital media brand Visual Capitalist. The company predicts China will be producing 62% of the world’s lithium-ion battery capacity by 2020, with the US, South Korea, and Poland the only other major players. Whoever is producing it, however, there will clearly will be a lot more lithium batteries being transported across the globe at that point.

For the supply chain, this poses a problem because these batteries are hazardous cargo, and storing and transporting them poses a significant safety risk.

“Depending on their status as certified/tested, prototype or damaged/end of life, there are varying risks associated with safe handling, storage and shipping of the batteries,” confirms Christopher Fuchs, MD at Nefab Packaging. “The challenges that lithium batteries present are their high value, the high risk of damage following a thermal runaway, and the heavy weight.”

Fathi Tlatli, president of global automotive sector at DHL Customer Solutions and Innovation, also points to the logistics challenges of moving lithium batteries, highlighting their weight, which can be anything from 30-900kg, and their high sensitivity to external factors such as temperature, humidity and shock.

“Damaged or defective lithium-ion batteries must not be transported by air freight,” he says. “As a logistics service provider operating worldwide, it’s crucial that we are familiar with the respective regulatory requirements and the constraints of different transport modes.”

According to Achim Glass, senior vice-president and head of the global automotive vertical at transport and logistics company Kuehne + Nagel, lithium batteries are designed to provide high levels of power and so the electrical energy in them is significant, meaning that such batteries can generate a great amount of heat if short-circuited.

“The chemical contents of these batteries may catch fire if damaged or if improperly designed or assembled,” he explains. “Therefore, these batteries represent an extraordinary health and safety hazard. Incidents involving single batteries or battery-powered devices include fire, violent rupture, explosion or a dangerous evolution of heat.”

Lithium battery fire cannot be extinguished in the normal way, either, he points out.

Lack of global regulation

There are a number of regulations that govern the storage, packaging and transport of lithium batteries because of these risks. The issue with the regulations is that they differ by authority and country, with no single common, global rule. For example, packaging requirements in China are different to those in the US, which in themselves differ from those in many European countries.

”The chemical contents of these batteries may catch fire if damaged or if improperly designed or assembled. Therefore, these batteries represent an extraordinary health and safety hazard” – Achim Glass, Kuehne + Nagel

The various regulations include the European Agreement concerning the International Carriage of Dangerous Goods (ADR), rail (RID) and inland waters (ADN), for transport of goods within Europe; the IMDG Code (for international ocean shipments); and ICAO/IATA (for international air shipments). Some European countries have their own separate regulations, however, such as the German Regulation on the Maritime Transportation of Dangerous Goods (GGVSee).

According to Brian Beetz, manager, regulatory affairs and corporate responsibility at Labelmaster, a business that helps companies comply with regulations governing the shipping of dangerous goods: “It’s important for companies to work with all of their shipping partners to ensure that the lithium battery shipments are compliant throughout the supply chain.”

Transport considerations

In transporting such batteries, packaging and labelling must comply with the various regulations.

“For transportation within Europe, the sender must include the transport documents required by the legislator,” confirms Peter Koltai, head of transport logistics at Audi. “The sender must also label the carriers as required – for example containers and packaging.”

Koltai adds that when moving batteries in trucks, they must meet the corresponding ADR requirements. This includes having warning signs and a driver with ADR dangerous goods training and protective equipment.

In terms of maritime transport of dangerous goods, the requirements differ again.

Koltai explains: “No special containers are required for the maritime transportation of lithium-ion batteries. Labelling and the inclusion of transport documents are governed by the aforementioned regulations. Depending on the distances involved, the use of refrigerated containers may be necessary in order to prevent an inadmissible rise in temperature inside the container.”

Koltai says the regulations for air transport of dangerous goods specify that batteries with a gross weight above 35kg must be transported using all-freight aircraft only, with the sender needing to obtain a permit from the national authority of the country in which the goods are loaded onto an aircraft for the first time.

“If the destination airport is in the US, or the aircraft passes through US airspace, a permit must also be obtained from the US aviation authority,” he says.

Label size

There is a minimum label size on the packaging of batteries. “Requirements for the use of the labels vary depending upon the type of battery being shipped – if it’s lithium ion or lithium metal – and how the batteries are packed – whether they are without equipment, with equipment or contained in equipment,” says Glass.

There are also generic guidelines, such as the requirement that only compatible types may be combined in the same package.

“One of the main objectives of proper packaging is to avoid short-circuiting,” says Glass. “Therefore, each battery should be packed in fully enclosed inner packaging made of non-conductive material. Batteries should be separated to prevent contact with other batteries or conductive material in the packaging. Cushioning the batteries to prevent shifting is also very advisable.”

Nefab’s customers have faced problems in arranging air freight, especially for the supply of cells and modules from the Far East into Europe and the Americas. “Air cargo operators are very reluctant to take lithium batteries on board,” he says. “At Nefab, we are therefore developing a new packaging solution made out of engineered plywood that is foldable, lightweight and offers an interesting ratio of outer to inner volume, but passes F90 fire tests.”

UN certification

At the BMW Group, all battery transport follows local legal requirements. The high-voltage lithium batteries used in series production for electrified BMW Group vehicles are certified under the UN3480 regulations from the United Nations, which cover the packaging of lithium-ion batteries. These detail the materials that may be used, the packaging types and packaging instructions.

“To receive this certification, the components and batteries have to pass a number of tests in a laboratory environment to get the confirmation that they can be transported safely without dangerous goods packaging,” says Michael Appler, project leader, logistics planning at BMW Group. “At the BMW Group, we normally use racks made out of stainless steel for batteries for regional transportation. This packaging needs to be marked with the Dangerous Goods class 9 label and the UN3480 label.”

While complying with dangerous goods regulations is key to ensuring safe storage and transport of lithium batteries, packaging is crucial to making this happen. Fuchs says that only really intelligent packaging solutions can protect property in the case of a thermal runaway.

“Dangerous goods packaging in most cases only responds to external risks during transport and handling,” he says. “Providing a robust solution to protect the contents inside from drops and shocks is the main focus of the UN packaging regulations. But what do you do when the biggest risk comes from within, when shipping a prototype battery where the battery management system is failing, or a damaged box turns critical during transport?”

When that happens, the packaging needs to manage the pressure building up inside the container and prevent a thermal runaway from turning into a large fire or explosion. Fuchs says it is important to manage the rapid pressure build-up inside and prevent oxygen entering the area where the combustible battery fumes and sparks are emitted during the thermal runaway.

Another area to consider is battery lifecycle and damage, as this increases risk.

“At the end of each battery’s lifecycle there is increased potential exposure to the hazards and, based on a scientific analysis, the shipper needs to declare the lithium battery as ‘defect and critical’ or ‘defect and non-critical’,” says Glass.

“The challenges that lithium batteries present are their high value, the high risk of damage following a thermal runaway, and the heavy weight” – Christopher Fuchs, Nefab Packaging

According to Glass, dangerous goods regulations differ between both categories and the impact on cost for packaging is significant.

“A container for a ‘defect and critical’ EV battery comes with a comparatively high price tag while packaging costs for a ‘defect and not critical’ battery are a fraction of that,” he says. “In addition to the financial impact, these special containers are considered an asset and therefore stock is often limited.”

According to Lars Witte, head of brand logistics planning at Audi, containers are selected on the basis of the requirements for the specific product and the specific logistics process, taking into account the legal provisions for the transport of dangerous goods.

“Depending on the properties of the product, type-tested packaging must be used in accordance with the respective regulations on the transportation of dangerous goods,” he says. “Simplifications are provided, such as by the ADR, for batteries weighing over 12kg that have a robust, shock-proof enclosure. In this case, type-tested packaging is not required.”

Witte explains that during the coordination process prior to the start of production, all partners are included in the container development process to ensure that all of the relevant requirements are taken into account. These include compliance with dangerous goods regulations; manual/automatic loading and unloading requirements; dust protection requirements; and state of charge (SoC) values, which are required for air transport.

Packaging problems

The number and complexity of the regulations can cause production problems for carmakers when importing lithium cells. Glass says there are multiple sea and air carriers that completely ban the transport of lithium cells and lithium batteries to avoid any transport risk.

“Transport of new lithium cells today takes place in the form of sea freight and air freight shipments from Asia to Europe and North America, which makes capacity a rare resource, in addition to the aforementioned different regulations and associated threats of fines and risk on health and safety,” says Glass.

To help customers overcome the challenges, Kuehne + Nagel developed KN BatteryChain to provide customised transport and storage services for industries including automotive.

Overall size and weight and the type of packaging materials are also considerations when transporting lithium batteries. Beetz says closely matching the size of the battery to the packaging can significantly reduce shipping costs, as carriers charge by both package size and weight.

“The type of outer packaging chosen can impact the shipping cost, for example fibreboard, metal, plastic and wood, as well as the inner packaging materials, for example vermiculite and bubble-wrap,” he says. “However, the packaging options will be limited to those types specifically required in the packing instructions for each mode of transportation.”

Labelmaster’s Obexion packaging is a line of protective packaging solutions designed for shipping and storing lithium batteries and devices that contain them. The current Obexion packaging line is aimed at smaller consumer electronics-type batteries, but can also be applied to larger format batteries such as those used in the automotive industry.

Collection and recycling

The risk associated with storing and transporting lithium batteries is greatest at the end of their lifecycle, as they are more likely to explode or go wrong at that point. According to McKinsey, 97% of the lead in lead-acid batteries can be recycled, but lithium is more difficult – and therefore more costly – to recycle.

Glass says extra care needs to be taken on safely packaging and shipping lithium batteries, in particular if they are deemed to be in need of repair, recycling or disposal.

“The transport and storage risk is without any doubt the greatest at the end of a lithium battery’s lifecycle,” he says.

According to Beetz, the considerations for collecting and recycling lithium batteries can vary significantly from company to company based on factors such as battery size, chemistry/construction, and supply chain procedures. Beetz says questions such as who is doing the battery collecting, whether the batteries can be recycled and how close the facilities are for recycling/disposal all have to be taken into account.

”Depending on the properties of the product, type-tested packaging must be used in accordance with the respective regulations on the transportation of dangerous goods” – Lars Witte, Audi

Fuchs also points to the quarantining of containers for batteries that turn critical during the recovery process, as well as safe storage solutions for those awaiting processing or shipping.

There are risks to storing and transporting lithium batteries but it is important that investment continues in this technology if the predicted upswing in adoption of EVs is to take place.

While packaging, battery and logistics providers are all working to ensure this, responsibility also falls on carmakers to invest and ensure the supply chain is fit for purpose. The work has already started with Tesla and Panasonic partnering to build a $5 billion lithium-ion battery factory outside of Nevada, while Daimler is investing €500m ($585m) in a lithium-ion battery factory in Germany.

Such work has to continue, if the US and Europe are to be able to fully accommodate future demand for electric vehicles.

BMW’s battery factory in Spartanburg, US, is one of three it operates globally

BMW’s battery factory in Spartanburg, US, is one of three it operates globallyThe BMW Group operates three battery factories worldwide: in Dingolfing, Germany, Spartanburg, in the US, and Shenyang, China. The group has been producing batteries at its Spartanburg plant since 2015, but the modules for these are produced at the Dingolfing plant.

Michael Appler, project leader, logistics planning at BMW Group, says the use of environmentally friendly packaging for transport has been an important issue.

“Initially, the BMW Group used disposable cardboard packaging, which complies with the relevant regulations,” he says. “Disposable packaging results in a lot of waste, but cardboard is easy to recycle and its manufacturing uses less energy than that of many other materials. Reusable packaging would not have been any more sustainable due to the one-way stream of the goods, as the shipping of the empty containers back to Germany would have used a lot of resources.”

In 2016, however, BMW partnered with Chep to create sustainable packaging and a process to reduce waste. The packaging used since then consists of a container and cover made out of plastic, as well as an inner tray made out of cardboard. The modules produced in Germany are packed into that box and moved via sea to the US. The inner tray made out of cardboard is then recycled.

Appler explains: “The reusable components of the box are picked up by Chep and shipped to another customer in the US that is using the same outer box for transport of its goods to Germany. Consequently, the packaging is only transported when in use and there is no need for an expensive, unsustainable and inefficient return process.”

Topics

- Air Freight

- Analysis

- Asia

- Asia

- Audi

- Battery Supply Chain

- BMW

- BMW

- BMW Group

- Chep

- CHEP

- China

- Daimler

- DHL

- Electric Vehicles

- Europe

- features

- Inbound Logistics

- International Energy Agency

- Korea Rep

- Kuehne + Nagel

- Labelmaster

- Materials handling

- Mercedes-Benz

- Nefab Packaging

- North America

- North America

- Packaging

- Panasonic

- Plant Logistics

- Poland

- Policy and regulation

- Ports and processors

- PwC Autofacts

- Road

- Service Part Logistics

- Shipping

- Tesla

- United States Of America

- Visual Capitalist

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)