Houthi attacks on vessels passing through the Red Sea are increasing, causing container ship and ro-ro operators to reroute vessels to avoid danger. Follow Automotive Logistics’ live blog below for the latest updates.

5th August 2024

Almost ten months on from the beginning of the disruption in the Red Sea, logistics operators and shipping firms are still having to reroute to avoid vessel attacks, with Maersk expecting the geopolitical situation to continue until at least the end of the year.

Maersk has raised its outlook for the global container market volume growth for the full year, despite the supply chain disruption caused by the situation in the Red Sea. Meanwhile, global maritime risk management firm Ambrey found that risk at the Red Sea was still high in the second quarter (Q2) of 2024, with 62 Houthi-related events registered in the period. Of these events, 49 were registered as suspicious approaches, with 13 causing physical damage to the vessels. Ambrey said the Houthi target profile has remained largely unchanged since January, with perceived affiliation and opportunity remaining the drivers for targets.

1st February 2024

Eight of the 10 largest container liners are now avoiding the Bab al-Mandab Strait because of the conflict in the Red Sea, according to consulting firm RSM. The eight liners, which control 61% of global shipping capacity, are diverting around Africa instead, which adds around 10-14 days tp journey times and significantly increases costs.

RSM said it envisages supply chain disruption to continue through at least the first quarter of the year.

Tom Pugh, economist, RSM UK said: ”Spot rates for containers travelling from Asia to Europe have more than doubled in the last month, although they remain well below the rates reached during the pandemic-induced supply chain crisis.”

Looking at the impacts of the crisis on the UK, Pugh said UK manufacturers may be looking at delays of two weeks.

26th January 2024

Ocean shipping delays are starting to shift some ex-Asia ocean volumes to rail and cargo alternatives, according to global freight rate comparison and shipment management firm Freightos.

Freightos said that ex-China air cargo rates have declined since the start of the year, though some rates out of Asia and the Middle East have increased moderately recently, possibly reflecting this shift.

The company added that possible impacts of capacity shifts and equipment shortages on non-Red Sea lanes may be less sever than anticipated as carriers pushed off rate increases and surcharges for transatlantic shipments meant for this week.

Elsewhere, supply chain visibility firm Portcast has found that the Red Sea crisis has caused a 350% surge in CO2 emissions on affected shipping routes as vessels divert around the Cape of Good Hope. Portcast said that shipping routes affected in the Suez Canal region and the Middle East have seen a 350% increase, while emisisons rose on Singapore/Malaysia to Europe routes by 40% and Singapore/Malaysia to US East Coast by 16%. From China to Europe emissions saw a 30% increase, and China to the US East Coast saw a 12% rise.

23rd January 2024

Container availability and vessel space are expected to be even more constrained in the lead up to the Chinese New Year, while freight rates are expected to remain high, according to container logistics platform Container xChange.

Christian Roeloffs, CEO, Container xChange said the ongoing conflict in the Red Sea is a “nightmare situation for shippers and exporters”. He said the impact has been significantly deterrent for container vessels since last month, with 70-80% of container traffic having been rerouted.

”As Chinese New Year approaches amid ongoing disruptions in the Red Sea, we anticipate a tightening of container availability and vessel space in the pre-Chinese New Year phase,” Roeloffs said. ”The rerouting via the Cape of Good Hope adds complexity to the situation. We expect freight rates to remain elevated, and supply chain managers will need to navigate ongoing schedule disruptions.”

Beyond the Chinese New Year, Roeloffs said the firm predicts blank sailings and capacity reduction by carriers.

While the situation in the Red Sea is hitting container vessels particularly hard, they are benefitting from other sectors’ exodus of the Panama Canal, according to shipping consultant Drewry. The firm said that containerships are “just about managing to maintain daily transit averages through the Panama Canal while other sectors reroute”.

Using monthly data from the Panama Canal Authority (ACP), Drewry found the total number of transits across all commercial shipping sectors is declining, but containerships are growing their share as other shipping sectors are increasingly bypassing the canal.

22nd January 2024

Maersk has announced changes to its ME2 service due to the ongoing volatile situation in the Red Sea.

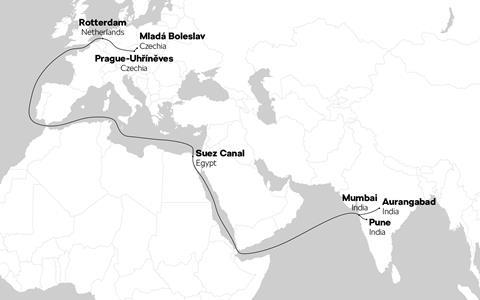

In a customer advisory notice issued today, the shipping line said the ME2 service, which covers routes between Europe and India, Middle East and Africa, will be diverted via the Cape of Good Hope.

Eastbound from Europe, the route typically runs from Port Tanger-Med in Morroco, the largest port in Africa to Jawaharlal Nehru, the second largest container port in India. Westbound from IMEA into Europe the route usually runs from Jebel Ali, a large port on the southern outskirts of Dubai, UAE to Genoa in the northwest of Italy.

Maersk said the revised rotation will be Jebel Ali, UAE - Mundra, India - Jawaharlal Nehru, India - Port Tanger-Med, Morocco – Algeciras, Spain – Salalah, Oman - Jebel Ali, UAE. The service will turn in the West Mediterranean and westbound calls to Salalah and Jeddah will be paused until further notice.

To mitigate the disruption, Maersk said the ports of Algeciras and Tangiers will be used for onward connections to northern Europe and the Mediterranean, and a feeder will be added for Valenicia, Spain and Vado, Italy. Hubs in Salalah and Jebel Ali offer connections to remaining locations in the Middle East.

19th January 2024

Data research and analysis firm Sea-Intelligence has said the Red Sea crisis is more damaging to supply chains than the pandemic.

In its Trade Capacity Outlook report, the firm analysed weekly capacity deviation from the 52-week average baseline. In April 2020, due to the Covid pandemic, TEU capacity per week deviated from the norm in a drop of 50%, whereas TEU capacity per week has deviated by 60% due to the ongoing Suez Canal crisis.

The Red Sea crisis has now had the second biggest negative impact on shipping capacity in the last decade, beaten only by the Ever Given crisis in 2021, when the ship blocked the Suez Canal and caused capacity devaition of almost 90%.

16th January 2024

Suzuki and Volvo have announced halts in production due to supply shortages caused by the disruption on the Red Sea.

Suzuki will suspend production of its Vitara and S-Cross models from its plant in Hungary from 15 January until 21 January due to delays in the shipment of its Japanese-made engines, while Volvo’s factory in Ghent, Belgium will pause production for three days due to a delayed delivery of gearboxes.

The two OEMs follow Tesla’s earlier announcement that it will halt manufacturing for two weeks, from 29 January, at its factory in Gruenheide, Berlin due to the disruption to its supply chain.

15th January 2024

A vessel in the Red Sea has been hit from above by a missile, according to the United Kingdom Maritime Trade Operations (UKMTO) organisation.

The vessel hit was approximately 95 nautical miles South East of Aden, Yemen.

The UKMTO advised vessels to transit with caution.

15th January 2024

Container xChange, a container logistics platform, has issued a critical advisory as the Red Sea crisis deepens and container demand surges.

The platform said there is a growing demand for containers in Asia as shippers and forwarders foresee cargo demand in the coming weeks. According to Container xChange, a container manufacturer from China said: “Shipping companies are demanding more containers now as they avoid the red sea. Therefore, shipping companies and leasing companies have placed more than 750,000 TEU container orders our of China in the last two months.”

As a reuslt, container trading spot rates are increasing at a “staggering rate” according to Container xChange, with spot rates in Shanghai, Hamburg and Boston experiencing a steep uptick in demand.

The firm said it expects average container spot rates to rise as an immediate reaction to the disruption, but then plateau after reaching a high.

Christian Roeloffs, cofounder and CEO, Container xChange said: ”We foresee that the rate hikes will flatten out in the mid to long term. We have enough capacity which can be soaked up in longer transit times and yet not cause permanent capacity crunch.”

15th January 2024

Škoda has confirmed to Automotive Logistics that it does not expect any significant restrictions at its plants due to the ongoing situation in the Red Sea, but said there may be slight delays on its deliveries.

It follows the recent announcement by Tesla that it will halt manufacturing for two weeks, from 29 January, at its factory in Gruenheide, Berlin due to the disruption to its supply chain.

In a statement, a Škoda spokesperson said: “As things stand today, Škoda Auto does not expect any significant production restrictions at its plants. Škoda Auto is in close coordination with the shipping companies and is monitoring the situation closely in order to assess the impact on production and market supply and - as far as possible - avoide it.

“Almost all the major shipping companies began rerouting their ships in December already. This will ensure that freight reaches its destination, albeit with a slight delay.”

Read more: Škoda begins exports to Vietnam

15th January 2024

A global research firm has warned that freight rates could spike due to the disruption at the Suez Canal.

Olly Anibaba, analyst at research firm Third Bridge, gave the warning after speaking to industry experts about the situation in the Red Sea.

“Our experts believe freight rates could spike to $4,000 to $6,ooo per container, from $1,500, although it is unlikely to reach the 2021 peak levels of $15,000,” Anibaba said. ”Ripple effects such as the US port congestion, particularly on the east coast, Panama Canal bottlenecks and rate hikes on unrelated routes show no trade is isolated from the Red Sea disruption.”

The situation in the Red Sea and the drought affecting the Panama Canal are both compounding the effects of one another. The Panama Canal Authority previously said the attacks on vessels on the Red Sea is further complicating the disruption at Panama Canal.

12th January 2024

Tesla has announced it will halt manufacturing for two weeks, from 29 January, at its factory in Gruenheide, Berlin following air strikes carried out by the US and UK in Yemen last night. The carmaker said longer delivery times as a result of the Red Sea disruptions have created a gap in its supply chain.

In a statement, Tesla said: “The armed conflicts in the Red Sea and the associated shifts in transport routes between Europe and Asia via the Cape of Good Hope are also having an impact on production in Gruenheide. The considerably longer transportation times are creating a gap in supply chains.”

The company said the plant will reopen on 11 February.

Prior to production in Germany, Tesla’s outbound logistics in Europe for imports had periods of high demand for logistics services followed by periods of very low demand. In that situation the carmaker was relying heavily on the spot market, but has in recent years scaled up production.

Houthi spokesman Mohammed Abdulsalem has said the group will continue targeting ships heading towards Israel.

11th January 2024

Maersk, which has already diverted its vessels from the Suez Canal and Red Sea, has announced that it is also avoiding the Panama Canal due to the ongoing drought affecting its water levels. Instead, the container shipping line said it will use a rail ‘land bridge’ to mitigate disruptions.

The company said it is remaining in close contact with the Panama Canal Authority (PCA) to ensure any supply chain disruption is minimised.

In its last update on 28 December, the PCA said the conflict in the Middle East and the attacks on vessels on the Red Sea is further complicating the disruption at Panama Canal.

10th January 2024

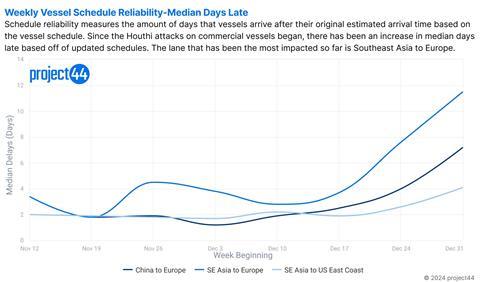

A total of 257 vessels have been rerouted from the Red Sea, with only five vessels still drifting, according to supply chain visibility provider Project44’s most recent report, which was last updated yesterday.

Project44 said its AI-powered ETAs are showing that the majority of impacted vessels will experience between seven and 20 day increases in transit time, depending on speeds travelled. Some of the vessels that are rerouting around Africa have increased their speeds to help mitigate delivery delays, but this means more fuel is being used, prompting further concern about increasing shipping prices.

The five drifting vessels are remaining stationary and currently holding off passage. The 18 vessels that were previously drifting have now opted to reroute around the Cape of Good Hope.

The volume of container vessels travelling through the Suez Canal has greatly reduced since the Houthi attacks, from an average of 15 vessels per day previously to just 5.8 vessels per day this past week.

10th January 2024

In a press briefing today, the British defence secretary Grant Shapps said attacks on vessels in the Red Sea cannot continue and did not rule out striking Houthi targets on land.

His comments come after a US and British warship in the area shot down 18 drones and three missiles last night, as stated by the US Central Command. The US said this was the 26th Houthi attack on commercial shipping lanes in the area since November 19.

10th January 2024

Ocean freight rates have surged due to diversions around the Red Sea, according to data insights firm Everstream Analytics.

Asia-to-Europe and Asia-to-North America rates have more than doubled since the start of the crisis, and the impact has been worsened by the drought affecting the Panama Canal. The Asia-to-North America route is not typically dependent on the use of the Suez Canal, but the drought has placed an increased reliance on the Red Sea route for US East Coast bound shipments from Asia.

Some transport and logistics firms are increasing their use of intermodal transport to reach the US East Coast as a result, increasing rates on the route by 63%.

An Everstream report said that it expects to see a surge in demand in the air freight industry to mitigate the impact of the Red Sea disruption on deliveries.

10th January 2024

The number of container ships passing between the Red Sea and the Suez Canal has dropped 90% in the first week of January, compared to the same week last year. Research by shipping services firm Clarksons also showed that the number of vessels diverting to the Cape of Good Hope on January 9 more than doubled since December.

According to data analytics firm Everstream Analytics, redirecting vessels around the Cape is expected to increase the cost of fuel up to $1m (£786,000) for every round-trip voyage between Asia and northern Europe. In total, $200 billion in trade has been diverted from the Red Sea since November, according to the insights firm. Everstream expects global container shipping capacity, which currently totals a combined 24.6m TEUs, to be reduced by 10-15% as a result.

3rd January 2024

Container ship and ro-ro operators have rerouted vessels to avoid danger to crew and cargo in the Red Sea following a number of attacks on ships by Houthi militants in Yemen since October last year.

In response to the incident, which took place on 30th December 2023, Denmark’s AP Møller Maersk suspended plans to gradually reintroduce routes through the Red Sea and Suez Canal. Maersk said it would reroute vessels around the Cape of Good Hope if needed, although diverting cargo around the cape is estimated to extend transit times by a minimum of seven to ten days, according to supply chain visibility provider Project44.

Mediterranean Shipping Line MSC has also been diverting its vessels around the Cape of Good Hope, along with Evergreen and Hapag Lloyd, which is diverting vessels following a drone attack on one of its ships on December 15.

READ THE FULL STORY HERE: VESSEL OPERATORS DIVERT SHIPS FROM RED SEA FOLLOWING HOUTHI ATTACKS

Operators of pure car and truck carriers (PCTCs), such as Ocean Network Express (ONE), which includes Japan’s Mitsui OSK Lines, Nippon Yusen (NYK), and Kawasaki Kisen Kaisha (Kline), are also diverting vessels.

The targeting of vessels in the Bab al-Mandeb Strait has been increasing due to Israel’s ongoing attacks on Gaza in recent months. A Houthi spokesman has said that they are targeting ships heading toward Israel, and added they will not stop the attacks on vessels until Israel adheres to a ceasefire. In November, the Galaxy Leader, a PCTC chartered by NYK Line en route to India was seized by Houthi rebels in the Red Sea, off the coast of Yemen. The vessel, which has the capacity to carry more than 5,000 car equivalent units (CEUs), was intercepted on November 19, but NYK said that there was no cargo on board.

Topics

- Analysis

- Deep sea

- Editor's pick

- Emergency logistics

- Europe and Middle East

- Finished vehicle logistics

- Inbound logistics

- Logistics service provider

- Maersk

- Middle East and Africa

- Mitsui OSK Lines (MOL)

- News

- Nippon Express

- NYK Line

- Ports and processors

- Shipping

- Suppliers

- Supply chain management

- Track-and-trace

- Trade & Customs

- Wallenius Wilhelmsen

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet