UECC has outlined its strategy for compliance with European regulations on maritime decarbonisation and how it is supplying OEM customers with alternative fuels

Maritime shipping companies have three main challenges when it comes to making their finished vehicle transport services more sustainable in European waters, according to United European Car Carriers (UECC): balancing their own sustainable goals with those of their OEM customers; assessing the best long-term alternative fuels to use; and identifying what is needed to accelerate the slow rate of decarbonisation in the maritime sector.

In terms of targets, shipping companies operating in European waters need to comply with a number of regulations. The FuelEU Maritime regulation, which is being fully applied since the beginning of January this year, sets maximum limits for the yearly average greenhouse gas (GHG) emissions from energy used by ships above 5,000GT calling at European ports. The regulation encourages companies to invest in vessels running on alternative fuels and is the biggest lever for decarbonisation in the maritime sector for a generation, according to UECC.

“I think what’s really interesting about FuelEU Maritime above all else is you can’t operate your way out of it,” said Daniel Gent, energy and sustainability manager at UECC, at a press briefing held last week. “It’s about switching fuel from conventional marine fuels to alternative fuels. You can’t sail slow, you can’t carry more cargo, you can’t call at fewer ports, you can’t spend more time at sea; there is no workaround for it other than to introduce alternative fuel. It’s as simple as that.”

The targets are designed to ensure that the GHG intensity of fuels used in the sector will gradually decrease over time, starting with a 2% decrease by 2025 and reaching up to an 80% reduction by 2050.

At the same time shipping companies need to comply with the EU Emissions Trading System (EU ETS) which requires polluters to pay for their GHG emissions and has applied to the maritime sector since last year. Under the EU ETS, companies are encouraged to move to alternative fuels, such as biofuels, by not having to pay for emissions generated by their use. The aim is to bring overall EU emissions down, while generating revenues to finance the green transition.

From January 1, 2025, shipping companies will have to pay for 40% of their emissions reported in 2024. In 2026 that will rise to 70% of emissions reported in 2025 and from 2027, shipping companies will have to pay for 100% of their emissions.

An important consideration for shipping companies investing in alternative fuels is how certain and long-term are those regulations.

“We’re talking here about securing fuels on a long-term basis and that… should only really be done if you have a reasonable degree of certainty that the regulations that are coming, are either staying as they are or getting more stringent,” said Gent.

LNG investments

UECC has a list of priorities in its decarbonisation strategy. They include the shift from fossil to alternative fuels, getting improvements in energy efficiency from the vessel fleet to combat carbon and cost, and the delivery of shore-to-ship electric power.

On the first point Gent said there is a huge opportunity for UECC through FuelEU Maritime given the significant investments the company has already made in alternative fuels and vessels. That commitment means it is the owner of a commodity that can be sold to competitors that have not engaged with alternative fuels so far. “From our perspective, the regulations that are coming are providing opportunities for us as a forward-thinking shipping company,” said Gent.

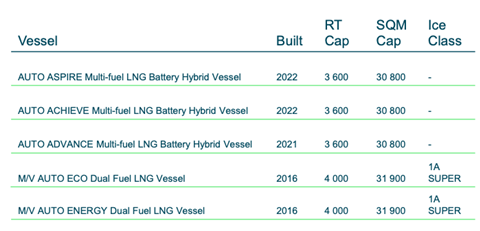

The company is already operating five vessels that run on alternative fuels, with the first two dual fuel LNG vessels delivered in 2016 and the latest two LNG battery hybrid vessels delivered in 2022. UECC reports achieving a 25% reduction in CO2 emissions through the use of LNG on these vessels. In support of that it started introducing biofuels in 2020 and last year introduced bioLNG.

In December 2024 it announced the addition of the 200-metre-long Blue Aspire which was delivered by CIMC Raffles Offshore Engineering. It will operate alongside the five other vessels on a route between the Mediterranean and Northern Europe.

In November last year it also signed an order for up to four multi-fuel battery hybrid pure car and truck carriers (PCTCs) to expand its fleet of more sustainable vessels. This means UECC is already set to be in excess of FuelEU compliance until the late 2030s, towards its goal of net-zero operations by 2040.

One source of alternative fuel for UECC’s LNG vessels is the Naturgy biomethane production plant in Vigo, Spain, from which it currently takes all of the bioLNG produced there and will do exclusively for the next three years.

Sail for Change

In June last year UECC launched its Sail for Change sustainable fuel switch programme to give carmakers the opportunity to move their vehicles on its vessels powered with renewable fuels. As part of the programme, UECC has facilitated bunkering of ISCC-EU certified bioLNG on its five LNG dual-fuel and multi-fuel pure car and truck carriers (PCTCs) at the Port of Zeebrugge through an earlier agreement with Titan Clean Fuels.

The carmakers’ decision to adopt bioLNG for the transport of their vehicles is estimated to reduce emissions by 80,000 tonnes, equal to more than one third of UECC’s global scope 1 emission from ship operations (220,000), according to UECC. Customer support is as important as regulatory payback, according to Gent, and so far five vehicle manufacturers have signed up for the programme since its launch, including Ford, JLR and Toyota.

“What we see in our sector is there is good demand from our customers for a decarbonised product because they are obviously very close to the end user, the drivers and owners of cars, and they’re wanting to push that as well,” he said.

One of the advantages of the Sail for Change programme, according to Gent, is that it is “technologically agnostic”, meaning that the fuel used is not prescribed at the beginning. “We don’t say if you adopt Sail for Change, it has to be this type of fuel; it’s open to discussion,” he said. “The good thing is that in 2024 almost all of our alternative fuel investment was in biofuels.”

However, with an effort to accelerate the rate of decarbonisation in the maritime sector with support from the customer, UECC took a different approach in its Sail for Change programme and the use of bioLNG.

“Where normally we would wait for a customer to say to us, go out and buy this fuel for me, we went out and bought the fuel expecting that they would want it, and they did,” said Gent. “That has then snowballed into a long-term bioLNG contract.”

Gent said it was important to understand how to introduce an alternative fuel in a financially sustainable way. It requires “knowing that you can introduce a fuel to your fleet and you can sell the compliance surplus to another shipping company, or that you have customers who are prepared to buy it,” he said.

EU ETS paybacks combined with other forms of financial support for investments in the switch to alternative fuels like this, such as government subsidies, help to unlock value for finished vehicle logistics operators. They can decide how much to pass on to the OEM customer and commoditize the emission reduction. Gent said that by looking at which alternative fuels offer the best return reveals the potential for running an alternative fuel programme at discount compared to using fossil fuels and paying the price under the current regulations.

Securing the scale

There are some important considerations when it comes to which alternative fuels to choose as not all do what they say on the tin. Fuels need to meet the regulatory criteria for being called sustainable and they need to meet the criteria of the customer.

One important question, according to Gent, relates to scalability and whether there is enough of the fuel long term for the vessel fleet. “Ultimately, if you set the decarbonisation target at 2040 and you have interim checkpoints, a one-year or two-year contract for a certain biofuel isn’t going to cut it. You need to be able to deliver something much more than that,” he pointed out.

The vessels also have to be prepared for particular alternative fuel chosen, with support from the suppliers on how to handle it onboard the vessel. After decades of marine bunker use around the world there are now big variety of alternative marine fuels which each need handling in different ways. According to Gent that necessitates supplier expertise on shore and at sea.

Another key consideration when choosing the fuel to be used is what is its actual impact. “We’ve been quite vocal in our sort of support for bioLNG and there’s a very specific type of bioenergy that we look for… with as low a carbon intensity as possible because that’s where you can deliver the most impact on a well-to-wake basis,” said Gent. “A very key point is how much CO2 do we actually reduce by introducing this fuel?”

Long-term there needs to be greater standardisation and there is an urgent need for biofuel specification, said Gent. It is also important to understand bioLNG as a transitional pathway and maintain focus on the next steps. Running vessels on biofuel for the next 30 years is shortsighted, according to Gent, and attention needs to be kept on supporting investments in technology using different fuels for the future.

Looking ahead UECC is aiming to maintain and expand on its Sail for Change fuel swich programme and its continued investment in new fuels and vessels capable of running on them. “You will see that across Europe there’s going to be more and more alternative fuels coming into our fleet, which will deliver Sail for Change opportunities for customers and it will also deliver FuelEU Maritime compliance opportunities for other shipping companies who are not willing to engage in alternative fuels,” said Gent.

UECC direction on FuelEU Maritime compliance

Delivering on a long-term promise to insulate customers from regulatory penalties and investing in LNG for the future

Actively exploring pooling opportunities, going out to other shipping companies and working on deals to sell compliance surplus

Identifying where to join up the fragmented supply of bioLNG and standardise the criteria for what constitutes a biofuel.

Dividing the waters: European finished vehicle ports review

- 1

- 2

- 3

- 4

Currently reading

Currently readingUECC’s sustainable strategy is turning regulation on maritime emissions into a commercial advantage

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet