Opportunities ahead for automotive OEMs and tier suppliers

By Automotive from Ultima Media2019-09-25T06:00:00

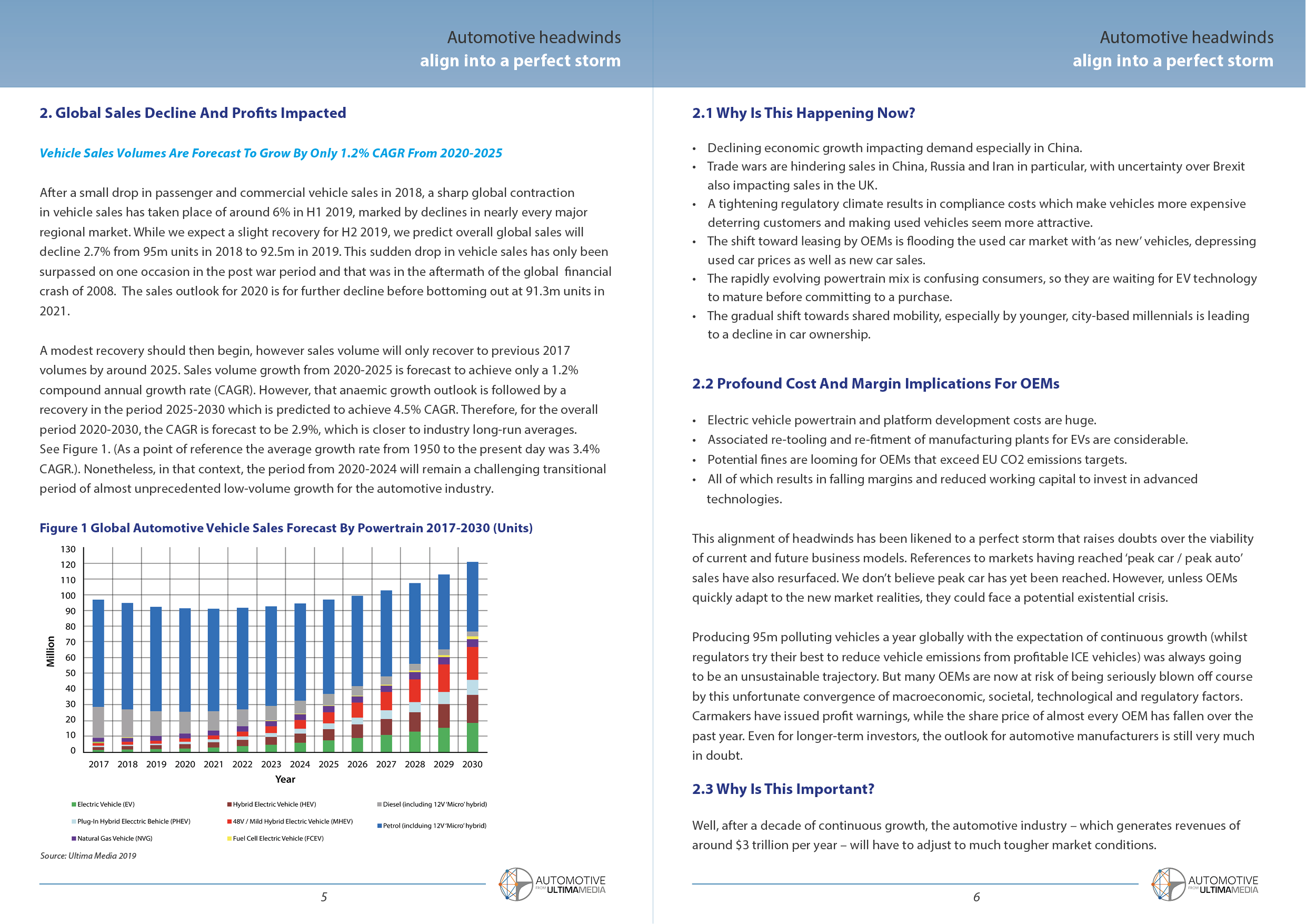

The downturn in automotive sales volume creates many challenges, but the transitional state of the industry also provides many business opportunities, according to a forecast and report from Ultima Media.

Despite tightening cash flow, OEMs, tier suppliers and new entrants are investing heavily in connectivity, autonomy, shared mobility and electrification (CASE) technologies, which will make tomorrow’s vehicles radically different to today’s.

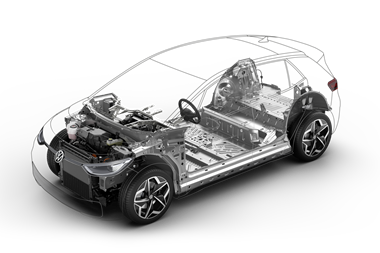

Daniel Harrison, automotive analyst at Ultima Media and author of the report, ’Automotive headwinds align into a perfect storm’, sees a myriad of opportunities for manufacturers who embrace the changes in the market. Due to imminent emission regulations, most OEMs are investing heavily in electrification, with some global vehicle manufacturers using the opportunity to completely rebrand themselves. The relative simplicity of EV powertrains also provides opportunities for new entrants and startups beyond legacy OEMs.

Vehicle manufacturers are also seizing the potential of newer product categories, such as small SUVs and crossovers, which generally have higher margins. Furthermore, a new category is predicted of shared, autonomous and electric vehicles (SAEV) where the technologies are inextricably linked.

And many players are thinking even more broadly beyond the traditional revenue generation of manufacturing and vehicle ownership, to new revenue streams such as subscription services. Many OEMs are also transitioning to a data driven world where valued added services and exploiting big data produced by connected cars becomes their business model, writes Harrison.

“We could imagine a scenario where the vehicle is a break-even or even a loss-leading product in which consumers ‘subscribe’, locking into the OEMs’ ecosystem of add-on services,” he writes.

A full copy of the report, ‘Automotive headwinds align into a perfect storm’, is available for download below for registered users of Automotive Logistics.

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)