BMW’s drive toward a regionalised battery supply chain in North America may have lost some momentum in the face of lower EV demand but the carmaker is still loyal to its electric strategy

Quite what the impact will be following Umicore’s decision to pause construction on its Loyalist plant in Ontario, Canada are yet to be fully assessed, but the decision raises wider questions about global hesitancy surrounding electric vehicles (EVs) and their supply chains. The Canadian authorities, which were due to inject a sizeable chunk of cash into the Loyalist site, noted the facility would manufacture cathode active materials (CAM) and precursor cathode active materials (pCAM), critical components for producing EV batteries.

BMW said last year that Belgian company, Umicore had been recruited as a further partner for establishing a local supply chain in North America.

Umicore would supply BMW’s battery cell supplier, AESC with cathode active battery materials from Ontario. A statement from BMW noted: “In accordance with the ‘local for local’ principle, our partner AESC is currently building a battery cell factory in Florence, South Carolina.

Click here to read a special exclusive series on BMW’s logistics in Spartanburg

“With an initial capacity of 30 GWh/a, the facility will produce cylindrical lithium-ion battery cells specifically developed for the sixth generation of BMW eDrive technology.” Electricity for production of the battery cells and cathode raw material will come exclusively from renewable sources.

Yokohama-based AESC, founded in 2007 and which develops and manufactures batteries for zero-emission EVs and energy storage systems, noted its battery technology powers more than 1m cars across 60-plus countries.

BMW is remaining strictly tight-lipped on the Umicore situation, however. “We have no further comment on the decision of the indirect supplier to temporarily stop the construction project in Ontario,” it said. “We are in exchange with our suppliers and will build up a resilient supply chain for the future high-voltage battery assembly at the new Woodruff location.”

Sharp slowdown

In an investor relations call in June this year, newly appointed Umicore CEO, Bart Sap, took a series of forensic and probing questions.

“Against the backdrop of a sharp slowdown in the growth of EV demand affecting the industry, our customer demand projections for our battery materials have steeply declined,” said Sap. “Consequently, 2024 volumes for our battery materials could be equal or slightly lower than last year.

Sap said that volumes for its legacy contracts were coming to an end faster than anticipated and that there is a delay in the anticipated ramp-up of new contracts for Europe, adding that volumes for a Chinese battery OEM were not materialising in 2024.

“Clearly, we will continue to work closely with our existing and potential customers to create clarity,” said Sap. “In the meantime, we expect Capex for 2024 will not exceed €650m ($722m). We will speedily address ways to adjust our cost structure.”

Delayed spending

The Umicore chief stuck to his word about that speediness. Those investor relations call comments were in June and by the following month, the company announced it was delaying spending on the construction of its battery materials plant in Loyalist, Canada.

Umicore said in a statement sent to Automotive Logistics: “This delayed spending on our plant in Loyalist is part of a thorough review of our Battery Materials business group, following the significant worsening of the EV market context and the impacts this has on the entire supply chain.

Umicore said the demand projections for its battery materials from customers had steeply declined recently, which has impacted Umicore’s Battery Materials business. On June 12 the company announced a contract with a Chinese OEM would not materialise and that legacy contracts are tailing off faster than anticipated. There is also a delay in the ramp-up of contracts in Europe.

“We then took stock of what we have in our Battery Materials business and we based ourselves on our existing footprint as well as our projected order book. Building on these existing assets and order book, Umicore developed a base scenario to realign its operations to the new market reality.”

Umicore outlook

• At least 18 months delay in the ramp-up of its customer contracted volumes

• Substantially reduced volume projections reflecting current offtake commitments at take-or-pay thresholds in line with currently confirmed investment waves

• More prudent assumptions on operational cost evolution

• Minimised further expansion of the existing footprint in Europe and Korea to serve its customers, which implies lower capex spending

“With this current scenario as baseline, a strategic review has been launched to unlock and maximise future business value in Battery Materials,” said a Umicore spokesperson. “This comprehensive review will explore opportunities on top of the current scenario. It will be developed in close engagement with Umicore’s stakeholders, in particular its downstream industry partners. The conclusion of the review will be presented during our Capital Markets Day in Q1 next year.”

BMW connection with AESC

Japan-headquartered AESC referred questions about its US operations back to Umicore and BMW, but in October last year announced it had signed a long-term supply would provide AESC with critical materials for manufacturing EV batteries in the company’s American facilities.

AESC has a growing US footprint, which currently includes battery plants in Kentucky, South Carolina and Tennessee. By 2026, AESC’s US plants will provide up to 70 GWh capacity annually.

There is now a strong BMW connection to AESC as well. Former president and CEO of BMW Manufacturing Corporation USA, Knudt Flor, was recently appointed as CEO for AESC US and Europe, and as global head of quality, based in Murfreesboro, Tennessee.

During his 33-year career at BMW, Flor held significant roles overseeing operations, engineering, logistics and quality for the company in plants and joint ventures in Europe, the US, Africa and Asia. Among his roles, he served as the head of corporate quality for BMW Group.

Canadian angle

What of Canada and the significant sums of money pledged by the authorities into the Loyalist project?

In October last year, the governments of Canada and Ontario said they “welcomed” the project with its total eligible cost envelope of up to $2.761 billion, planned to be executed in multiple stages. Of that, said a statement from the Canada government, Umicore had announced its firm investment decision for the first stage of $2.1 billion, of which $1.8 billion is capital expenditures, for a battery materials production capacity of 35 GWh annually.

Based on the full scope of the envisioned project, the government of Canada added it was supporting Umicore’s project through an investment of up to $551.3m, while the government of Ontario would plough in up to $424.6m. The government – noting the facility would be the “first of its kind in North America” – added it would produce CAM and pCAM on a large industrial scale for EV and battery producers in Canada and the US.

In the project’s first stage, the company would create 600 new direct jobs, plus an additional 700 co-op positions for students throughout the project.

Slowing construction pace

The government of Canada’s Innovation, Science and Economic Development (ISED) federal institution said Umicore had informed it prior to its public announcement on July 26, 2024 that the company was slowing down the pace of construction at its battery materials facility in Loyalist, Ontario.

That announcement followed Umicore’s decision in May, 2024 to reassess its global spending plans for its battery materials projects in light of lower than expected demand from its customers in the EV and battery market.

In a statement sent to Automotive Logistics, ISED noted: “While Umicore has started incurring costs for its project, no Strategic Innovation Fund’s funding has been disbursed. ISED is in regular contact with the company on its project activities and will remain in touch while it conducts and finalises its strategic review.”

The ISED also noted Canada has “everything it needs to lead in the global EV ecosystem,” namely strength in automotive manufacturing, access to markets, talent, green energy, critical minerals and a focus on reusing and recycling.

“Since 2022, some of the world’s largest companies have announced generational investments of over $40 billion into the EV battery supply chain in Canada, seizing on a generational opportunity for promoting clean growth, anchoring North American supply chains, and supporting the shift to a net-zero economy,” added the ISED.

The department said in some cases, companies need to adjust timelines and manufacturing plans to ensure assembly plants are prepared for long-term success. In this way, planned activities related to some projects may be subject to change, resulting in delays.

“This is consistent with trends observed in other jurisdictions as companies globally are revisiting their planned EV and battery plant investments due to a slower growth of EV demand than anticipated,” said the ISED. Working with its partners, including provinces and territories, Canada is committed to the automotive industry’s transition to electrification.”

Millions of parts every day

It is tricky to gauge what happens now with BMW’s US battery supply policy, given the uncertainty surrounding Loyalist, but the German automaker has previously outlined ambitious plans for North America.

Those plans may have to be tweaked depending on how long any delay in the construction of Umicore’s plant will be, but further details may soon be forthcoming as Ulrich Wieland becomes the new logistics lead in Spartanburg.

Wieland took over responsibility for logistics, material control and production system for BMW’s largest global manufacturing operation, in Spartanburg, South Carolina, on September 1.

BMW chairman Oliver Zipse stressed the importance of sourcing local solutions and partners, noting in May this year: “Who has control over technological expertise and urgently needed raw materials? That is what decides the competitiveness of companies and economic areas.

“We locate production facilities for BMW plants – in Hungary, the US and China,” he said. “The benefits for us are clear: short transport distances and supply stability in the event of unforeseen events around the globe.”

Zipse said that global only works at a local level, which also applies to its supply chains. “We have learned in recent years how vulnerable and susceptible to disruption they can be. Take a guess: how many parts do you think our plants worldwide need to be supplied with every day? The answer is 36m. The right quantities have to be in the right place, at the right time.”

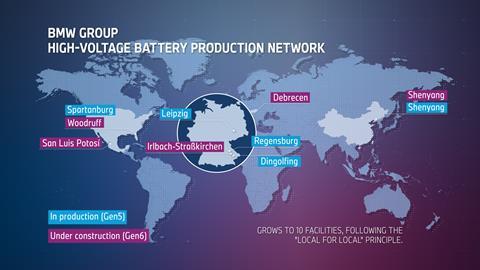

The Neue Klasse range of EVs from BMW will need to draw strongly on the production of powerful high-voltage batteries, with significant expansion planned. “We are setting up five facilities on three continents to produce our sixth-generation high-voltage batteries,” said Milan Nedeljković, board member for production at BMW.

Across the globe, the principle of ‘local for local’ will apply: “Close connection of battery production with vehicle production is part of our strategy,” added Markus Fallböhmer, senior-vice president of battery production.

Battery and vehicle production

The automaker said the Neue Klasse will be the first to incorporate new cylindrical cells. “These represent a technological leap by the BMW Group, offering improved energy density, charging times and range,” noted BMW.

They will be assembled in new facilities located as closely as possible to vehicle plants. Assembly plants for sixth-generation high-voltage batteries are currently under construction in Irlbach-Strasskirchen (Germany), Debrecen (Hungary), Woodruff (US), Shenyang (China) and San Luis Potosí (Mexico). With an eye on global political instability, BMW adds production will be able to continue despite “unexpected political or economic events”.

In addition, short distances between battery and vehicle plants will reduce the carbon footprint of car production.

In South Carolina, BMW’s Woodruff facility will cover an area of around 93 hectares and consist of a technology building, ancillary structures, energy centre, staff restaurant, fire department and what the OEM describes as a Talent Campus.

Creating more than 300 new jobs in BMW Group, when construction is completed in 2026, Woodruff will assemble high-voltage batteries for fully electric cars made in the nearby Spartanburg plant.

BMW Group has delivered more than 2m EVs to customers, including more than 1m battery EVs (BEVs), but the manufacturer remains more optimistic than some for this year, noting that for 2024, with a line-up which includes more than 15 BEV models across all brands, it anticipates a “significant increase in BEV deliveries, which will remain our biggest growth driver”.

It also estimates, depending on prevailing market conditions in the second half of the decade, development in raw material prices and availability, as well as the pace at which a comprehensive charging infrastructure is created, more than 50% of all BMW Group vehicles delivered worldwide could have a fully-electric drivetrain before 2030.

One major concern surrounding EVs is how to recycle batteries in a way which does not add to existing environmental issues. BMW notes it is working on “industrialising” high-voltage battery recycling through various research and collaborative projects.

A statement sent to Automotive Logistics by BMW added: “Owing to their durability, we do not expect to see a significant quantity of high-voltage batteries returning from the market before the late 2020s.

“BMW Group already takes back high-voltage batteries free of charge for all customers with battery-powered vehicles.”

Politics of electrification

With America roiled by the political machinations of an election year like no other at home, (and globally there are a record 70 countries going to the ballot box in 2024), US politicians are taking to the stump to talk about what they would – and wouldn’t – do to protect domestic auto manufacturing in light of the move to electrification.

Donald Trump has consistently zeroed in on the auto sector, making grand declarations at the recent Republican Convention in Milwaukee, among which were: “I will end the electric vehicle mandate on day one, thereby saving the US auto industry from complete obliteration, which is happening right now and saving US customers thousands and thousands of dollars per car.”

Delivered in classic, blustery Trumpian style, nonetheless the 2024 Republican Platform or manifesto claims the party will revive the US auto industry by cancelling what it refers to as “Biden’s electric vehicle and other mandates and preventing the importation of Chinese vehicles”.

Incentivising the EV market

The outcome of the US election in November this year and what a Harris win could mean for the automotive sector emains to be seen. The Democrat candidate is still vice-president in a Joe Biden administration, but current White House policy outlined in May this year stresses as a focus on electrifying transport.

“Incentivising the development of a robust EV market through business tax credits for manufacturing of batteries and production of critical minerals, consumer tax credits for EV adoption, smart standards, Federal investments in EV charging infrastructure and grants to supply EV and battery manufacturing.

The policy outline continues: “The increase in the tariff rate on EVs will protect these investments and jobs from unfairly priced Chinese imports.”

BMW supply chain executives are also likely to have seen another White House note on batteries, battery components and critical minerals. It says: “Concentration of critical minerals mining and refining capacity in China leaves our supply chains vulnerable and our national security and clean energy goals at risk. The US government says that to improve US and global resiliency in these supply chains, President Biden has invested across the US battery supply chain to build a sufficient domestic industrial base.”

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet