BMW’s senior vice-president of logistics, Jürgen Maidl, and other executives talk to Automotive Logistics about the carmaker’s drive towards a decentralised and fully connected logistics flow

Carmakers do not typically issue strategy statements about logistics. Their board members are usually more preoccupied with vehicle sales, product development, manufacturing stability and profits. Sure, logistics plays important roles across these areas and has cost implications that can make or break most initiatives, but customers don’t willingly pay more for a vehicle because it has fancy logistics behind it; rather, supply chains have to be carefully managed so that cars are competitively priced in spite of such complexity and costs.

So it has been notable of late that several manufacturers, especially in Germany, are becoming more vocal about logistics, in particular the technology they are using. Daimler has spoken about using more robots and equipment to assist logistics workers lifting and moving parts, while the Volkswagen Group has discussed new material handling, including a ‘ride along’ platform to assist workers in sequencing parts, and robots that respond to worker movements and perform image processing. Audi recently revealed that it is using a glove with a built-in scanner at a parts centre.

Higher productivity and improving ergonomics for an ageing workforce are among the drivers of this technology in automotive logistics – a sector that hereto has seen less automation compared to assembly, or even to logistics for other sectors, such as e-commerce.

BMW’s leadership has also been talking a lot about logistics technology with the business community, the supply base and the media, including the role that digitalisation, smart robots and autonomous driving will play across its supply chain. A clear message about cooperation has emerged about what the carmaker hopes to see from its supply chain partners, and even from competitors.

In October, speaking at a logistics conference in Berlin organised by the German federal logistics association, BVL, BMW Group’s board member for production, Oliver Zipse, described logistics as the “heart of BMW’s production system”, noting the huge flow that the supply chain must support: 30m parts per day move from 1,800 suppliers; 7,000 sea freight containers per day, and in a year 84m cubic metres across ocean, road, rail and air freight. Outbound, around 9,000 vehicles leave BMW plants each day on their way to 4,500 dealers in 160 countries.

The planning for this material and product flow is all the more significant thanks to BMW’s order-to-delivery system, which allows customers considerable flexibility in customising vehicles, including the ability to make changes up to six days before production. BMW’s logistics must be able to support both the fixed sequence of the frozen period across transport and material handling, while accounting for a supply chain with intercontinental flows and long lead times that require a ‘warehouse on wheels’ or ‘warehouse on the water’ approach to inventory management.

However, Zipse’s address was about more than numbers and complexity. Of greater significance may be how the ‘heart of production’ will beat and support circulation in the coming years and beyond, with BMW anticipating significant technological and consumer changes. The executive presented a road map of sorts that its logistics organisation has developed to chart the changes. This ‘Connected Supply Chain’ starts with improvements in efficiency and visibility today, including the ongoing implementation of new automated guided vehicles (AGVs) and a global transport management system (TMS); but it also goes well beyond the status quo, envisioning future operations in which automation, analytics and connectivity will be defining characteristics of logistics and of ‘industry 4.0’ more broadly.

“We are working towards a reorganisation of production processes by connecting all the work flows in logistics,” Zipse told the BVL conference. “The idea is that, through digitalisation, our global value chains will be more transparent. In the long term, we want to move away from central steering towards the self-steering of objects in the supply chain.”

Zipse also made it clear that, for such a system to be possible, manufacturers and logistics providers would need to use data and communication that are mutually intelligible, especially for autonomous transport, for which a proliferation of systems would render the technology unusable outside an individual carmaker’s facilities.

The supply chain of the future

Jürgen Maidl, senior vice-president of BMW’s logistics production division, is the carmaker’s top logistics executive and in many ways the architect of the Connected Supply Chain at BMW.

His organisation covers inbound, outbound, in-plant and international logistics, as well as programme planning. Within logistics is also an innovation group, which includes initiatives in areas focused on IT connectivity, AGVs and smart robots, augmented reality, connected vehicle distribution and sustainability, led by Marco Prüglmeier, project manager for innovation and industry 4.0.

Together with Maidl, these teams have recently been showcasing their latest developments, as well as the Connected Supply Chain vision, to logistics providers and suppliers, and to the media at a logistics innovation day held near Munich. Following Zipse’s message in Berlin, the logistics group is actively encouraging its supply base and partners to work with it on adapting new technologies.

“We are open to each partner in technology and logistics,” Maidl tells Automotive Logistics. “We recently held a big event with logistics providers that invited them to build upon our concepts. We are also going on innovation trips to other countries, including the US, Israel and others, to look for new ideas and partners for sensor-based equipment and IT systems in logistics.”

Although the vision of a highly automated, de-centrally steered supply chain is, at best, years if not decades away, understanding its potential and challenges is important when exploring what the innovation teams are currently working on. In many ways, each project group is building towards this vision, although they also feature other improvements and gains that will be implemented much sooner.

“The use of innovative and digital technologies will become a key factor in our complex logistics processes,” says Maidl. “Some ideas might seem futuristic and many elements will come much later. However, many processes are already in place and are gaining pace in our supply chain.”

At its most advanced, the Connected Supply Chain anticipates a huge shift towards a cyber-physical production system, with logistics not only the heart of production, but also the mobile mind guiding parts and vehicles to where they need to be, based on real demand and transport conditions, as well as the arms and legs supporting the picking and moving of material. The extensive use of cloud-based data management will also mean that information and communication move seamlessly across the OEM, its suppliers, logistics providers and customers.

The automation would start with the customer order and specification, which appoints itself in the production system, and determines which factory will build the vehicle based on material supply constraints and customer location. That order would then trigger material orders to suppliers and calculate a delivery arrival time to dealers.

While many aspects of order management are already digitised and automated today, such allocation is almost entirely pre-defined by assembly line infrastructure, tooling and takt times at plants.

“In a faraway future, you might imagine the order comes in and says ‘I’m the order and I need parts X, Y and Z’, based on the option, colours, engine size, etc., which would each be signalled by the order as though it were hailing a taxi, rather than through a central SAP system,” says Maidl.

Once material is ordered, the ‘steering’ of the supply chain would then move to individual components and logistical flows, which continue to ‘call off’ transport or handling as they move from suppliers through plants.

“As it moves through plant or down the line, the uncompleted car will signal that it is now at takt 54, for example, and trigger takt 55 for material and transport,” says Maidl.

Autonomous transport is central to this vision. Driverless trucks would deliver most material and vehicles, while within plants and warehouses mobile robots, AGVs and automated tugger trains would pick and move parts, subassemblies and even entire shelves to work stations.

Though determining the logistics flow will be decentralised, the digital cloud will mean all the information in the supply chain is visible. Sensors in parts, trucks or ‘smart containers’ would broadcast information in real time about inventory, location and the conditions of parts and material in the supply chain. Weather, strikes, border closures or other external conditions would also feed into the cloud, with freight rerouting itself, ordering new material or chartering emergency transport to avoid disruptions. This information, combined with historic data, would be subject to deeper analytics to better plan current and future routes.

Visibility today and tomorrow

Maidl makes no concrete prediction as to when BMW might realise this vision. Instead, he and his teams are focused on taking a step-by-step approach to the Connected Supply Chain, including improving transport visibility, rolling out new types of material handling equipment, or increasing the use of green transport methods (for more on BMW’s drive towards greener operations, see BMW’s ‘connected’ logistics: Towards a sustainable supply chain).

While each area may represent a small productivity improvement, collectively they amount to significant gains; they also point towards future developments that will go much further.

For example, a TMS that connects active shipment information across logistics carriers is being put into place, with plans for more extensive track-and-trace in real time. BMW wanted to open up the ‘black box’ that has traditionally existed between material picked up at suppliers and delivery at the carmaker’s plants, during which time the carmaker has limited information about its inbound material.

In the first phase, the TMS integrates transport and route information across logistics carriers into a private cloud, using delivery confirmations and, where possible, GPS data to track material. The information is then fed into a system that can be viewed via a ‘cockpit’ that provides an overview of material flows and inventory, which can be tailored based on which job function views it. A material planner, for example, should be able to recognise early if a part was damaged during transport and may be able to re-order parts in time to avoid having to move them by air. Looking at current and past flows, meanwhile, will help planners to optimise logistics routes.

The system has already been implemented and provides transparency for the intercontinental supply between BMW’s packaging site and overseas plants. Transparency of inland continental routes, for example within Europe, will be implemented over the next few years.

According to Maidl, after integrating information from logistics carriers, the next step is to gain visibility over the material at the ‘goods sending’ area at supplier plants, to further improve transparency over inventory. Armed with this information, for example, BMW could more readily make a decision about whether it needs to dispatch emergency freight, or whether it can obtain new material fairly quickly.

BMW also plans deeper, more real-time track-and-trace. For example, an expanded use of sensor-based readings in plants could be set up to make instant connections between material and the IT platform. A big win could also be achieved by taking such readings during transport. That would allow not only information about locations, but also remote ‘condition monitoring’ that could give warnings about the temperature, humidity and quality status of parts.

“We need to be able to track the current position and condition of material,” says Maidl. “For example, if containers on a ship to South Africa move around and damage parts, it could lead to a disruption of production. We need to know what happens on a ship so that we can plan a detour or alternative.”

Already, a small number of parts and packaging can provide this information, but such uses will grow, both through sensors and RFID in some cases.

“We are discussing this with the VDA (the German automotive association), whether we can have a standard container in which RFID is already included,” says Maidl.

The most cost-effective, practical application will probably be to have sensors on transport equipment, such as trucks, rail wagons or ocean containers. “For most of our material, having a single ID would work, because if you can identify a single lorry, you can cover its materials as well,” he says. “This will also be true for containers, especially since there it will be more difficult. Imagine your container is the lowest in the middle of the ship – it would be difficult for individual parts to send any data via satellite through all the steel above it.”

A host of technical and legal issues will also need to be determined. While some logistics providers may have fleets equipped with GPS or telematics to handle satellite readings, they might use subcontractors that don’t necessarily have this equipment. “Then you have to start negotiating contracts with providers,” he says.

Maidl also acknowledges that BMW will have to work through further issues over data ownership and privacy, including between tier suppliers and transport companies. To gain visibility over inventory held at tier supplier plants, for example, the carmaker is currently determining how the information can be shared, and whether it should be a BMW system or through a third party.

“We are in negotiations about this, as we have to decide who owns the data and uses it, especially as we are not the only OEM thinking about how to connect suppliers,” he says. “We still have to determine the format. For carriers, it is more straightforward as it was a systems integration.”

Such challenges only emphasise the scale of the potential benefits in having full transparency. This information will also be important to building up intelligent data and analysis. For example, understanding exactly when and where transport flows were disrupted will inform future decisions, while business decisions about inventory and order levels can be made more accurately.

[sta_anchor id=”3”]“If you have enough data to do prediction, then you will have a smoother way of fulfilling lean manufacturing,” says Maidl. “Today, many inventory buffers are based on gut feeling, rather than calculations. But with real data you can look into the analysis and see that for particular materials you only need [a] one day buffer rather than three, because years of data show you that.”

Automation in motion AGVs and more flexible robots are another important area for BMW. Earlier in 2016, it unveiled a ‘Smart Transport Robot’ (STR), developed together with research institute Fraunhofer IML, which uses sensors and self-driving technology to move to workstations in the most efficient way, rather than following pre-defined routes. The STR is made with recycled lithium-ion batteries from BMW’s electric i3 model; they can carry up to 600g. Plans are currently underway for the equipment to use a 3D camera to improve navigation further.

Ten STRs have so far been commissioned at BMW’s logistics centre in Wackersdorf, in southern Germany, where material is consolidated for knockdown kit exports to plants around the world. Maidl says that this location was chosen specifically because international parts consolidation is less time critical than assembly plants – packing goods for a train waiting several hours allows more time to catch up should there be a delay, compared to losing production at a plant.

However, STRs will next be rolled out to a number of major German plants, including first to Regensburg, followed by Leipzig and Dingolfing. Maidl says the timing will coincide with the introduction of new model cycles at each location – information that is not shared publically. However, he expects the logistics processes to be updated across European plants over the next five years.

Autonomous ‘tugger trains’ (tow tractors) are also being piloted at Dingolfing, which builds top-range models. The trains move material over longer distances, such as between warehouses and the assembly line. They navigate the plant based on laser signals and by generating a digital 2D room profile.

BMW is also interested in using even more flexible automation equipment and robots. One robot prototype, for example, uses a 3D camera to trace objects and obtain information about what it needs to pick up, allowing it to perform tasks that have traditionally been more difficult to automate, such as parts picking. In a pilot in Leipzig, the robot is currently used to assist workers with picking and transporting empty containers.

There are also pilots in picking using ‘data goggles’. The glasses support logistics staff by signalling to those picking parts where to find the right goods and where to place them. Going even further, the goggles can visually record the part being sorted and complete a quality check, verifying information from a previously compiled database and recognising different types of potential defects.

Such automation will play an important role in productivity gains for BMW’s transport and manufacturing, moving towards the ‘self-steering’ model envisioned by the Connected Supply Chain, and to changing operations in the shorter term.

For example, in his speech in Berlin, Zipse spoke about “erasing the yellow line” – the point at which parts are delivered to assembly and which has traditionally separated logistics responsibility from manufacturing. The future assembly line will still feature many human tasks, he predicted, but delivery to it will be almost completely automated, including mobile robots that cross the factory floor to work on vehicles, while AGVs move parts to supermarkets for further sorting or directly to the line. Driverless trucks might even deliver AGVs loaded with parts or shelves that move from the delivery gate directly to the line and back.

Maidl admits that such a step is very much a long-term vision, rather than anything BMW is targeting in the near term. However, the increased mobility of material in a plant will increasingly make the yellow line less defined as a physical space.

“If we are increasingly able to move small or large pallets precisely to the point on the line where a worker can remove a part, then you effectively eliminate the yellow line,” he says. “The yellow line is only a line of displacement, but if displacement can happen anywhere, then you will have something like a virtual yellow line between where logistics handles a part, and assembly receives it.”

Connecting to vehicle distribution

Connectivity and automation are not only in focus for inbound logistics or parts. One of the fastest developing areas of the connected supply chain is BMW’s ‘Connected Distribution’ project. Last year BMW told Automotive Logistics it had been running trials that use the built-in telematics and infotainment systems in vehicles to track locations in transit. Likewise, the carmaker can do ‘condition monitoring’ of vehicles by checking quality aspects such as tyre pressure, mileage, battery charge and whether vehicles are securely locked.

Over the past year or more, the trials have been expanded across a range of locations and functions. The car sends a signals at specific moments, such as when it has been opened or locked, parked, or turned on or off, providing highly accurate information about its handling and transport, from where it was parked at a given facility, the timings it entered or left a yard, and even when it boarded a vessel. The information is copied into BMW’s distribution system, allowing controllers to see whether it is headed for on-time delivery or needs to be sped up in the supply chain.

Dr Maike Rotmann, who has worked on the project team for ‘Connected Distribution’, reveals that tests across vehicles from multiple plants to global destinations have provided successful readings on locations and quality. At a vehicle yard, for example, locations can be pinpointed to within one or two vehicle lengths. “That is accurate enough to locate specific units when you know which model and colour it is, for example,” she says. “However, to ensure fully accurate inventory, manual scans of each vehicle are still necessary for yard management. So we will use both methods for the time being.”

Michael Bomann, head of vehicle distribution centres and global standards, admits that the “real win” for using such tracking will come when BMW can access 100% of its vehicles this way, rather than only a share of the models it sells right now. “But we had to start somewhere to keep progress on the project, as it has been so successful,” he says. “We are measuring vehicles across the chain now, though in some cases, such as where we use importers for distribution, that might only be to the port of entry.”

Likewise, further gains will come when data readings are communicated across transport. While transmitting information every two seconds would not be necessary, so far transmissions have typically happened at the beginning and end of a transport leg, rather than during it. For example, the last readings from the port of Bremerhaven would be after the vehicle is positioned on a ro-ro vessel; the signal is useful for verifying that it made it on board, however, no further readings are made until the vehicle arrives in another destination port.

“Having information on the water will be very useful, especially for knowing if there was potential damage or if a ship is likely to arrive late,” Bomann says.

There are still challenges to work through in terms of reading information at various stages of transport, as well as communicating across different mobile networks, but Bomann and Rotmann are confident these can be overcome.

In the project’s next phase, the interior display will be used to send notifications or receipts for work steps in the transport chain. For example, the screen can display information about the accessories and options to be installed in vehicle distribution centres, as well as route and parking information at yards.

Such developments for vehicle logistics again presage a self-steering supply chain. Vehicles can already perform bi-directional communication and it will be possible, especially with more autonomous driving features, for them to communicate with other equipment, such as trucks or trains for loading, or move to designated parking areas.

[Telematic readings are] accurate enough to locate specific units when you know which model and colour it is, for example. However, to ensure fully accurate inventory, manual scans of each vehicle are still necessary for yard management. So we will use both methods for the time being.”

– Dr Maike Rotmann, BMW

Combining logistics and IT

Jürgen Maidl has been with BMW for 18 years, with key roles in logistics and production steering since 2011; he’s led the logistics department since 2014 after it was reorganised under the production division. Much of Maidl’s career, however, has been across IT and software applications at a number of major European firms, including CAP Gemini SCS, where he held positions including head of software solutions and leader for its electronics unit.

He joined BMW in taking over the carmaker’s group IT strategy, and was later senior vice-president for IT management including global data centres and infrastructure. In 2006, he took over the carmaker’s in-house consulting arm.

With his experience in IT and across business functions, Maidl is particularly well suited to manage both the technical and practical requirements around the Connected Supply Chain, while appreciating its more strategic significance within production and distribution. For example, he understands the complexity around integrating the various IT systems and software used by both BMW and its supply chain partners that makes improving visibility so hard.

Maidl also foresees the systems changes that will be required to make a switch from “central to decentralised steering”, in which material call-offs and work orders are issued directly by parts or vehicles moving through the supply chain rather than by a mainframe enterprise resource planning system.

“In a decentralised flow, where it will be the object – the order, uncompleted car or finished vehicle – doing the call-off rather than huge backend systems like SAP, we will need an entirely different way of thinking,” he points out. “That will include a different IT approach, for example, with more emphasis on micro services.”

The right skills for the future

Though not planned in any immediate scenario, the prospect of such automation across the inbound, plant and outbound supply chain raises questions for the logistics sector, with risks to some existing jobs or services. The prospect of complete or increased automation on either side of the ‘yellow line’ could cause worries and disputes with unions. Beyond plants, the current automotive supply chain is labour-heavy in many areas, whether parts warehousing, or vehicle handling across yards and port terminals.

However, such automation needs to be understood more finely. For one thing, even in the long run, Maidl doesn’t anticipate the full degree of automation in logistics seen in assembly tasks like body-in-white, especially with the extreme variety of parts and handling required.

Instead, the technology BMW is trialling or implementing is more often ‘cooperative’ automation. Robots that lift heavy parts or roll shelves to work stations, as well as data goggles, will function alongside human workers. In many parts of the industrialised world, including western Europe and the US, growing shortages of truck and forklift drivers may lead to more automation to avoid disruption. Ageing workforces from Germany to China may also come to depend more on automated assistance to do their jobs safely.

Such cooperation with technology will also be true for management and analyst roles, as the expanded use of data analytics for logistics planning and optimisation changes how material planners work. But that does not mean they will be eliminated altogether. Those working in logistics will probably have more value-added roles to perform, whether in the factory or in management.

“Some areas will see roles change more heavily than others, such as on the shopfloor, but overall there will be an enhancement of logistics jobs, with more focus over quality aspects and working with data,” Maidl says. “Logistics roles will be enhanced in this way.”

Dealing with this change requires close collaboration across BMW’s management, labour and training institutions. Maidl says the logistics organisation is already talking with unions and the carmaker’s Betriebsrat (the works council, which represents labour on the management board) about the impact of these projects in logistics.

“It will change the job description and it will change the education required. We need to discuss this with unions to make sure that we can get their buy-in to move forward,” he says.

Training and re-training is becoming increasingly important, both for current and future staff. Maidl emphasises a constant dialogue between human relations departments and logistics to understand how to educate workers, and collaboration with schools to influence curricula and change vocational training.

The elevation of logistics jobs to involve more skills in maths, IT or data analysis will also need to be addressed. While a number of technical universities in Germany have prominent logistics programmes, Maidl says it is absent from many others. In some parts of the world, logistics is still viewed as moving boxes and forklifts. If more young, highly skilled workers are to be attracted to the sector, more needs to be done to show its opportunities.

An open-source supply chain

Along with Zipse’s unveiling of the project in Berlin, Maidl and his team have thus been spending time spreading ideas about the Connected Supply Chain in detail. During such events, a key theme of the project emerges, as well as perhaps one of the biggest challenges to digitalisation: the need for the industry to share open platforms and standards, especially in areas such as autonomous driving, sensor-based communication and other kinds of automated messaging and tracking, for example on shared digital cloud networks.

So far, it is unclear whether the industry is ready to work together in this way.

“One reason why we are sharing these projects openly is to address standardisation,” said Marco Prüglmeier, speaking at the logistics innovation press event near Munich. “We cannot solve these issues alone, but need a bigger approach.

“For example, if every manufacturer were to use its own closed system for autonomous transport, then logistics providers would not be able to handle the processes effectively when delivering to different companies,” he added. “We want to have open interfaces.”

Open sharing and standards of information will also be necessary if BMW’s use of telematics in its vehicles is to be effective during vehicle distribution. For example, service providers should also be able to access the data. “It is no use for our managers in Munich to see that a car at a port in Japan has a window open if our providers there can’t see that and respond,” says Michael Bomann.

Standard protocols for telematics are also needed across different OEMs, which will each have differences between systems, if logistics providers are to manage the data effectively. Maike Rotmann says that BMW is in discussion with other carmakers about how to manage this. Other groups, such as the Association of European Vehicle Logistics (ECG), are also working on establishing such standards.

“We may even need a neutral third party, such as the TÜV (the German inspection association) or a university that could be a go-between on this data sharing,” Rotmann says. “We don’t see a solution yet.”

There are deeper IT and systems questions over moving towards real-time transport and material monitoring. For example, updating data about 30m parts per day every few seconds would almost certainly overwhelm or crash a central IT system, as would data about every vehicle in global transport. In future, a shift towards smaller, decentralised infrastructure will probably follow.

“[For our TMS] we have now implemented a layer above our SAP system that takes data from SAP and other bespoke systems or from our partners around the world, and in this system we handle the data,” Maidl says. “That will be the truth for a long time, but in future we will likely see an entirely different IT architecture from big, silo installation to micro services.”

Currently, BMW is also using a private cloud, though Maidl appreciates that there will be some benefits to using a public cloud where information can be easily shared. “At the moment we are a little bit reluctant about going into the public cloud, even if we are fairly confident that the data are secure. We will look into further developments,” he says.

The heart beats on

While these ongoing developments will be rolled out in a phased manner, in some functions and regions they will have significant impacts. BMW’s new plant in San Luis Potosi, Mexico, for example, will incorporate many new features when it opens in 2019. Maidl expects visibility over the total supply chain to be highly advanced at the plant.

“We expect to be much further forward by then. If possible, we will have the full Connected Supply Chain in place, but I would not promise that,” he says.

AGVs and smart robots will be available at the new plant as well, though use of such equipment there will depend on the business case – especially given lower labour costs in Mexico.

A number of other projects and systems will also play influential roles in BMW’s supply chain over the coming years. In 2017, the 5 series will be produced in Dingolfing, at Magna Steyr’s contract assembly plant in Graz, Austria, and in China. By 2019, the 3 series will be built at Munich, China and Mexico.

For such co-located production, BMW is increasing its use of ‘pearl chain’ deliveries – long distance, just-in-sequence supply to plants in which parts packed in order of production move almost directly to the assembly line. That allows BMW to use the same set of suppliers for multiple locations, for example. However, with intercontinental lead times, it puts huge pressure on logistics to pack parts accurately, meet delivery times and to manage engineering changes.

“When you are building something in Germany and outside Europe, you have to manage delay times of about one month, which is difficult especially if you have changes,” he says. “You may have to fly or pre-produce parts, but you must handle it. We have introduced a new system to help manage that issue.”

Furthermore, a new order-to-deliver system, called Pro-flex, is being developed that will do considerably more to update and synchronise vehicle orders and delivery forecasts in line with real-time material, production and logistics constraints. According to Maidl, Pro-flex will provide a “permanent pearl chain of orders” that will help to fix and stabilise production so that the vehicles BMW builds more accurately match its longer-term production planning. Changes in orders or supply will update forecasts automatically, for example.

“We expect accuracy of 80% or more, which will help our suppliers and supply chain and allow us to reduce buffers in some instances,” he says.

Data analytics could also play a much more important role. Currently, BMW has started pilots to use predictive analytics in its supply chain to better calculate routes and delivery times. However, it is not fully implemented, especially as logistics staff still need to be trained in how to work with data analysts.

The company is also starting to look into how it can predict customer behaviour, though Maidl admits this is more difficult. “If we could use data to predict with 95% probability which kind of cars will be sold next month in, say, Montana, that would help us to have a really stable supply chain,” he says. “However, it does not help if the accuracy is only 50-60%; you need to be in the upper 90s. We have not found the golden key yet.”

For Maidl, the technological changes across the supply chain are likely to only increase the significance of logistics. Logistics at carmakers like BMW will remain highly strategic and executives need to push for innovation processes that support the changing shape of manufacturing. “If you [as logistics executives] think only as a service provider [to manufacturing], you are lost in that game,” he says.

That is because many industry 4.0 applications, such as self-driving vehicles or augmented reality, might be more relevant for logistics than manufacturing or finished products, at least in the short term. “Optimisation and automation has already taken place in body-in-white or paintshop, probably more than logistics ever will be. But are they autonomous? No, but we think logistics will get to that point faster than other areas in assembly.

“Logistics will remain the heart of production and therefore a strategic cornerstone,” he concludes.

Global VDC network: more high quality than high tech

While BMW is using new technology to improve supply chain visibility and move towards ‘cyber-physical’ connections, not all efficiency in logistics depends on automation. In vehicle distribution, for example, cars still require processing and preparation before going to dealers, whether that is checking for damage, readying fleets, testing equipment or applying market-specific documents. It’s unlikely such requirements will disappear.

An important example for BMW is its vehicle distribution centre (VDC) in Garching, northern Munich. The centre opened in 2015, replacing another site in Freimann less than 10km south, which had been used for more than 50 years. According to Michael Bomann, head of VDCs and global standards, around 50,000 vehicles per year pass through Garching, including cars delivered through special distribution channels, such as major fleet and rental customers, cars for BMW’s DriveNow car sharing scheme, and vehicles in development for testing.

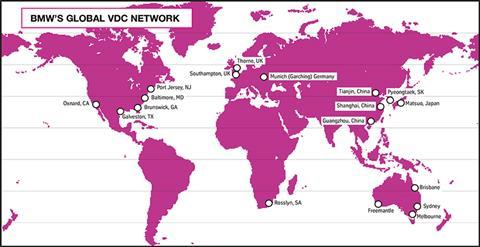

Garching is one of 18 VDCs at BMW, most of them at or close to major ports of entry in large import markets (see map below). These operations include activities that it would be inefficient to do at production factories. For example, imported cars to Japan require around 30 different stickers verifying tests and checks, which are much better handled by local employees in the country than in Germany. Other market-specific items are also added at the VDCs, including accessories in the US, regulatory checks for South Korea, and special tracking and anti-smash spray for cars in South Africa.

According to Bomann, the site in Garching is a global competence centre for BMW’s vehicle distribution, both for its handling and testing of vehicles, as well as for the ergonomic design of its work stations, which include hydraulic platforms. For example, while the Freimann centre was arranged as a single assembly line that vehicles moved down, the new site has 38 identical stations, which allows more work to be done simultaneously at different speeds.

“We apply lessons from this VDC to our global network; however we also transfer knowledge from other centres across the world,” says Bomann.

BMW operates the Garching VDC in-house, with 91 employees processing between 180-340 units per day, thus requiring a high degree of flexibility. According to Helmuth Schwartz, who is responsible for the VDC, skill and training levels need to be very high, including handling and testing 30-plus development cars on site each day. The VDC uses a standard set of KPIs that it measures daily across its working teams, with performance and improvement actions.

“We also do training together with other plants. For example, we work with our plant in Dingolfing on how to handle the new 5 series, including its functions, as well as how parts are changed or fitted,” says Schwartz. “We work with plants as early as possible in the development phase to make sure a market launch is smooth.”

Garching has space for nearly 5,000 vehicles in its yard, which arrive both by truck and from a nearby rail station. Vehicles from BMW plants around the world arrive here, including from across Europe, the US and South Africa, for customers in Germany as well as for testing and audits. The centre is equipped almost as a mini-plant, with a paint shop for repairs or changes, a small parts warehouse, repair and installation areas, and a car wash.

Topics

- Asia

- Automation

- BMW

- Deep sea

- Digitalisation

- Europe

- europe

- Europe

- features

- Finished Vehicle Logistics

- Finished vehicles

- Germany

- Germany

- Green Freight & Transportation

- Inbound Logistics

- Industry 4.0

- Interviews

- Inventory management

- IT

- North America

- OEMs

- OEMs

- Packaging

- parts

- Plant Logistics

- production

- Rail

- Road

- Supply Chain Planning

- Sustainability

- telematics

- Telematics

- Track-and-trace

- Transport Management Systems & Warehouse Management Systems

BMW’s ‘connected’ logistics: Shaping a self-steering supply chain

- 1

Currently reading

Currently readingBMW’s ‘connected’ logistics: Shaping a self-steering supply chain

- 2

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)