At the ECG Spring Congress 2024, Justin Cox, director of global production at LMC Automotive, offered keen insights into the European automotive market’s current state. With inflationary woes and China’s sway looming large, Cox’s address highlighted the imperative for agile adaptation amidst market flux.

The state of the European automotive market and its bearing on vehicle logistics was laid bare at the Association of European Vehicle Logistics (ECG) General Assembly and Spring Congress 2024, this last week in Baveno, Italy. It’s no secret that inflation levels have been a global and persistent bugbear for automotive logistics companies, with rates remaining higher, for longer than average.

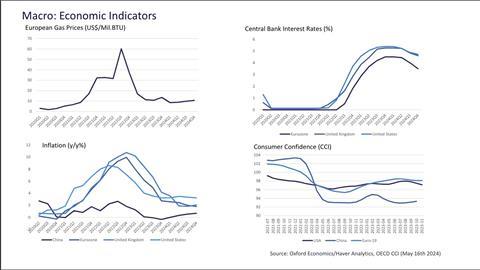

However, Justin Cox, director of global production at LMC Automotive, said that despite this a dip in inflation is expected. The speed of this reduction is likely to be gradual, however.

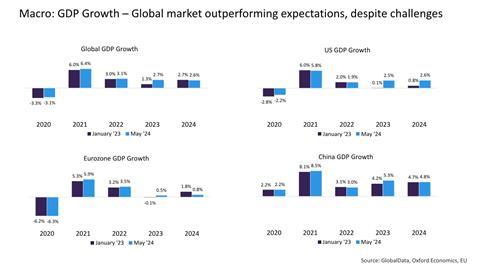

So market recovery remains robust but slow, with automotive LSPs needing to factor this trend into their operations and strategies. Cox vocalises what many of in the industry are already feeling, that beyond the imaginary world of economic forces in a vacuum, this situation “has a lot to do with China”, which represents a third of all vehicle sales. China began the year weak and vacillating, “and any wobble in China reflects in the rest of the world.”

The return of demand-driven supply

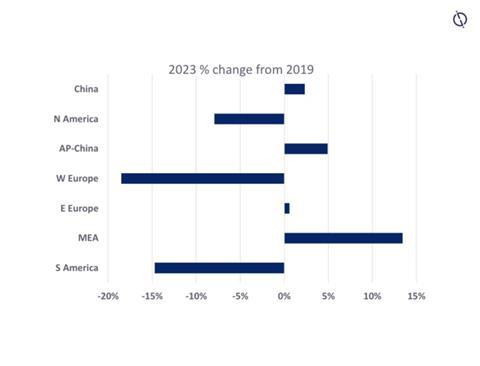

In terms of automotive sales, western Europe’s output stands at about 19% below pre-pandemic levels, with the US at about 8% below for the same period.

“But the layer behind all of this is the electrified vehicle market,” said Cox.

“By the end of 2023, we judge that disruption will be at a more normalised level; meaning being able to cope with things better. This marks a shift back towards demand driving supply rather than constraints.”

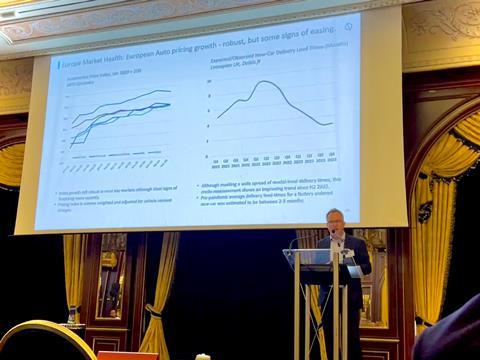

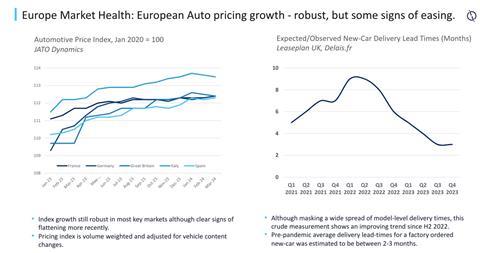

Statistics from Jato Dynamics show that Index growth remains robust in most key markets, though there are clear signs of recent flattening. The pricing index, which is volume-weighted and adjusted for changes in vehicle content, shows an improving trend since the second half of 2022, despite masking a wide range of model-level delivery times.

Pre-pandemic, the average delivery lead time for a factory-ordered new car was estimated to be between 2-3 months, rising to 8-9 months because of disruption. New car delivery times have now fallen back from these peaks. Still, Cox said there is room for price cutting for many OEMs.

Battery electric vehicles: destocking and recalibrations

In terms of battery electric vehicle (BEV) market share, he said that everything is fractured in the markets right now. BEV sales slipped from 13% in 2023 down to 11% in Q1 of 2024. Smaller vehicles seem to be more appealing to the European market.

Cox also pointed to a “media backlash” concerning BEVs. For example, in April of last year the Telegraph in the UK printed a story entitled ‘Car parks could collapse under the weight of electric cars’. There are also obvious cost considerations. Cox said plainly: “The rich tend to buy into BEVs and it’s far more difficult to make others buy into them.”

Then there is the added issue of attempting to bring about the transition in an unpredictable and unforgiving market. During 2023, BEV incentives were phased out in the key German market. This, coupled with BEV market demand falling below original plans in other European markets, affected production. The VW Group’s German production was particularly exposed to this slower market development.

In the second half of 2023, a combination of de-stocking and component shortages further undermined BEV volumes. As a result, volume expectations have been recalibrated, with price cuts planned to support demand-led production in 2024. “VW now have a relatively disciplined approach to stock control,” said Cox. European production is expected to nudge ahead by around 1% but in comparison with past performance that is good, according to Cox.

China seeks European penetration but protectionism on the rise

Then there is the issue of China. On the one hand, 15% of all Chinese vehicle exports now go to Russia. But how many are ending up in Europe? “China is ahead,” said Cox. “Some say by ten years, some say by five. Either way, they are ahead.”

In 2023, China exported over 4m passenger vehicles, marking a year-over-year increase of over 60%. After surpassing Germany in 2022 to become the second-largest auto exporter, China exceeded Japan in 2023 to become the world’s largest auto exporter. The leading factors in this surge were exports of new energy vehicles (NEVs) and shipments to Russia.

In terms of wider light vehicle impacts, in the most aggressive scenario, Europe will be behind by many millions. But the base scenario still shows a major cutdown.

In 2023, the CIS region (of which Russia is the leading player) accounted for well over half of Europe’s Chinese brand light vehicle sales. Penetration has been increasing in the rest of Europe, with SAIC’s MG brand leading key market progress outside the CIS, with over 60% of China-branded light vehicle sales SAIC-owned. BYD, Geely, and other companies plan to push Chinese brand market share across Europe towards 10% by 2030.

European output is expected to remain below pre-pandemic levels. The US is just about to break out, and Cox said this has a lot to do with nearshoring.

Biden recently announced that the US is doubling import duties on electric vehicles by over 100%, aiming to regulate imports from China. Tariff hikes will also target lithium batteries, semiconductors, critical minerals, steel, aluminium and other goods, to be implemented gradually over the next two years under the review of Section 301 of the US Trade Act of 1974. These measures will impact imports worth $18 billion from China. There are indications that Europe is to follow suit.

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet