As the first results for 2023 start coming in from Europe’s finished vehicle-handling ports, it is clear that China is targeting Europe for electric vehicle sales at a time when ro-ro capacity is recovering and shipping is facing geopolitical disruption.

Europe’s top performing vehicle-handling ports report some similar trends for activity in 2023, including the rise in Chinese vehicle imports, which is continuing into 2024. Those Chinese import volumes are being delivered by deep ocean pure car and truck carriers (PCTCs) but there is also an increased volume of containerised vehicles being delivered to Europe. That comes at a time when vessels travelling from the Far East to Europe and back are being disrupted by attacks in the Red Sea and Gulf of Aden, something that has forced some vessel operators to divert shipments around South Africa’s Cape of Good Hope, adding up to 15 days to delivery schedules.

In addition, the ro-ro shipping sector is still struggling to recover capacity meaning less frequent but larger volume deliveries, leading to longer dwell times and terminal capacity constraints exacerbated by other factors, such as the shortage of road haulage drivers and finished vehicle equipment. However, certain ports have been able to rely on improved rail services, which has the added bonus of meeting sustainable logistics goals.

Combined flows

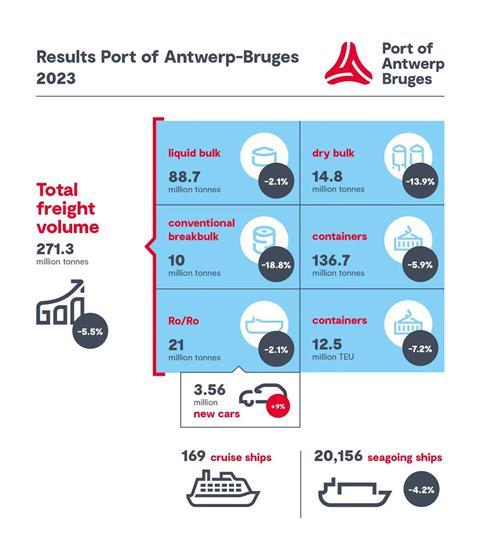

Europe’s top-performing port by the volume of vehicles handled in 2023 is the recently merged port of Antwerp-Bruges (formerly Antwerp and Zeebrugge), which finalised its joint authority in April 2022. The merged port posted a +9% increase in the number of new finished vehicles processed in calendar year 2023, at 3.56m. That increase was because of multiple factors, including new carmakers targeting the European car market and the transition to electric vehicles (EVs) attracting dominant Chinese EV makers aiming products at Europe. The port authority says increased numbers are also accounted for by carmakers fulfilling the backlog of demand created by the drop in sales during Covid and the consequent parts shortages that affected production, including the semiconductor crisis.

As with other vehicle-handling ports in Europe, Antwerp-Bruges has faced terminal capacity problems over the last year caused by large incoming volumes and a slow rotation of stock from the port. That extended dwell time is because of a slowdown in sales but it is also to do with the shortage of drivers and equipment in the road haulage sector, further slowing the rotation. However, the driver shortage affecting the road haulage of finished vehicles has led to an increase in the volume transported to and from the port by rail, which ties in well with the efforts being made by carmakers to clean up their outbound deliveries and meet EU reporting rules on carbon emissions.

Sustainability and efficiency are factors behind the automation of processes at the rail classification or (hump yard) at Antwerp-North marshalling yard. Currently the rail bundling project is focused on rail tank cars (for liquid commodities), with the chemical industry having given Antwerp-Bruges a mandate to tend the first and last mile in the port.

“Neutral management on the Antwerp-North shunting hill was a prerequisite to divert short and long-haul tractions,” says the spokesperson. “The bundling operations are in practice since this year [and] we will evaluate and hope to inspire other rail cargo flows.”

Another factor causing a capacity shortage at the vehicle terminals, according to the port authority of Antwerp-Bruges, is the choice by OEMs to create larger strategic stock at the port to facilitate faster delivery to the end customer. More customers are choosing online methods of purchasing their vehicles influencing the transition from a dealer to agent network. European carmakers are increasing direct sales through online platforms for a fixed fee alongside traditional dealer sales.

[Article continues below port data]

The rise of China’s EV imports

Cargo movements to European ports are also now more likely to include vehicles from China, though the tightness in capacity on ro-ro tonnage means high volumes of these vehicles are being moved in containers.

That is registered at the port of Antwerp-Bruges which says that the Far East was its most important region for car imports and taking into account ro-ro and container, there had been a growth in total car imports from China, though Japan remains the bigger Far East exporter of vehicles to Antwerp-Bruges.

A spokesperson for the port authority says it is in close contact with its terminal operators (see box) on finding answers to the capacity problem. “We are happy that multiple terminal operators decided to maximise the use of land in our port by building multi-level car decks on their sites,” says the spokesperson. “Next to that, as port authority, we made extra land available on a temporary basis for car handling in our port and are making additional quay wall capacity available.”

The German port of Emden, which exclusively processes VW Group vehicles, also reports dealing with longer vehicle dwell time at the terminal because of a shortage of truck capacity, caused by the driver and equipment shortages. That comes on top of car carrier capacity problems originating from the Covid pandemic. However, a spokesperson for VW says that Volkswagen Group Logistics had managed the shortage well, “especially by using more long-term agreements with service providers and chartered vessels which can be used flexible on different routes where needed”.

The carmaker also reports establishing new rail services in Europe and established long-term partnerships with its transport providers. VW Group has a long relationship with state rail provider Deutsche Bahn through its DB Cargo division.

BLG Logistics has also piloted a finished vehicle rail connection from the BLG AutoTerminal in Kelheim for Köseköy in Turkey, one of the largest logistics centres of the Turkish state railroad and the closest freight terminal to Istanbul.

Since August 2023, two car trains have been departing monthly from the BLG AutoTerminal Kelheim for Köseköy. In total, the car trains consist of 19 car transport wagons, which can transport 190 to 228 cars, depending on the load factor. The BLG car trains are the first to travel through the 13.6-kilometre Marmaray Tunnel connecting the Asian part of Turkey with Europe.

Barcelona’s strategy: Containerised EV imports

The Spanish port of Barcelona has also seen a rise in containerised vehicle shipments from China. In addition to more than 790,000 containers of goods, the port handled 20,000 v-racked containers of finished vehicles imported from China in 2023. The containerised vehicles arrive at Barcelona’s container or multipurpose terminals, managed by Hutchison Best, APM Terminal or Bergé, and are then transported by truck to Barcelona Autoterminal, where they are unloaded using ramps directly from the truck and managed as ro-ro cargo for the distribution through Europe and the Mediterranean area.

“The logistics for these operations in Barcelona is very good, since existing container terminals are located about 1 km only from the car terminals and the multipurpose terminal (for the v-racks) is just across the fence,” says París. “Car terminals are fast at stripping containers and no extra costs for equipment detention are produced.”

That containerised volume adds to the sizeable increase the port has seen in ro-ro imports from the country.

“China is the global new player as vehicles producer, and it has had a positive impact in Barcelona,” says Lluís París commercial head of the automotive, ro-ro and SSS Bulk division at Port de Barcelona.

“The imports from China have grown from almost 0 in 2021, to 52,131 starting in mid-2022, and 99,645 in 2023, registering an annual increase by 91%” – Lluís Paris, Port de Barcelona

In 2023, around 80% of the Chinese imported vehicles were electric or hybrid, which represent almost 90% of the total EVs received at the port over that period.

París says that to accommodate the OEMs requirements for minimum charging levels, the terminals installed EV chargers. “Autoterminal, which receives the Chinese cars, is equipped with more than 40 chargers, more than enough to face the charging needs,” he says.

Tesla started using the port of Barcelona in mid-2022 for China-made vehicles destined for Europe and has rapidly risen to become one of the main carmakers using the port, behind Seat/Cupra and Volkswagen, which use Barcelona for Spanish-made vehicle exports to the Mediterranean and north of Europe. Renault is also a big user of the port, distributing vehicles to the Mediterranean and importing Korean and Turkish volumes.

Barcelona port also counts Mazda as an important customer. “For more than 20 years Mazda has been using Barcelona as south European hub, and the interannual growth for this in 2023 has been really impressive,” says París.

Rails to the future: Boosting green logistics

He also points out that rail is playing its part in managing these flows. He says the port is the only logistics facility in Spain fitted with UIC rail infrastructure and has handled around 80,000 vehicles by rail from and to Central Europe, including Germany, Austria and France.

Reliance on rail has helped in the face of the driver shortage affecting finished vehicle movements by road. The increase in rail ties in with Port de Barcelona’s efforts to become a greener hub for the vehicle imports from China and European exports.

In 2022, DB was offering four weekly services between Barcelona and Germany and during 2023, Hödlmayr added another service to Austria and, Pecovasa with France.

“Today, the demand to add new trains keeps growing,” says París. “However, we have current capacity limitation to add more international trains, [which have to go through] Can Tunis shunting terminal. That is where all the trains arriving or departing from Barcelona need to stop.

París says Spanish state-owned railway infrastructure manager ADIF is already developing a project to add capacity by building six large international gauge tracks to the current one that should be ready at the end of 2024. “In the meantime, we are giving preference to the trains handling vehicles that are using the maritime facilities,” he explains.

The port of Barcelona also reports a growth of 34% in vehicle exports, which París says is increasing month after month. It is however, still 14% below pre-Covid volumes last recorded in 2019 but he expects that production will be fully recovered by the end of 2024. In preparation for volume recovery the carmaker has been working with its resident terminal operators Bergé and Setram to increase vehicle handling capacity.

“We have moved our multipurpose terminal [managed by Bergé] to the area neigbouring our car terminals, thus occupying part of the area we used to employ as extra-space for car terminals,” says París. “Further to this very recent new layout, the port is studying new solutions to rationally use the new spaces resulting from these changes.”

Koper’s capacity expansion

At the Slovenian port of Koper, which has seen more than a 14% rise in vehicle volumes in 2023, the port operator Luka Koper reports that increase coming from a combination of established customers setting up new destinations as well as new brands from the Far East looking to penetrate the European market, especially those making EVs.

One notable addition in late 2023 was Vietnamese EV maker Vinfast, which delivered its first batch of Europe-bound VF8 EVs at the end of November. Luka Koper is providing stevedoring and other terminal services, including predelivery inspection and services (PDI/PDS), vehicle care and maintenance services, quality checks, and vehicle body work.

Luka Koper has also been dealing with capacity issues affecting inland and maritime transport in 2023, in part caused by workforce shortages. “The lack of labour in other European ports resulted in delays, which with a simultaneous increase of the handled volume, caused additional pressure on storage capacities,” says a spokesperson for Luka Koper.

Working with its partners, Luka Koper has been able to prioritise the evacuation of finished vehicles from the terminals and keep the port operational. It now plans to expand storage space.

In its strategic plan for 2024-2028 Luka Koper says it will pay particular attention to infrastructure development and capacity expansion, investing €785m ($852m), for the container and automotive segments. That includes providing more capacity for the handling of both finished vehicles and containers, and efforts to make throughput more fluid.

In the mid-term Luka Koper plans to build additional open space storage areas in the eastern part of the port, similar to the one it opened last year following an total investment of €7.3m, which provided space for an additional 3,500 vehicles in the hinterland of Basin III.

“In the strategic plan we also include the extension of the garage for an additional 11,600 units,” said Luka Koper’s spokesperson. “In Basin III we plan to build a dedicated twin berth for car carriers. All investments will be executed in phases during the next 2-4 years.”

Extended dwell time

At the French port of Le Havre, operated by Haropa Port, there was a 8.2% drop in finished vehicle traffic last year, which it put down to a couple of reasons in addition to the ongoing impact of the semiconductor shortage and its impact on vehicle production. Those other factors were shared among other European ports, namely longer dwell time for imported volumes on terminals that were already full, with the further impact on dwell time caused by the lack of drivers to haul vehicles out of the ports on road. Both have caused the decline in throughput at Le Havre.

“The port authority is seeking to encourage the development of infrastructure for vehicle storage and logistics outlets, while transport operators are stepping up their recruitment and training efforts,” notes Kris Danaradjou, deputy general manager at Haropa Port.

In terms of additional land for vehicle storage, Haropa is working to find land on the Seine Axis to store imported vehicles, thereby giving back space at the ro-ro terminal. Danaradjou also says that Haropa Port has mobilised 20 additional hectares of land between Le Havre and Rouen.

By contrast the port operator reports that the shortage of ro-ro capacity was not a particular problem in 2023. However, like many vehicle ports in Europe, the port has seen a significant increase in containerised vehicle shipments from China since September 2023. Maritime logistics giant CMA CGM has delivered 35,000 containerised vehicles for SAIC Motor over that time through Le Havre. The port has also received 25,000 vehicles from China delivered on ro-ro vessels in calendar year 2023.

BLG Logistics terminal at the port of Bremerhaven in Germany is also seeing Chinese vehicles in 2023 and in February received the first of a regular shipment of vehicles from BYD. BYD has started commissioning its own ro-ro vessel builds and the BYD Explorer No 1 docked at the port on February 26 with around 3,000 vehicles for unloading through AutoTerminal Bremerhaven.

The BYD Explorer No. 1 is the first car carrier of eight car carriers that that BYD has on order to accelerate the export of Chinese cars to Europe.

Digital tools

The port of Antwerp-Bruges has again invested in digital technology to increase operational efficiency in the face of capacity-limiting incidents. That includes benefiting from a digital radar and camera network, including the use of drones, to provide transparency on port activity.

“The radar, camera and drone network provides transparency in the operational efficiency of our port platforms,” confirms the spokesperson. “The collected data is connected to the digital twin, Apica [Advanced Port Information and Control Assistant], and gives all our colleagues a good view on the real-time status of the port. Having this means that the terminal operators can also be informed of the exact arrival information of the vessel they expect.”

Navigating through geopolitical disruptions

Geopolitical problems currently disrupting the maritime supply chain, such as Houthi attacks on vessels in the Red Sea, have had an impact on vessel movements between Asia and Europe. Antwerp-Bruges port authority said it is still early to see the full impact of vessel diversions around South Africa’s Cape of Good Hope but it is expecting delays in vessel arrivals and extra vessel capacity constraints because of the longer transit times, as well as other disruptions in the supply chain.

Luka Koper says it is currently feeling the consequences of some deep-sea vessel delays by 10-14 days but also says that volumes remain stable.

Port de Barcelona is also seeing the impact on services because of the diversion, which could go on until the conflict is over.

“In terms of calls, we’ve seen the 15-day gap during the month of January, and it would explain why imports have seen a decline at the beginning of 2024,” says París. “However, we think the volumes shipped from China are not declining, but this should just be the impact of this 15-day delay.

París points to figures from maritime data and insight provider Esgian that indicate the conflict in the Middle East has taken away 3% to 5% of vessel capacity, something that could extend the recovery period, as diverting the vessels through the Cape of Good Hope adds around 10 to 14 extra days to the vessels schedule.

Haropa Ports says it is largely unaffected because 80% of the ro-ro traffic handled Le Havre comes from Turkey, Morocco, Spain and the UK and has not been affected. The remaining 20% of traffic does come from Asia and while some of that has been affected Haropa does not report any impact and flows are being managed normally.

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet