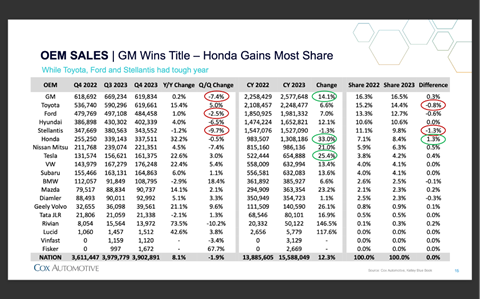

GM had the strongest sales in North America last year compared to other OEMs, having sold nearly 2.6m units in 2023, up 14% over 2022 according to market analyst Cox Automotive.

GM was “the big winner of 2023”, according to Charlie Chesbrough, senior economist, Cox Automotive. He said that Asian brands like Honda, Nissan and Mazda also ranked among the top-selling OEMs. Honda had the largest gain in market share over the year, while Nissan and Mazda posted strong gains as they recovered from a lean supply period in 2022. Tesla continued to see large increases up 25% over 2022, now holding greater market share than the VW Group.

“Among the OEMs with a disappointing year, Stellantis leads the pack,” said Chesbrough. The OEM’s sales in 2023 fell 1%, and as a result they gave up 1.3% of the market share, leading Hyundai Group to surpass them. He said Ford also had a “lackluster year”.

“One contributing factor for both companies was the UAW strike, as the Detroit three all had sales declines in Q4 from Q3,” he said.

Toyota also had a difficult year, having lost one point of market share in 2023 from sales growing at half the national average. However, its tight inventories improved continuously through the year and Q4 had strong gains over Q3. Chesbrough said this suggests Toyota enters 2024 “with stronger momentum than some of their competitors”.

Elsewhere, Cox Automotive predicted that 2024 will be the “year of the EV”. Stephanie Valdez Streaty, director, Industry Insights, Cox Automotive said with more competition and a decline in battery prices there will be continued movement towards price parity between EVs and ICE vehicles, leading to higher consumer demand. She said: “2024 will be the year of more EV models, more incentives, more discounting, more advertising and more sales muscle.”

The overall outlook for the automotive market in North America this year is that there will be slow growth ahead. Jonathan Smoke, chief economist, Cox Automotive said: “The economic context is a slow growing economy for the economy and the auto market. We’re in for just 1-2% growth, but growth beats a recession.”

He added: “As we enter 2024, new supply is back to spring 2020 levels, which favours consumers and leads to lower prices, which means we officially bid farewell to the seller’s market that has defined the last four years. We are expecting balance to return to the US auto market in 2024.”

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet