The combined impact of vehicle and parts import tariffs could cut production and sales forecasts in the US this year, according to figures from the US the National Automobile Dealers Association, with consumer spending and manufacturing investment revised.

The US is going to have one of the highest average tariff rates in the world based on calculation that has no basis in any economic theory, according to Patrick Manzi, chief economist at the National Automobile Dealers Association (NADA), who was speaking at last week’s Finished Vehicle Logistics North America conference. Those tariffs are going to impact average household disposable income in the US by $3,800, with lower income households hit hardest.

In terms of the automotive sector, a tariff of 25% is already in place on new imported vehicles not compliant with USMCA local content rules. Given US only makes 53% of the cars sold there it is bad news for vehicle prices in the country.

However, even those vehicles made in the US will become more expensive. As it currently stands, a 25% tariff is also planned for automotive parts imports to the US from May 3 and it is already in place on steel and aluminium (causing a rise of between $300-$500 per vehicle, according to Nada). As with other countries, vehicles assembled in the US are reliant on parts imports from around the world. The rise in the cost of vehicle parts could drive up prices on US-produced vehicles between $3,000 to $12,000 across OEM lineups, according to figures presented by Manzi.

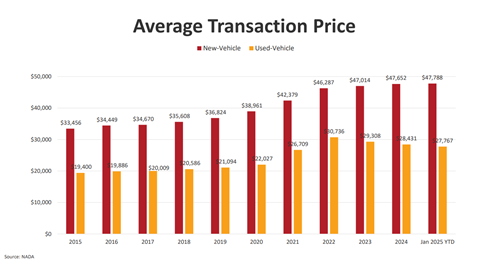

That also means an increase of average monthly payments to $830 from the current average of $738, based on the current average transaction price of $48,000 for a new vehicle. The rise is expected to have a knock-on effect for used vehicle prices. The new rules also mean there is a 25% on imported used cars.

Inflation, insurance and invisible duties

The US is also now expected to see a higher level of inflation (it was 2.4% in March) and Manzi said it is expected to climb this year to between 4-5% by the summer once the full extent of the tariffs take effect and existing inventory is worked through. With reference to motor vehicle insurance, which is already up 55% since the Covid pandemic, further rises are expected and Manzi said that with a 25% increase on automotive parts, replacement costs for insurance companies will go up, and dealership finance and insurance products will increase with the tariffs.

The situation is further complicated by data gleaned from the American Automotive Labeling Act by the US Department of Transport’s National Highway Transportation Safety Administration (NHTSA). The problem with the data, according to Manzi, is that the US And Canadian automotive industries are so intertwined that official data does not distinguish between US and Canadian production.

“So come May 3rd, you’re going to have to pay tariffs on your non-US content in a vehicle that is produced in a USMCA country,” he said. “It’s very confusing and we currently don’t even have a publicly available data source that can tell us how much solely US content is in a vehicle because that’s how intertwined our industries are. So the administration has less than a month now to come up with a way to calculate and collect those duties.”

That increase in vehicle and parts prices comes at a time when real disposable income is trending downward and consumer uncertainty is hitting spending, which is in turn is expected hit sales and production in the US.

Subprime automotive delinquencies are the highest they’ve ever been, according to Manzi, a troubling statistic, with repossessions expected increase among subprime borrowers this year.

At the same time Nada said there are a growing number of automotive businesses talking about raising prices and fewer talking about new expansions or planning capital expenditures within the next three to six months.

Production for import cut

The impact on production and distribution is stark according to Nada figures. North American production stands at 63,900 a day, with 17,600 coming from Mexico and 4,600 from Canada. However, some production of vehicles imported from those countries to the US have been stopped because of the tariffs. Stellantis has temporarily pausing production at its plants in Canada and Mexico and is laying off 900 staff at five plants in the US for the short-term. The VW Group has suspended vehicle imports into the US from Mexico and the Audi division of the group is storing

Production of Infiniti QX50 and QX55 SUVs built at the Compas plant Nissan shares with Mercedes-Benz in Aguascalientes in Mexico was suspended last week.

“That vehicle would be subject to a 55% tariff under the new rule so they’ve just halted production altogether,” said Manzi. “We’re seeing vehicles stopped outside of the country, so all sorts of things are happening while OEMs try to come up with their own responses.”

The 55% figure is because of tariff stacking, where the same vehicle can be subject to several separate cumulative tariffs and fees, an already complicated calculation made more complex by the separate tariffs the Trump administration has now imposed.

Further afield, JLR has stopped shipments to the US, its biggest export market for SUVs produced in the UK.

March a watermark for sales

The seasonally adjusted annual rate for new light vehicle sales in the US stood at 17.7m in March, the highest it has been since 2021. Combined passenger car and light truck sales were around 1.59m. “I do believe that this will be the high watermark for sales going forward,” said Manzi. “I do not expect to see a Saar like this in a world of tariffs for a very long time.”

Vehicle inventory was depleted in March, and there is currently an average of 45 days of supply on the forecourts or in transit (2.7m) but with a sizeable difference between pick-ups (68 days) and small to middle sized passenger cars (32/33 days) and cross-over vehicles (39 days), which is important when considering what is affordable to consumers reigning in their spending in an uncertain climate. “We have seen a lot of customers choose these smaller vehicles, these less expensive vehicles due to the high interest rates and rising transaction prices,” said Manzi.

The higher available inventory available from carmakers including Ford’s Lincoln division, Stellantis’ Ram brand and Nissan’s Infiniti will stand them in good stead ahead of the full exposure the tariff impact, which Nada predicts will start being felt in earnest by summer 2025.

“We’re not really going to feel the sting of tariff vehicles on the ground in most of Q2 because [the dealers] have all these vehicles to work through right now, so it really doesn’t start to take effect until the summer. That is when we could start to see significant impacts to vehicle sales this year,” said Manzi, with anything between 15m-16m units sold in 2025 forecast, depending on the fallout of the wavering tariff policy current rocking the market.

Stay tuned for more insights and content on our recap blog

Finished Vehicle Logistics North America 2025 took place on 8-10 April at the Waterfront Beach Resort, Huntington Beach, California.

The event will return next year on 21-23 April 2026 | Waterfront Beach Resort, Huntington Beach, California.

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet