In the latest development in the dispute between the International Longshoremen’s Association (ILA) and the US Maritime Alliance (USMX), both parties have reached an agreement on a new six-year master agreement, subject to review and ratification by members on both sides.

The International Longshoremen’s Association (ILA) signed an extension to its Master Contract with the United States Maritime Alliance (USMX) on March 11 that will last until September 30, 2030. The signing follows the tentative agreement announced in January this year, protecting jobs and establishing a framework for implementing technologies to modernise US ports on the east and Gulf coasts.

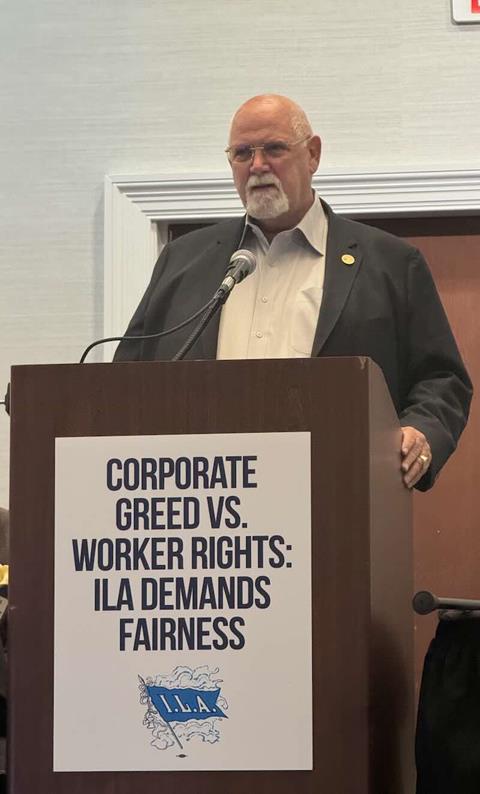

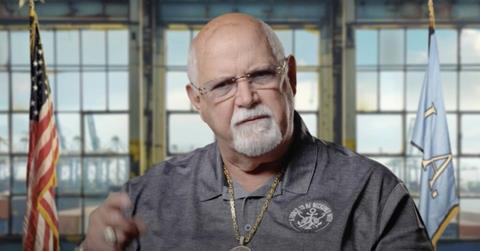

“I am proud to have produced this new agreement with the help of my ILA Wage Scale Committee for my ILA members,” said ILA president Harold Daggett. “We achieved a record-setting 62% increase in wages, full protection against automation, accelerated wages raises for new workers, full container royalty funds returned to the ILA, the best medical plan in our MILA national health care programme that fully protects our ILA members and their families, and raises in contributions to money purchase plans.”

Contention between the ILA and USMX began in September last year over wages and concerns that automation would threaten port jobs. It resulted in a short-lived strike at the beginning of October, which threatened extensive disruption to US container and finished vehicle imports, but was called off on October 4 (see below). Between then and January, stop-start negotiations continued, with an agreement on wages secured but continued debate on the use of automation. In a section focused on new technology and workforce protection the new master document states that there will be no fully automated terminals developed or fully automated equipment (ie devoid of human interaction) used during the term of the contract. It also states that “[t]here shall be no implementation of semi-automated equipment or technology/automation until both parties agree to workforce protections and staffing levels”. The ILA and USMX have established a New Technology Committee consisting of seven members from each organisation.

Workforce protection guidelines include the requirement to define the types of technology and the effects on capacity and efficiency, and determine the manning for the new equipment. They also stipulate that new work created by the technology is identified and training is provided.

F. Paul De Maria, USMX executive vice president and chief operating officer, who led negotiations, said the agreement had unanimous support from USMX members. He also said that the agreement furthered USMX’s mission to “create modern and safe working conditions across the industry, while continuing to focus on enhancing strong and efficient supply chains”.

January 9

ILA and USMX reach tentative agreement on a new Master Contract

The ILA has reached a tentative agreement with the USMX just one week before strike action was threatened to resume on the US east and Gulf coasts ports. The two sides have reported that the agreement covers all items on a new six-year master contract and both have agreed to continue to operate under the current contract until the ILA union can meet with its full Wage Scale Committee and schedule a ratification vote. The USMX also has to ratify the terms of the final contract.

Details of the agreement will not be released until members have reviewed and approved the final document.

In a joint statement the ILA and USMX said: “This agreement protects current ILA jobs and establishes a framework for implementing technologies that will create more jobs while modernising East and Gulf coasts ports – making them safer and more efficient, and creating the capacity they need to keep our supply chains strong.”

The original strike was called off after three days on October 3 (see below) when a tentative agreement on wages and an extension to the master contract was secured up to January 15. Without the current agreement, strike action was scheduled to recommence after that date. The ILA took action in October in response to the perceived threat of USMX implementing semi-automated equipment at the ports, which the ILA interpreted as a threat to jobs.

ILA president Harold Daggett said that the face-to-face meeting he had with Donald Trump on December 17 was the main reason the ILA was able “to win protections against automation” for the membership and negotiate the master contract.

December 18

Trump shows support for ILA in port automation dispute

Donald Trump has shown his support for the ILA in its dispute with USMX over the introduction of semi-automated equipment at ports up and down the east and Gulf coasts of the US. Negotiations between the ILA and USMX broke down last month over the use of automated equipment, which the ILA perceives as a threat to jobs and USMX maintains is essential to improving efficient and safe throughput of cargo.

Following a meeting with ILA president Harold Daggett and executive vice-president Dennis Daggett on December 12, the US president-elect wrote on his social media platform Truth Social that the money saved through the use of automated equipment is “nowhere near the distress, hurt and harm it causes for American [w]orkers, in this case, our [l]ongshoremen”. Trump pointed out that foreign companies that have “made a fortune in the US” should not be looking “for every last penny knowing how many families are hurt”.

On December 15 the ILA issued a press release noting the strong support and commitment Trump was demonstrating to help ILA longshore workers and in a post on his Facebook page Dennis Daggett wrote that Trump was “receptive and genuinely engaged in a discussion about the existential threat automation poses” to the longshore sector.

In its own statement, the USMX sought to liken the concerns for protecting American port jobs with its own but said the contract with the ILA went beyond the ports and is “about supporting American consumers and giving American businesses access to the global marketplace… to sell their products”.

“To achieve this, we need modern technology that is proven to improve worker safety, boost port efficiency, increase port capacity and strengthen our supply chains,” said the USMX statement.

Following temporary disruption caused by strike action at the beginning of October, the ILA and USMX extended their existing contract through to January 15. It is so far unclear how the support shown by the president-elect will resolve the standoff.

Earlier in December the USMX said that modernisation and investment in new technology are core priorities for bargaining the new master contract with the ILA as they mean improving performance and moving more cargo through existing facilities that lack available new land for expansion.

“USMX is not, nor has it ever been, seeking to eliminate jobs, but to simply implement and maintain the use of equipment and technology already allowed under the current contract agreements and already widely in use, including at some USMX ports,” said the Alliance.

It said terminals could nearly double volume after incorporating the use of modern rail-mounted gantry cranes into daily operations and the added capacity delivered an equal increase in hours worked.

November 14

Talks to resolve US ports dispute break down over automated equipment proposal

The International Longshoremen’s Association (ILA) has broken off negotiations with the US Maritime Alliance (USMX) on a working contract for members employed at the east and Gulf coast ports in the US. The ILA and USMX extended their existing contract through to January 15 following a dispute that led to disruption at ports at the beginning of October (see below).

The ILA has complained that during the latest talks management introduced their intent to implement semi-automated equipment at the ports, which the ILA interprets as a threat to jobs. The union said that the statement of intention was a direct contradiction to the USMX’s opening statement on Monday that neither full nor semi-automation would be on the table for negotiation.

This week the ILA said it had always supported modernisation when it leads to increased volumes and efficiency. “For over 13 years, our position has been clear: we embrace technologies that improve safety and efficiency, but only when a human being remains at the helm,” it said in a statement. “Automation, whether full or semi, replaces jobs and erodes the historical work functions we’ve fought hard to protect.”

In its own statement the USMX said it had been clear on not seeking technology that would eliminate jobs. “What we need is continued modernisation that is essential to improve worker safety, increase efficiency in a way that protects and grows jobs, keeps supply chains strong, and increases capacity that will financially benefit American businesses and workers alike.”

The perceived threat of automation to port jobs was also one of the sticking points in the recent dispute between the unions representing dock workers and employers at the Canadian ports of Vancouver, Prince Rupert and Montreal. The standoff was ended this week by Canada’s labour minister, Steven MacKinnon, who used federal powers to end work stoppages at the ports, ordering binding and final arbitration between labour unions and ports ownership. However, the Montreal Longshoremen’s Union, said it planned to challenge the federal intervention in court.

October 4

The strike on the US east coast and Gulf coast ports has been called off, with an agreement on a wage deal reached between the ILA union and the port operators.

After just three days on strike, ports began reopening late last night (October 3), but the impact on the automotive supply chain is yet to be felt, with a cargo backlog of at least 54 container ships that will take time to clear. Everstream Analytics estimated that one day of strikes would mean it would take seven days to clear the backlog, while three days of strikes would take anywhere between 21 and 25 days.

Industry experts at ALSC Global 2024 estimated similar times, including Jessica Hanson, vice-president of Logistics at Bosch North America. She said: “The average standard right now is that it takes us, in the industry, at least one week per day of strike to try to recover.”

Similarly, the automotive supply chain is already dealing with the impacts caused by attempting to mitigate disruption from the strike. Skotti Fietsam, senior vice-president, Supply Chain, Accuride said: “Along with the strike on the east coast, we’re watching congestion on the west coast because a lot of product has been already diverted to the West Coast, and so we’re going to see that delay.”

And Sean Leary, General Manager Automotive and Mobility, DSV said that congestion is likely across all logistics modes. At the time of the ALSC Global event, which occurred before the strike began, he said: “The west coast is starting to see some congestion and is preparing for what this is going to look like with the east coast strike. We’re starting to see diversions already. So, you’re going to see some backlogs in rail, trucking, potentially border congestion on the northern border, some places where you don’t traditionally maybe see that.”

Read more: ALSC Global 2024 recap blog

The threat of further strikes by the union continues, though, as the ILA and the United States Maritime Alliance (USMA) have only extended their existing contract through to January 15. If a new contract is not negotiated by then, further strikes could loom in the new year.

October 3

Port associations and terminal operators affected by the strike involving 45,000 members of the International Longshoremen’s Association (ILA) are dealing with backups to container and finished vehicle shipments despite advance contingency plans.

“We have had operational contingency plans in place at the ports for weeks,” said Cary Davis, president and CEO of the American Association of Port Authorities. “Our seaports have a done a great job communicating that with their customers. We have daily meetings with the National Economic Council [which] advises the [US] President on economic policy. At the end of the day we just need a quick resolution to this.”

Cary pointed to the resiliency of the supply chain and alternative paths for cargo to flow but acknowledged that the container and ro-ro segments are most impacted. He said the stability of US ports is vital to the functioning of the US economy and global trade and AAPA is hoping for a quick resolution.

The Port Authority of New York and New Jersey (PANYNJ) said all container and vehicle shipping activity has ceased because of the strike and the daily economic impact on the 16 counties in the New York and New Jersey region is estimated to be between $250m-$300m. Petrochemical and oil-based products are not impacted, neither are prescription pharmaceuticals, many of which are imported as airfreight.

However, in a broadcast meeting with Newark mayor Ras Baraka on October 2, Bethann Rooney, port director at the Port Authority of New York and New Jersey, said that finished vehicle trade is affected.

“While we are not the largest automobile port… we do supply new automobiles, certainly to the four-state area – New York, New Jersey, Connecticut and Pennsylvania – and sometimes beyond,” she said. “New automobiles that come off the ships are also impacted by this.”

Last year PANYNJ processed more than 403,300 autos, 92% of which were imports.

See our data snapshot for US ports processing in 2023, with a link to the full report included

The Maryland Port Administration (MPA), which oversees activity at the port of Baltimore issued a statement imploring the ILA and the United States Maritime Alliance (USMX) to come together and “negotiate an agreement that properly compensates the men and women of the ILA, while maintaining cost effective and efficient cargo flows”.

It said that in the meantime the MPA will work with the ILA to ensure its members can peacefully gather outside its marine terminals. “The port industry is one of our nation’s leading job generators and is critically important to our national supply chain. We remain hopeful that an agreement will be reached very soon,” said the MPA.

This week Reuters reported that President Biden’s administration had put pressure on US port employers to raise their offer to secure a deal with dockworkers and end the strike.

“They made incredible profits, over 800% profit since the pandemic, and the owners are making tens of millions of dollars from this,” Biden told reporters on October 2. “It’s time for them to sit at the table and get this strike done.”

The port of Jacksonville authority (Jaxport) said it expected the strike to impact about one-third of its business, particularly international container volumes operated by SSA Jacksonville, as well as international vehicle volumes.

According to Rooney at PANYNJ, one unfortunate consequence of the dock workers strike is that a lot of independent owner operators in the road haulage sector are unable to work as long as the strike continues.

“Most of the cargo that had been pulled out of the port early in advance of the strike has already been delivered, so a lot of those drivers are home unfortunately, and are unable to work until this is resolved,” said Rooney. “Many of them work on per move basis rather than an hourly or daily wage. We are concerned about the independent drivers and the impact the strike will have on them.”

Mayor Barack also pointed out that components that are inbound to automotive manufacturing plants in the Midwest are affected.

He also pointed to electrical wire which was in high demand because of the devastating impact of Hurricane Helene in North Carolina. The port of New York and New Jersey has a facility on the port that produces the wire that is used in the transmission of electricity and the raw materials for that wire are delivered in containers.

Emphasising the avoidance of retail panic, Rooney pointed out that the US Coastguard, Customs and Border Protection, the Maritime Administration and the port authority are meeting on a daily basis to plan the restart and prioritise the vessels that are at anchor waiting to dock.

“There are commodities on those ships that are in those critical life safety or manufacturing areas so we can prioritise those,” she said. “US Customs and Coastguard are doing inspections and boarding ships now, even though [the ships] are unable to come in yet. We will be prioritising with the Coastguard the order in which the ships come in when it is appropriate to do so.”

October 1

Strike action has started across east and south coast ports in the US threatening extensive disruption to import export trade.

The strikes involve approximately 50,000 members of the International Longshoreman’s Association (ILA), North America’s largest maritime union, which is in a dispute with the United States Maritime Alliance (USMX) port management group.

Both sides in the dispute failed to reach an agreement by midnight on September 30 over wage increases and the use of automation despite a last-minute attempt by the USMX to offer a 50% pay rise over five years.

It is the first such action to affect the ports since 1977 and is forecast to have a big impact on the automotive supply chain, with one day of strike action estimated impact the supply chain for at least one week.

As indicated earlier (below), logistics provider CH Robinson said that so far this year the US east coast ports have handled over 300,000 TEUs and 17,000 LCL shipments of automotive parts and finished vehicles from OEMs and tier one suppliers, with over half of the automotive freight coming into US heavily dependent on the east coast.

Congestion and delays at the ports is expected to severely impact the availability of containers, increase costs and disrupt schedules. The action is expected to also impact breakbulk and ro-ro cargoes.

Shippers and logistics providers have been planning contingencies for the strike by moving cargo to alternative ports, including on the west coast of the US and in Mexico, themselves already subject to congestion. The move will also put pressure on land and road transport, as well as necessitate an increase in air freight.

“We’re seeing shippers responding to this port uncertainty with similar methods and tools deployed during the Canadian railroad labour negotiations earlier this year,” said Matt Muenster, chief economist at transport technology provider Breakthrough. “Prepared businesses have created contingency plans that they executed when labour uncertainty continued to the deadline they set for internal action.”

At last week’s Automotive Logistics and Supply Chain Global conference in Dearborn Michigan, delegates talked about the actions necessary to mitigate the disruption to the supply chain. That included pulling forward and diverting inventory to avoid the east coast ports, which will be congested and backed up by vessels that will drop anchor and wait.

Christopher Ludwig, chief content officer at Automotive Logistics, told delegates: ”Whether it lasts from several days to weeks, the impact across the supply chain will last considerably longer than that. It’s part of a trend. We saw that with Canadian rail in the west coast strikes, and last year with the UAW strikes. If you’re not pulling forward months in advance it’ll be difficult to react without flying parts around.”

That point was backed up by RXO’s senior vice-president Dennis McCaffrey who also referred back to the (short-lived) Canadian rail strike in August.

“We had six months of planning with an OEM leading up to that and part of that is having a really strong relationship,” he said, adding that having playbook from prior events and a continuous improvement process in place was very valuable. A post-mortem strategy to disruptive events better equips you for the future, according to McCaffrey.

September 26

In the latest advisory from Container xChange on the threat of a longshoreman strike affecting the east coast ports of the US, the container trading and leasing technology provider said the strike could push the container trade into chaos and impact automotive, manufacturing and retail supply chains.

“The congestion and delays at these major ports will severely impact the availability of containers, increase costs, and disrupt schedules,” said Christian Roeloffs, cofounder and CEO of Container xChange. “Small traders, in particular, may feel the squeeze as they are more vulnerable to price surges and extended delays in securing and moving their boxes. Businesses are acting now to reroute shipments and secure their container supply, or they risk being left stranded in a congested and costly aftermath.”

The immediate supply chain challenges identified by Container xChange include stranded cargo, logistics bottlenecks caused by rerouting to alternative ports, including those on the US west coast, and an escalation of costs for shippers. According to the company, Maersk has already announced a disruption surcharge for all cargo moving to and from US east and Gulf Coast terminals, starting on October 21. The surcharge will be $1,500 per TEU and $3,000 per FEU, depending on the extent of the supply chain disruption.

Container xChange also reports that Hapag-Lloyd is bringing in a “Work Interruption Destination Surcharge” for imports from East Asia on October 19, and a “Work Disruption Surcharge” for cargo from the rest of the world on October 18, both at $1,000 per TEU.

In addition, CMA CGM is introducing an export surcharge on October 11, set at $800 per TEU and $1,000 per FEU. It is also charging a $1,500 per TEU import surcharge. Additionally, starting November 1, CMA CGM will apply a $1,000 peak season surcharge for imports from the Indian Subcontinent and the Middle East, delayed from the original October 1 date.

Those costs are likely to be passed on to the end customer according to Container xChange.

Roeloffs said that the automotive industry, which relies on timely deliveries of parts to assembly plants, could face production delays, especially for vehicles assembled in the US.

“Each day of the strike could mean five days of delays for businesses already struggling with tight margins and timelines,” he said. “For many, this could be the breaking point.”

Roeloffs warned that the cost of shipping will skyrocket and the end consumer will bear the brunt whether buying holiday gifts or essential auto parts.

Container xChange is advising proactive strategies be taken, such as rerouting shipments and factoring in additional transit time. It said prioritising high value and critical goods was important for automotive companies. That includes OEMs and suppliers working closely with freight forwarders and customs agents to expedite the processing of goods already en route.

Container xChange also advised shippers to use extended gate hours at the ports ahead of the strike deadline. “Utilizing these extra hours to clear inbound shipments will help companies avoid the backlog that is expected if the strike occurs,” said the advisory. “Terminal operators APM Terminals, Maher and Port Newark Container Terminal will have extended gate hours.”

September 24

Automotive shippers are being advised to turn to air charters and transloading to mitigate the impact of port closures if the upcoming US east coast port strike goes ahead.

In an advisory notice, CH Robinson said that air freight may become a necessary alternative as shippers shift their volumes to the west coast. The company said that although only a small amount of shippers are currently moving to the west coast, the number is expected to grow as the potential strike date gets nearer. Increased volume on the coast will require rail and trucking to respond, shifting the flow of freight further and affecting inland moves when the ports on the east and Gulf coasts would reopen.

Historically, rail takes more time to bounce back from disruptions, as evidenced in the latest Canadian rail strike, and the ongoing effects of this would impact a shift to the west coast too.

CH Robinson added that a US port strike would shut down 36 ports along the east and Gulf coasts, including five of the ten busiest ports in North America. Auto companies and suppliers would be impacted not only in the US, but also across Europe, Oceania, Latin America and Asia.

”So far this year, the US east coast alone has handled over 300,000 TEUs and 17,000 LCL shipments of auto parts and automobiles from OEMs and tier one suppliers,” the advisory notice said. Of this, 50-60% of volume originated from Europe and India, with the remainder originating from Asia-Pacific (Apac). ”While the Apac region typically has more options to shift freight to the US west coast, over half of the automotive freight coming in today is heavily dependent on the east coast. For example, the Germany to Charleston and Savannah corridor is crucial for European automakers which would be shut down in the event of a strike. Currently, there are only two container service loops operating between Europe and the US west coast.”

The notice advised transloading as another option for moving critical freight quicker, as it avoids the 2-7 day wait typically seen when loading containers at ports to connect with rail services, especially as that wait time would increase as port congestion rises.

More to follow…

September 19

The International Longshoremen’s Association (ILA), which represents more than 85,000 dockworkers, is demanding a new contract with the representative of the dock employers, United States Maritime Alliance (USMX), asking for wages that are proportionate with the billion-dollar profits earned by ocean carriers. The USMX employers include Maersk’s APM Terminals and SSA Marine.

Talks between the union and the USMX broke down in June, and on 13 September the USMX claimed there had been no further negotiations on the master contract. If an agreement between the union and the USMX is not met by the time the current six-year contract expires on 30 September, strikes will begin immediately, according to the ILA.

Any hopes of government involvement have been dashed, as administration officials said this week that US President Joe Biden doesn’t intend to invoke a federal law known as the Taft-Hartley that could force workers back on the job during an 80-day cooling off period.

In a statement, the ILA said: “Time is running out to get a new master contract agreement settled with USMX.” Meanwhile, the USMX said: “The only way to resolve this impasse is to resume negotiations, which we are willing to do at any time.”

What ports will be affected by the ILA strike?

Ports with ILA operations span across North America’s east coast, including in Boston, New York, Philadelphia, Baltimore, Hampton Roads, Wilmington, Charleston, Savannah, Jacksonville, Miami, Tampa, Mobile, New Orleans and Houston. The port authorities of New Jersey, Houston and New Orleans also fall within the ILA.

Last year, the US east coast and Gulf coast ports accounted for more than half (57%) of US imports and 8% of global container trade, according to HSBC Global Research’s latest Global Freight Monitor.

Most of the ports with ILA workers are container ports, meaning the majority of affected automotive operations would likely be in inbound and parts logistics, although the effects will likely ripple to disrupt finished vehicle logistics too.

In fact, in 2023, containerised car deliveries soared on the east coast, with the Port Authority of New York and New Jersey reporting it handled more than 35,000 containerised vehicles last year, amounting to ten times the amount it handled in 2022. BMW and Toyota have terminals at the port and terminal operator FAPS also has a facility for processing vehicles for Ford, GM, Nissan, Polaris, Polestar and Nissan, among others.

Baltimore and its surrounding ports have already been under pressure this year after the Francis Scott Key Bridge collapse in Baltimore in March, which disrupted vehicle handling for months. Baltimore is the busiest US vehicle-handling port in the US, with its vehicle terminals, including Dundalk and Fairfield, having moved 847,158 vehicles in 2023. The bridge collapse put additional strain on nearby ports including New York, Norfolk and Philadelphia as vessels were forced to reroute to them during the incident.

Impact of east coast strikes on capacity and rates

September is traditionally one of the busiest months for US containerised imports, and last month saw container cargo imports surge by13% year-over-year, with major ports handling nearly 2.5m TEUs.

Christian Roeloffs, co-founder and CEO of shipping marketplace Container xChange said in a customer advisory notice issued this week that the strong freight demand intensifies concerns about the strikes.

“The possibility of strikes in US east coast and Gulf ports adds uncertainty for container shipping professionals doing business in the US,” Roeloffs said. He added that “short-term spikes” in demand should be anticipated as companies rush to secure capacity for leased containers in the run-up to the potential strike action.

However, he added that US inventories are strong due to the pulling forward of orders earlier in the year to avoid existing disruptions. “This stockpile will act as an essential buffer, mitigating the risk of container rates spiking dramatically due to the strikes.”

Of course, the overall impact of the strikes will depend on how prolonged the action is. Maersk has already warned of severe disruptions, noting that even a brief strike could cause accumulated backlogs that would take weeks to shift.

More to follow…

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet