Flash Analysis

Flash analysis and briefings from our Business Intelligence unit covering the major trends and critical factors impacting automotive logistics and supply chain

Flash Analysys

Global automotive industry shifts intensify challenges for logistics providers

Structural shifts and uncertainty in the global auto industry disrupt logistics providers, impacting flows, investments, and market strategies.

Trade disputes accelerate nearshoring trend with implications for logistics providers

Escalating trade disputes are pushing automotive companies towards nearshoring, reshaping logistics and supply chains across North America and beyond.

Top trends for automotive logistics in 2025

Explore the top automotive logistics trends for Q1 2025, including industry turmoil, cost-cutting strategies, and the rise of nearshoring.

Data snapshot: North American ports in review

This infographic provides a data-driven snapshot of key ports across the continent, highlighting their volumes across years

Red Sofa Interview: EVs present opportunities to consolidate a fragmented industry

Daniel Harrison, automotive analyst, Automotive Logistics talks to Christopher Ludwig, editor-in-chief about the highly fragmented North America logistics industry, capacity shortages, and opportunities to consolidate through the transition to EVs.

Six notes on a supply chain crisis: key takeaways from ALSC Global 2022

Flexibility rules the waves of logistics, but supply chain managers want better visibility and data to make decisions, while investing in the right skills

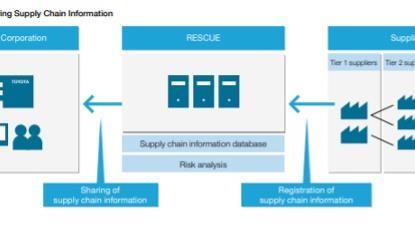

Supply chains made visible as part of US tax credit legislation on EVs

A new ruling on tax credits for EVs, which is ruled by strict parts localisation targets, means vehicle makers will have to make their material sourcing more transparent

CATL powers ahead with a regional, sustainable supply chain strategy

With a new carbon-neutral gigafactory in China, and a plant set to start production this year in Germany, the Chinese battery cell producer is scaling its production and logistics to create secure and sustainable battery supply.

Ukraine’s vital link in the European supply chain

The closure of Ukraine’s supplier industry and the impact on logistics routes reveals how important the country is to European automotive production

Russia’s invasion of Ukraine is a long-term risk for the automotive supply chain

The impacts stretch beyond inflation and corporate retreats to critical shortages upstream for semiconductor and EV supply.

Global automotive outlook: A rocky road, but better times are ahead

Top analyst Brandon Mason explains the depth of the semiconductor shortage and its impacts on vehicle production and sales, but also looks ahead to a fast-changing automotive and supply chain landscape across North America.

In the waiting room: how the chip crunch is now hitting dealer sales

Most OEMs have met demand through existing vehicle inventory, but worsening chip shortages are now choking off new vehicle registrations, with impacts likely across the supply chain for years.

Electrifying Europe: EU ‘Fit for 55’ legislation will transform the automotive supply chain

The EU’s latest salvo to mitigate against climate change will eliminate ICEs and transform automotive supply chains across Europe and beyond

Material shortages are forcing a supply chain rethink in automotive

In the face of material shortages across the board, carmakers and their suppliers are looking a range of radical alternatives as part of drive toward more sustainable closed-loop supply chains

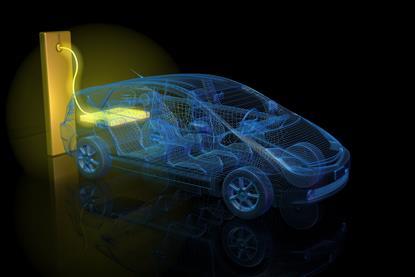

Vehicle electrification shakes up export and import flows

There are regional differences in the sales and manufacture of electric vehicles that are affecting finished vehicle logistics flows, with some countries with relatively small automotive output becoming the bigger EV exporters. That has consequences for finished vehicle logistics, as a new report from Ultima Media’s business intelligence unit, Automotive, makes clear

EV battery supply chains on the move

As electric vehicles become serious business for OEMs, they are reassessing their battery supply and manufacturing bases, putting their eggs in multiple baskets and taking more control of the process.

How the European automotive industry aims to build back semiconductor and chip supply

OEMs, suppliers and EU officials are considering how best to develop Europe’s semiconductor supply bases to mitigate current and future shortages, but the broad gaps at many levels – including for older, larger chips – mean there will be no magic bullet

The way we buy cars has changed forever

The impact of the Covid-19 pandemic has accelerated a latent online sales trend, with more than 50% of vehicles across Europe currently sold across some form of online channel, according to new research. This has solidified automakers’ roll out plans for new sales structures across the continent and beyond.

SK Innovation banned from the US for 10 years following LG lawsuit

The US International Trade Commission has imposed a 10-year ban on SK Innovation for the importation, domestic production and sale of electric vehicle batteries within the US because of intellectual property theft from rival LG Chem. It is a tough sentence, but perhaps unsurprising given the context of the global push to electrification.

Watch: The race to build a North American lithium-ion battery supply chain

Investing in regional battery supply will be critical for OEMs in North America to compete on electric vehicles, but can battery cell capacity keep up? Analyst Daniel Harrison details the evolving battery production footprint in the region.

Watch: Middle East and North Africa supply chains – the route to recovery (EP.3)

Watch this Livestream for the latest insight on vehicle demand, production and trade across Middle East and North Africa automotive supply chains, plus insights with General Motors’ head of purchasing and supply chain for the Middle East, Sulaiman Pallak.

Can the UK supply chain keep up with a 2030 ban on new ICE vehicle sales?

The UK government has announced it is bringing forward its plans to phase out the sale of new cars and vans powered by internal combustion engines. Daniel Harrison, automotive analyst at Ultima Media, examines how realistic that is and whether supply chains are ready to produce enough electric vehicles and batteries.

Watch: Scaling up battery and electric vehicle supply chains

Sales and production for electric vehicles are growing fast, as new vehicle and battery plants come on line. In this panel discussion at Automotive Logistics and Supply Chain Live, global experts from Volvo Cars, Gefco and Maersk share insights on the logistics challenges and advantages in building efficient and nimble EV supply chains.

Watch: Managing the battery supply chain will be a strategic advantage

In this presentation, automotive analyst Daniel Harrison details growth, investment and bottlenecks in lithium-ion battery supply chains, and demonstrates the competitive advantages that manufacturers could gain or risk in taking more control over battery sourcing and production.

Meeting increasing demand for EVs in Europe depends on better battery supply

Carmakers are investing colossal sums of money into low and zero-emission powertrain technologies. Even before the coronavirus crisis infected the finances of most manufacturers the survival of many of them hinged upon a return on investment and a successful transition to electrification over the coming years.

Pent-up demand drives European car market recovery in July

The European car market was expected to be one of the hardest hit regions because of the shutdowns caused by the coronavirus but the UK, France and Spain actually performed better than expected in July, with positive gains on the same month in 2019. Longer-term economic hardships could jeopardise the momentum of that recovery but there are signs of long-term growth in the take up of electric vehicles

Latest demand forecast: Vehicle sales will drop up to 40%, with second dip expected this year

The recovery in new vehicle sales in the wake of the coronavirus crisis will not only be varied in speed across major automotive markets, but it will also be uneven. Further pullbacks in sales are likely later in 2020 and into 2021 for many countries, according to a new report and forecast by Automotive from Ultima Media, the business intelligence arm of Automotive Logistics.

Coronavirus pandemic could force supplier consolidation

The Covid-19 pandemic will exact a heavy toll on automotive manufacturers and suppliers, who will face mounting financial losses and growing debt. Some may not survive, at least in their current form or without further government bailouts. Such financial fallout, and the need for companies to reduce costs and consolidate investments, could prompt more consolidation at all levels of the automotive industry in the coming years.

Calling stop on automotive supply chains: how long can companies survive the Covid-19 crisis?

With the coronavirus pandemic causing a level of automotive plant shutdowns not seen since the second world war, suppliers and logistics providers will face failures without direct support from government, and close collaboration with OEMs and industry.

Watch: A royal entry to Mexico’s competitive supply base

Kevin Reed, vice-president of supply chain at tier two electronics and battery component supplier Royal Power, talks to Daniel Harrison about why the company recently built a new plant in Mexico, and the challenges facing its supply chain and logistics. In the context of declining margins among tier suppliers, Reed discusses the key advantages of moving to Mexico to better serve customers and compete, and why maximising efficiency in the supply chain is a crucial differentiator.

Watch: Future of Mexican EV production depends on a dedicated supply chain

Daniel Harrison, automotive analyst at Ultima Media’s business intelligence unit, tells Christopher Ludwig about the regulatory impact on a steady Mexican automotive market and his outlook on production, which is built strongly on exports to the US.

Your webinar questions answered: How tier 1 suppliers are responding to tough headwinds

You asked, we answer. We return to the questions from our audience that we didn’t have time to answer in our live webinar, ranging from which parts of automotive tier 1 suppliers’ business models are at risk of commodification, to how tier suppliers are changing supply chain processes

Automotive suppliers buying and spinning their way into high tech segments

As BorgWarner’s acquisition of Delphi Technologies shows, tier one automotive suppliers are turning to acquisitions and restructuring their business to focus on advanced technology, helping to protect margins, avoid commodification and transition to electrified powertrains

Electric vehicles could transform role of tier 1 suppliers in managing logistics

As OEMs look to reduce production costs and manage more complexity, automotive suppliers will face challenges. But with more EV models in the pipeline, many have the opportunity to grab a larger piece of the pie both for manufacturing and supply chain management.

Part and parcel of the problem: why tier 1 supplier logistics will face a squeeze

As OEMs and automotive parts suppliers see their margins decline, cost pressures are going to increase on logistics operations and service providers further down the supply chain

Explaining EU vehicle emissions targets: can OEMs avoid heavy fines?

The new average fleet targets that came into force in Europe on January 1st 2020 are having big impacts on the supply chain, pushing OEMs to produce and sell more hybrids and EVs. But the rules are complex and varied by brands, volume and sales. Here we provide a summary of the key rules and terminology.

Is Sony’s Vision S a scary sight, or a revelation for carmakers and suppliers?

Should automotive manufacturers and the supply chain fear or embrace this surprise announcement from the consumer technology giant?

Suppliers will charge the change: opportunities in the EV value chain

While much focus is put on OEM plans to launch more electric vehicles, a great deal of the technology, value, production and services will come from both existing and emerging suppliers across the value chain. We expect many new opportunities for these companies over the next decade.

FCA–PSA fusion: first of the electric shock waves?

The merger attempt by FCA and PSA will be complicated but makes economic and operational sense, including for supply chain management and logistics. Whether or not it goes ahead, more consolidation is likely as the automotive industry gears up for electrification

You gotta carry that weight: how bigger vehicles and EVs will challenge logistics

With forecasts for strong growth in marketshare for electric vehicle and hybrid vehicle sales over the next decade, moving parts and vehicles will require new equipment, processes and standards across OEMs and logistics providers

Global trade disputes could dim electric vehicle supply chain potential in key markets

Trade uncertainties such as those between the US and China, or the UK and the EU, could put the brakes on growth in the electric vehicle and battery supply chain for some OEMs and countries, despite bullish forecasts for alternative powertrains

What took the air out of Dyson’s electric car project?

The iconic manufacturer of vacuum cleaners has cancelled plans to develop and build an EV. That was probably a smart decision, considering the huge costs, competition and struggling market that Dyson would have been entering.

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)