At the AL Mexico conference, Jose Cuervo’s director of supply chain gave delegates some insights into what distribution looks like for a tequila company

Where are Jose Cuervo products distributed and which are your biggest markets?

Jose Cuervo is part of a really big corporation called Becle, which has several companies around the world besides Jose Cuervo, such as Bushmills, Proximo Spirits and others. Jose Cuervo is focused on tequila production.

We have our own fields of agave and our supply chain is integrated; we have the agricultural part, the distillery, the bottling and the national distribution here in Mexico, plus distribution around the world. We also import some other products from Europe and from the US for distribution throughout Mexico.

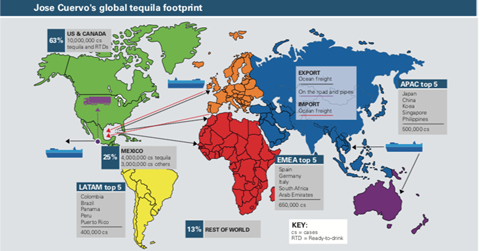

For tequila the biggest market is the US. It’s important in terms of volume [60% of total sales] and gross profit. The second biggest market is Mexico, but even though the US is much bigger and more important, Mexico is the basic market for us, because here is where we create and develop the brands, so that later on we can export to the US and Europe.

Then we have the rest of the world: APAC, EMEA and LATAM. In these regions we are developing the market, but it’s much more difficult as they are further away and we also have to communicate a different concept of tequila than the one consumers are used to; there is a lot of marketing and commercial work underway so that people understand that tequila is not only for shots and teenagers.

”I think we all have problems at the ports, not only delays but inconsistency and unclear shipping dates… if we don’t get space in the vessel for somereason, transportation is delayed by one or two weeks” - Laura Peréz Grovas, Jose Cuervo

In fact, that’s one of the biggest challenges for the company. We are trying to distribute and increase the market for premium tequila. But it’s not only Jose Cuervo – all tequila brands and companies are not only focusing on the margaritas and the shots now. Premium tequila for the last five or ten years has grown on a really fast track, while common tequila is almost flat. Eventually you will sip premium tequila everywhere!

Are there any special considerations for the distribution of tequila?

The main complexity lies in the Tequila Designation of Origin decided by the Tequila Regulatory Council, which controls compliance for the standards allowing you to call the spirit ‘tequila’ or not.

One of the most important requisites for compliance is that, from more than 100 agave species, only agave azul [blue agave] can be used to produce tequila. This agave needs to be grown and distilled only in five regions in Mexico to be approved. Based on a classification regarding the content of sugars, the tequila is designated as ‘100% agave’ or ‘tequila’, which has 51% sugar content from the agave. Each type has different rules for bottling processes and locations permitted. ‘Tequila’ can be bottled in the US, which directly impacts the transport and logistics.

In our case, we distil ‘tequila’ in Mexico and send it in jumbos and tankers to the US, where we also have a bottling site [in Indiana]. More than half of the volume for the US is bottled over there. Bulk logistics is easier and more efficient as you can transport much more liquid and with less cost. For the premium [100% agave] tequila, we bottle it here [in Mexico] and ship it around the world.

When you’re distributing to the rest of the world, which ports do you export from? Do you experience problems there, such as congestion?

We have two major ports: Manzanillo and Altamira. For LATAM we use Manzanillo and for the whole of Europe and EMEA we mainly use Altamira. I think we all have problems at the ports, not only delays but inconsistency and unclear shipping dates. As we don’t have so much volume yet to some destinations, some shipment schedules are just once per week, so if we don’t get space in the vessel for some reason, transportation is delayed by one or two weeks for these destinations.

Looking at Jose Cuervo’s logistics operation inside Mexico, what are the top three challenges?

For sure, security. The only part of our logistics network where we use extra security is within Mexico: guards travelling with the products. We normally try to make best use of the guards and trucks in terms of the costs, for example two trucks with one guard, but the implication is that we have a secondary logistics strategy linked with each delivery.

The second-biggest challenge is the issues that can happen in transit. For example, nowadays there are big protests blocking the railways and roads.

”The only part of our [distribution] network where we use extra security is within Mexico … The second-biggest challenge is the issues that can happen in transit … The third one is the complexity in the market here in Mexico” - Laura Peréz Grovas, Jose Cuervo

The third one is the complexity in the market here in Mexico. We have a lot of different distribution channels, much more than in other countries. We have retailers with crossdocks, but we also have small distributors where the facilities are not the best in class. So we have a lot of different types of transportation, from a 3.5-tonne truck to a complete trailer [30 tons] or two trucks in one [fulles]. We deliver all the way from 100 cases to 2,000 cases per shipment. The really high complexity of the Mexican market also affects warehouse operations, such as picking to deliver less than a pallet quantity per order.

Is the picking done by technology or by hand? Are you considering using automation?

We do it by hand. I think maybe we could use technology in the future. Automation for picking can be done, and there are some technologies that could help us, but for tequila it’s not like other industries such as pharmaceuticals, which handles small cases. Tequila bottles have bigger dimensions and can be broken easily.

In the automotive industry, packaging is something that companies are trying to improve on because there is a lot of waste. Are you looking into that as well?

It’s complex. We are trying to have better and more environmentally-friendly packaging, but at the end it’s hard to avoid the use of glass bottles and other materials to ensure quality throughout the whole logistics chain and keep the product safe. But we are improving a lot the packaging of the pallets and trying to be much more effective, and trying to use better wraps so we don’t waste so much. I don’t know if eliminating the packaging is what we are looking for, but reducing the impact is always a key factor for us.

Going back to the security issue, do you think technology can help there?

In fact, we use a lot of technology for security and there are specialised companies that are helping us with that. We use GPS in all of our transports; it’s a requisite for the carrier to have GPS and a team monitoring the trucks.

Mexican people are sometimes too ‘creative’ so in terms of security you have to always be one step ahead of the [criminals’] creativity and working on new ways to counteract it. One thing the criminals do is to block the GPS in the truck, so the security companies are helping us with technology to avoid the use of those blockers. Other technology on the trucks includes doors with extra security so that they cannot be opened as easily as others. Technology is key for security.

Have the challenges you face changed in recent years; either new challenges emerging or existing ones worsening?

I think they have not significantly changed. The security [problem] within Mexico increases year by year; you have to be always constantly improving and thinking of a ‘plan B’. The complexity of the market is not new – there have always been small clients and big clients – and the dangers on the roads have always been there. But each event has its own complexity and needs different solutions, so challenges in logistics are part of our daily work.

Do you think the food and drink industry can learn from automotive, and vice-versa?

I think we have a lot in common. In the end, we both have high-value products where you don’t have a lot of room for errors in logistics because the cost of the product is high and therefore the cost of an error is high; it’s more complex than moving a ‘basic’ product. We have to invest a lot in transportation to be sure of security, always trying to reduce delivery times and to prevent damages throughout the logistics network.

As we import and export a lot of products beyond the Mexican distribution, we have a lot in common with the automotive industry in that we have international supply chains and the challenges for those are mostly the same: congestion in the ports, delays on the roads, also the transportation between Mexico and the US, and others.

The new United States-Mexico-Canada Agreement is a big deal for the automotive industry. Will it impact your operations?

Thank God, no! The new agreements up to now do not affect the spirits business between Mexico and the US for tequila. The US put some taxes on spirits with other countries but not with Mexico. Fortunately, we are not affected so far.

Good news for you, for American drinkers and anyone who loves tequila!

I think we have a really good advantage over some other spirits due to the designation-of-origin certificate; even when it involves complexity in the processes and rules, the benefits will always be bigger.

Even when you have the option of not bottling in Mexico, the whole distillation and the heart of the tequila is really Mexican, so blocking that in some way would mean not having tequila. I hope we maintain international trade as we have right now.

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet