The merger of Canadian Pacific and Kansas City Southern will create the first truly integrated single-line North American Class 1 rail network, which bodes well for the automotive industry on the continent, according to KCS president and CEO, Patrick Ottensmeyer

The merger agreement between North American rail companies Canadian Pacific (CP) and Kansas City Southern (KCS), which was announced in September this year, is on track for final completion in the second half of 2022.

The Surface Transportation Board (STB) accepted the merger application on November 23, the first in a two-step procedure that now involves a full review prior to control approval.

“We are pleased that the Board has accepted our comprehensive joint application and declared it complete,” said Keith Creel, president and CEO of Canadian Pacific in a statement at the time. “We look forward to moving forward with a robust regulatory review of this historic combination that will add capacity to the US rail network, create new competitive transportation options, support North American economic growth, and deliver other important benefits to customers, employees, and the environment.”

The two rail providers also secured approval from the Mexican antitrust body The Federal Economic Competition Commission (Cofece) at the end of November, and from the Mexican Federal Telecommunications Institute (IFT) relating to telecommunications licences. CP and KCS also each secured shareholder approval in December.

These approvals mean KCS is a wholly owned subsidiary of CP but will be put in trust until the completion of the second phase of the STB review. Then the two companies will be integrated fully over the ensuing three years, unlocking the benefits of the combination, including for the automotive industry.

Continental connections

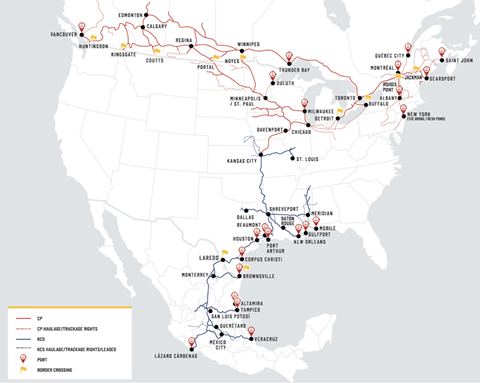

The combined company will have a much larger and more competitive network, operating approximately 20,000 miles (32,200 km) of rail, employing close to 20,000 people, and generating total revenues of approximately $8.7 billion based on last year’s combined results. It will be the first truly integrated single-line North American rail network, something that is particularly important for the movement of finished vehicles given the reduction in hand-off points between carriers which brings improvements in terms of service and cost, and reduces the risk of damage to the vehicles.

The network connects some of the largest, most significant and fastest growing industrial markets, certainly [those] in central Mexico, along with major markets across the continent” – Patrick Ottensmeyer, Kansas City Southern

“The network connects some of the largest, most significant and fastest growing industrial markets, certainly [those] in central Mexico, along with major markets across the continent,” said Pat Ottensmeyer, president and CEO, KCS, speaking at November’s Finished Vehicle Logistics North America conference, held in Newport Beach, California. “We think this will offer a lot of interesting options for our customers, particularly in the intermodal and automotive space.”

The combined network promises to join ports coast to coast, increasing opportunities for volume route planning and intermodal options across North America. Ottensmeyer forecast that the companies would be able to drive investment into the network because of the unique single-line service.

“The importance of that is lining up the operating philosophy [and] the long-term capital investment of CP and KCS to create new competitive, single-line options that don’t exist today,” he said. “The shippers are very interested in those options. It is a huge freight market and a huge auto market.”

The improved coordination of services that the merger heralds will result in a more reliable and consistent service, something in which customers were definitely interested, according to Ottensmeyer.

Bajío VDC

The network is very well positioned for the automotive industry in North America, especially on the Mexican side, following the announcement in October this year that carmakers are to benefit from a new rail-linked vehicle distribution centre (VDC) in the central Bajío region, home to biggest concentration of vehicle manufacturing in the country.

KCS is working with terminal operator Suministros Industriales Potosinos (Sipsa) and terminal developer TransDevelopment Group (TDG) on the set-up of the Central Bajío VDC, which is being built in Comonfort, in Guanajuato state.

The facility is expected to be operational in early 2022 and will be able to handle annual throughput of 50,000 vehicles in the initial phase. That is likely to grow.

”The facility’s throughput at full build-out could exceed 200,000 vehicles per year,” said Alex MacGregor, senior development manager at TDG. ”The site is unconstrained, with additional expansion land and track capacity to support multiple phases of expansion.”

Dennis Manns, executive leader, North Motors Group, who also worked on the project said: “This is a great alignment of partners… and for the industry the location is phenomenal,” said “It is going to be a solution for a number of people in the [automotive] industry.”

That goes for both finished vehicles as well as parts and materials, and Ottensmeyer indicated that the automotive industry would represent close to 20% of carloads, something that had potential to grow.

The long-term strategy here is to offer a service to customers that could result in significantly improved asset availability, consistency and reliability of service, according to Ottensmeyer.

“It is really intended to offer an opportunity for improved service for automotive producers in the central Mexico/Bajio region, which is a very large market [and] get them across the border at Laredo to large consumer markets in the south-east and eastern parts of the US and Canada,” he said.

Regional investment

Most of the capital investment that will benefit automotive will be in the US I35 corridor from Chicago down to Kansas City on the CP network, with some also funnelled into the Quad Cities – that region in the states of Iowa and Illinois that includes Davenport and Bettendorf in south-eastern Iowa, and Rock Island, Moline and East Moline in north-western Illinois.

“Most of the capital investment will be in there – the Quad Cities, Kansas City on the CP [network] and then down to the US Gulf in the Shreveport-Beaumont area,” confirmed Ottensmeyer.

The pandemic has taught us a lot of [supply chain] lessons. That coupled with the trade certainty in the USMCA creates a phenomenal opportunity for North America” – Patrick Ottensmeyer, Kansas City Southern

There will also be capital investment in Texas on the border and KCS is independently planning to build a second bridge from Laredo over the Rio Grande Nuevo Laredo in Mexico. The company has already received approval for the project on the US side. The existing bridge is a bottleneck to the smooth movement of freight across the border, a situation that is only likely to worsen as the growth in trade increases.

“We are pursuing approval on the Mexican side and we think we could possibly start construction before the end of next year and into 2023,” said Ottensmeyer. “That second bridge will add a tremendous amount of the capacity, improved consistency and reliability.”

As with the set-up of the Bajío VDC the name of the game is protect the freight and keep it moving, according to Manns. That helps to avoid some of perennial problems in moving volumes by rail in Mexico, including theft and vandalism.

KCS is also completing some important capital projects in the Monterrey area in Mexico that will relieve congestion there and help the market recover.

Positive signs

The movement of finished vehicles and parts on the new continental single line service will benefit from a more reliable trade climate under the US-Mexico-Canada Agreement (USMCA). Ottensmeyer said the removal of Nafta uncertainty coupled with other factors, such as the new impetus in the industry on strategies to take out supply chain risk by making core sub-components closer to the point of vehicle assembly, promised a more secure future.

“The pandemic has taught us a lot of [supply chain] lessons,” he said. “That coupled with the trade certainty in the USMCA creates a phenomenal opportunity for North America. The timing of this transaction couldn’t be better to position us for growth as a result of all these trends.”

In fact KCS has reported positive results over the past few months in terms of service levels and Ottensmeyer said there was good feedback from a range of customers at a meeting held on November 8 in Mexico.

“The feedback we have gotten supported by high-level data on velocity and dwell, and a look at trip plan compliance, [along with] other things that we track closely and report publicly, shows our service has improved dramatically over last two or three months,” he said.

There were problems with the way Covid health mandates were handled in Mexico and the revenue from automotive shipments has been hit by the impact of Covid and the consequent semiconductor shortage. Ottensmeyer said they were transitory but admitted that the ‘transitory’ was a term that had widened from three or four months to at least 12 as far as automotive was concerned.

High staff turnover

One issue that is troubling to freight shipments in general is recruitment and the maintenance of staffing levels, something being felt across the logistics industry. Numbers are down in core rail operations, including for engineers and onboard staff. It has also felt losses in the IT and accounting parts of the business. What is more, the turnover of new hires and those in training is much higher now.

As part of its merger preparations with CP, KCS has been able to put in place retention and severance programmes for employees to provide security and protection through the prolonged period of uncertainty.

“There is a higher frequency of people not completing the training, which adds cost and time to replace them,” said Ottensmeyer. “We have had to overshoot the targets to ensure we have the numbers to meet growth [in demand for services versus] attrition of staff in the network.”

In terms of the merger, however, Ottensmeyer does not see significant losses because there not any overlapping operations and there are no planned facility or route closures. “A really minimal headcount reduction will probably will be more than accounted for by attrition and turnover,” he said.

Service begets growth

Neither the rail providers nor their customers have a crystal ball view of when the problems affecting the automotive sector will be resolved but the important thing for everyone involved is to be prepared for the growth when it comes.

Ottensmeyer used the phrase ‘service begets growth’ and said the growth opportunities from its mix of business were sizeable (the company has been performing particularly well with grain shipments of late).

“It is about us maintaining an appropriate level of service with respect to consistency and reliability, if we can do that we can grow,” he said. “I feel very good about the service right now and we will continue to make sure that we have the resources in place.”

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet