The latest legislation on domestic EV production in the US will strengthen a more sustainable vehicle industry there, but it will also lead to a significant shift in the balance of imports and exports

President Biden signed a wide-ranging $750 billion health care, tax and climate bill into law on August 16 this year. Of the overall figure included in the Inflation Reduction Act (IRA), $369 billion is directed at energy security and climate change.

That part of the act aims to work as an incentive for companies, including those in the automotive industry, to switch to clean energy and help reduce greenhouse gas emissions by 40% compared to 2005 levels. That applies to the type of vehicles made, and the supply chain and logistics supporting production.

The act includes tax credit incentives, equal to a maximum of $7,500 for each vehicle that complies with rules on local content. It is designed to stimulate greater consumer take up. Those incentives apply to pick-up trucks and SUVs that sell for under $80,000 and sedans that sell for under $55,000.

Cutting emissions

Cleaning up the finished vehicle is a priority for meeting climate targets. Light vehicles, including sedans, SUVs and pick-ups, account for around 51% of transport emissions in the US. The wider transport sector, including road, rail, air and maritime, has grown to be the largest source of carbon emissions in the country, accounting for 33% of overall pollution. That is putting an emphasis on cleaner inbound and outbound logistics, and the industry is looking at how to move parts and finished vehicles more efficiently, and with less environmental impact.

As well as electrification, this also calls for greater use of hydrogen and biofuels, as well as sustainable aviation fuel, all of which needs to be produced from US domestic sources. Some $8 billion has been allocated to develop regional clean hydrogen hubs (H2Hubs) bolstered by the goal of reducing the cost of 1kg of hydrogen to $1 in one decade.

“If you don’t decarbonise at a system level – in the production, logistics and supply chain leading to the equipment that moves America’s economy – you still have significant carbon emissions,” says Dr Jacob Ward, supply chain deployment manager, at the Department of Energy’s newly created Office of Manufacturing and Energy Supply Chains (OMESC).

Ward also warns that without a system-wide approach to cleaning up the supply chain, the proportion of carbon emitted in the supply and production of an EV would proportionally increase from between 10-25% to anywhere between 50-90%.

Subsidising the sustainable

From a logistics point of view, the act aims to accelerate investment in domestic production, reduce vehicle and component imports, and open new jurisdictions to service the EV infrastructure, according to Joe McCabe, president and CEO at analyst firm, AutoForecast Solutions.

The IRA promotes local production of both zero-emission vehicles and lithium batteries, and includes the domestic supply of battery materials, offering lots of provisions to source domestic materials and localise battery production from start to finish in the US.

Those provisions take the shape of grants, credits and direct purchases, with $2 billion in funding allocated for domestic manufacturing, and conversion grants for existing assembly facilities to make low-carbon vehicles. The US government has also allocated $7 billion to ensure domestic manufacturers have the critical minerals and other components necessary to make batteries. The IRA also includes $3 billion in credit subsidies for advanced technology vehicle manufacturing through the Department of Energy’s (DoE) Loan Programs Office.

Those provisions are backed up by other legislation designed to support the growth of EV sales in the US on popular models. That includes the $7.5 billion Bipartisan Infrastructure Law, part of which is facilitating a national network of 500,000 EV charging points.

Impact on imports

Carmakers are matching investment by the government to accelerate EV production in the US (see below). That comes with its own consequences as it will reduce vehicle imports and potentially the import of components. The IRA is one piece of legislation stimulating this change but it is also because of other content rules on automotive production, including those included in the US-Mexico-Canada Agreement (USMCA). Under the trade agreement the regional value content (RVC) for passenger vehicles and light trucks made in North Amercia is increasing to 75% by the end of next year. It means the content of the vehicles made will require more parts and materials to originate from within North America to qualify for preferential treatment.

“If you have a vehicle that is in the price point, why would you ship it from Europe to [the US]? asked McCabe. “You have to plant a flag and build it [in the US] and that is going to really change how things are moved back and forth.”

McCabe says vehicle makers need to draw up new business strategies for the next 15 years and identify which of their suppliers are likely to remain so and which are not.

At the same time, the DoE’s OEMSC is studying the lithium-ion battery supply chain and how critical materials are fed into the production of subcomponents and built into batteries. It is also looking at end-of-life uses for batteries and recycling.

“We can see overarching considerations emerge, questions relevant to DoE and our private sector partners, including costs, logistics, equity, bottlenecks and resilience,” says Ward.

Electric goldrush

The aim of localising production of EVs and batteries is something US-based carmakers have already collectively invested $100m toward and there has been a spate of recent announcements of further investment.

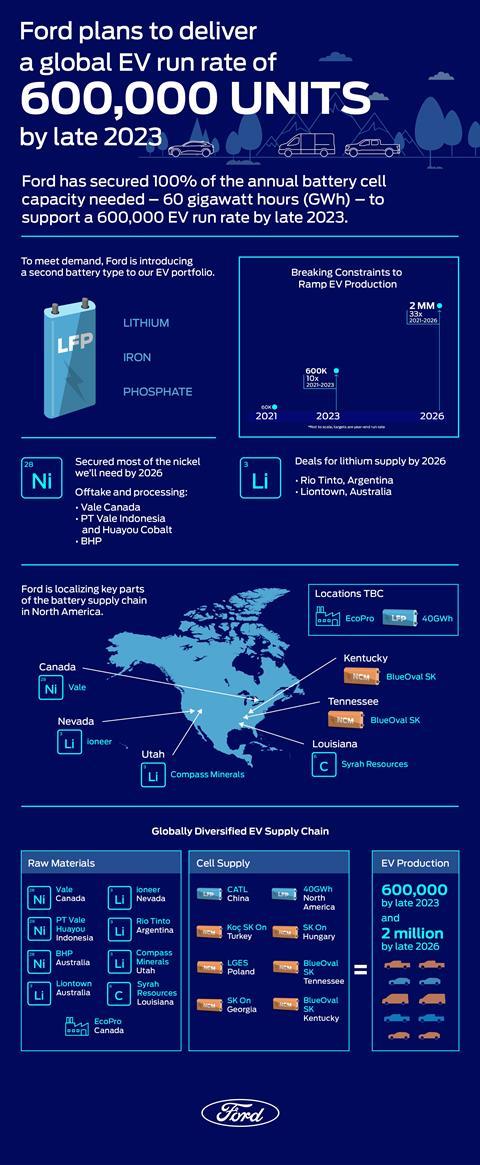

To take a few examples, in July this year, Ford announced a series of initiatives for increasing localised battery capacity and raw materials in support of its target to make 600,000 EVs a year globally by late 2023. Ford wants to increase that to 2m annually by the end of 2026 and is investing $3.7 billion in assembly plants in Michigan, Ohio and Missouri.

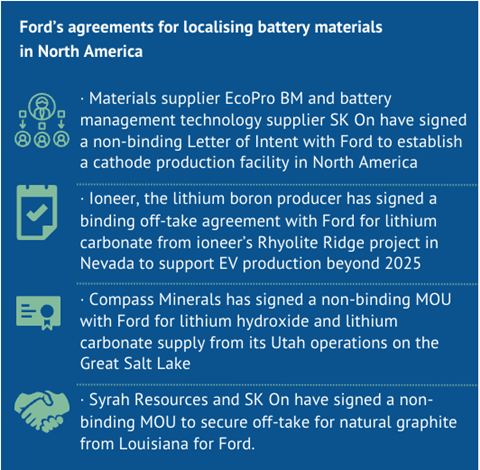

Those plans include localising battery materials in North America. Ford has signed a number of agreements with suppliers (see box below) to secure production in the US of the F-150 Lightning and Mustang Mach-E (the latter currently imported from China).

Stellantis has also signed agreements this year with Samsung SDI, Controlled Thermal Resources and with LG Energy for material sourcing and battery production in North America.

In March this year Stellantis outlined its Dare Forward plan to cut carbon from products and operations. In the US, the carmaker is daring to make battery electric vehicles (BEVs) account for 50% of sales by the end of the decade (compared to a 100% in Europe). Regionally, the carmaker plans to have a 25 new BEVs specific to the US.

Kia Motors also has a plan called the Kia Sustainability Movement, aimed at cutting carbon emissions across all operations from supply, logistics and vehicle production to vehicle use and recycling. At the same time, Hyundai has announced a $5.5 billion investment to build EVs and batteries near Savannah, Georgia.

Carbon-neutral logistics

Meanwhile, Mercedes-Benz US International (MBUSI) started production of its EQS fully electric SUV at the Tuscaloosa plant in Vance, Alabama, in August this year. That assembly is fed by local battery production at the nearby Mercedes-Benz Battery Plant in Woodstock, which the carmaker opened in March this year with Envision AESC.

MBUSI says it is working toward carbon neutral logistics as part of its Ambition 2039 environmental initiative, which aims to ensure all of its cars and light commercial vehicles are carbon neutral, including in their production, and through inbound and outbound logistics.

“The aim is to launch a CO2-neutral fleet from 2039 along the entire value chain and the entire lifecycle, including CO2-neutral logistics,” said the spokesperson.

Toyota has announced an additional $2.5 billion investment in manufacturing facility for EV production sited in a Greensboro, North Carolina, and Honda has signed a $4.4 billion joint venture with LG Energy Solution for a facility, the US location of which is yet to be announced.

Vietnamese EV maker, Vinfast, has announced a $5 billion+ investment in building electric vehicles and batteries in North Carolina and Tesla stands to benefit from Panasonic’s planned $4 billion battery plant in Kansas.

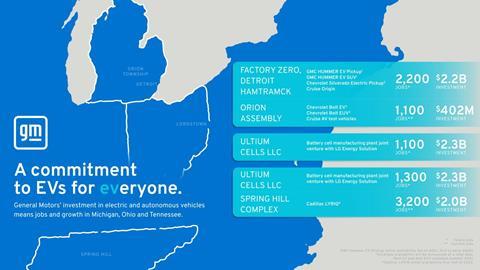

GM is also making historic investments to transform its entire portfolio. In July this year the carmaker secured a $2.5 billion loan through the Department of Energy’s Advanced Technology Vehicle Manufacturing programme to build battery manufacturing facilities in Ohio, Tennessee, and Michigan.

The carmaker said it welcomed the IRA and the provisions to accelerate the adoption of EVs and strengthen American manufacturing and jobs.

“This legislation will help drive further investments in American manufacturing, clean energy and sustainable, scalable, and secure supply chains as we work to establish the US as a global leader in electrification,” said GM in a statement. (See information below on GM’s investments to date).

Compromised content

However, as mentioned, carmakers are also critical that a sizeable proportion of their EV investments could be compromised by new rules governing eligibility for tax credits. The US does not have the battery manufacturing capacity or the localised supply of materials required to meet the production demand. That means a lot of vehicles will not benefit from incentives next year because the content of the batteries (and other key parts) will still be derived from overseas countries, including those deemed as foreign entities of concern.

The Clean Vehicle Credit part of the IRA stipulates that only those vehicles with final assembly in North America are eligible. That is effective immediately, with the result that far fewer vehicles sold from August 17 to the end of calendar year 2022 will benefit from the existing credit.

Stellantis confirms the new programme immediately limits eligibility to vehicles assembled in North America.

“Our lineup of eligible vehicles – the Chrysler Pacifica hybrid, Jeep Wrangler 4xe and Jeep Grand Cherokee 4xe – is included in this group,” says a spokesperson for the carmaker. “The US Treasury Secretary is expected to issue proposed guidance regarding the program’s application. Stellantis will advise its dealers accordingly.”

GM admits that some of the provisions in the new act are challenging and cannot be achieved overnight, though it remains confident about rising to the challenge because of the domestic manufacturing investments it is making to secure a supply chain for batteries and critical minerals. Regarding the planned production of the Chevy Equinox EV, which is scheduled for next year, GM said it was waiting for full US Treasury guidance to determine vehicle eligibility.

“The current ICE Equinox and the Equinox EV share many of the same suppliers, so we are leveraging the existing supply chain to produce the vehicle in the same plant in Ramos Arizpe, Mexico,” says a spokesperson for GM.

Enormous transformation

The immediate problems for carmakers currently making and selling EVs in the US were highlighted by one of the sector’s representative bodies, the Alliance for Automotive Innovation (AAI). It says the IRA is in itself a recognition of the enormity of the transformation facing the automotive industry.

“Automakers have already invested more than $100 billion in vehicle electrification – expanding the production of EVs inside the United States and across North America, and locating raw material and battery components on American soil,” said John Bozzella, president and CEO of AAI, in a statement after the signing of the act.

However, Bozella pointed out that requirements of the legislation’s purchase incentive disqualified 70% of the EVs currently sold in the US (including plug-in hybrid and fuel cell options). Furthermore, he said that none would qualify for full EV tax credit when additional sourcing requirements go into effect.

Eligibility for production

According to Bozella, there needs to a more gradual introduction of the legislative requirements for battery component, critical mineral and final assembly requirements. That is something that was picked up by Jennifer Safavian, president and CEO of Autos Drive America, another group representing OEMs in the US. Ahead of the act’s signing she said it would “take time for automakers to transition supply chains to meet the sourcing requirements in IRA and be able to provide consumers with a broad array of vehicles to meet their needs.”

Safavian went on to say that the US Congress did not recognise the necessity of working with all parties as supply chains were being developed within the North American region. She went further and said international allies in Europe and South Korea had already raised concerns that the Clean Vehicle Credit may violate international trade rules.

As detailed, the US has made some meaningful investments to support battery manufacturing. There is more than $15.5 billion in incentives and grants to ensure the US is building automotive supply chains and a globally competitive battery manufacturing platform. Over the long haul, that is going to be essential to making the widest range of EVs available to millions of additional drivers in all corners of the country.

However, Safavian said for the moment, the act was limiting that range: “At a time when countries and industry are investing together towards more resilient supply chains, we should not limit the partners that can help advance the transition towards cleaner transportation.”

Case study: GM

As confirmed in its second quarter earnings report published in July, GM now has binding agreements securing all of its battery raw material supply to support annual production capacity plans equal to 1m EVs in North America by the end of 2025. This includes lithium, nickel, cobalt and full cathode active material (CAM) supply.

In July it announced a long-term supply agreement with Livent for lithium hydroxide and an agreement with LG Chem for long-term CAM supply to support its EV plans. These latest announcements follow a three-year period of targeted investments to support localised EV production.

Battery cell manufacturing

-

December 2019: GM and LG Energy Solution invest $2.3 billion, via its Ultium Cells joint venture, to build an Ohio-based Ultium Cells plant for mass production of Ultium battery cells

-

April 2021: GM and LG Energy Solution announce a further $2.3 billion via Ultium Cells to build a battery plant in Spring Hill, Tennessee

-

January 2022: GM and LG Energy announce $2.6 billion investment to build an Ultium Cells manufacturing plant in Lansing, Michigan. A fourth US battery cell manufacturing site will be announced shortly .

Critical mineral investments

-

July 2021: GM forms a strategic investment and commercial collaboration with Controlled Thermal Resources (CTR) for the local and low-cost supply of lithium.

-

December 2021: GM and Posco Chemical announce plans to form a joint venture to establish a factory for processing CAM, a key battery material that represents ~40% of the cost of a battery cell.

-

December 2021: GM signs an agreement with GE Renewable Energy to support vertically integrated magnet manufacturing that both companies will use in the future. The companies will also work together to help establish new supply chains for additional materials, such as copper and eSteel, that are used in automotive traction motors and renewable power generation.

-

December 2021: GM signs an agreement with VAC, which makes advanced magnetic materials and the largest producer of permanent magnets.

-

April 12, 2022: GM signs a multi-year supply agreement for sustainable cobalt from the Glencore’s Murrin Murrin mine in Australia.

-

July 2022: LG Chem plans to supply more than 950,000 tons of CAM to GM beginning the second half of 2022 through 2030, enough for approximately 5m units of EV production.

-

August 2022: Livent will provide battery-grade lithium hydroxide to GM over a six-year period beginning in 2025. GM also enters a binding, long-term supply agreement with MP Materials to supply US-sourced and manufactured rare earth materials, alloys and finished magnets to GM.

No comments yet