Last year was one of unprecedented challenge for the UK’s vehicle handling ports but, as Marcus Williams reports, they maintained operations, invested in infrastructure and are taking lessons forward for future trade

As with the finished vehicle ports in mainland Europe, UK-based ports and terminal operators faced disruption to normal throughput across the year because of the Covid-19 pandemic. At the same time, like their counterparts across the Channel, port operators maintained services and even saw healthy numbers overall, in part because of increased traffic in Q4 ahead of the Brexit deadline.

“Despite the challenges brought about by the global pandemic, 2020 was a good year for automotive volumes handled by ABP, with total throughput reaching 1.1m vehicles,” says a spokesperson for the port operator. “This was almost evenly split between vehicles handled by the port of Southampton, the UK’s number one automotive port, and those handled by ABP’s ports on the Humber.”

ABP operates 21 ports in the UK, three of which handle finished vehicle traffic: Grimsby and Immingham on the east coast Humber estuary, and Southampton on the south coast.

That 1.1m figure was down on the previous year, when ABP handled 1.5m units, something the company says is unsurprising given the unprecedented challenges the global pandemic presented to the automotive industry. Those challenges included interruptions to manufacturing, and uncertainty around vehicle flows and storage requirements, something made more unstable by the fact different countries in Europe were going into lockdowns at different times for different periods. There were also variations in safety practices depending on location. The figure still puts Southampton port as the fourth busiest vehicle handling port in wider Europe, behind Emden in Germany and ahead of Antwerp in Belgium.

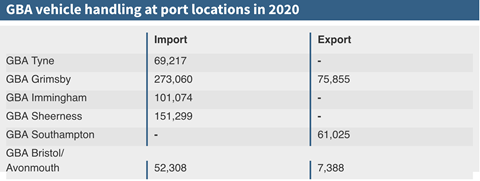

GBA Group, which manages finished vehicle imports and exports across six UK port locations, handled around 800,000 vehicles through 2020, again down by around 29% on the previous year because of the impact of UK’s first Covid-19 lockdown. GBA’s total vehicle handling, including technical and transport operations inland amounted to just over 1.3m in 2020.

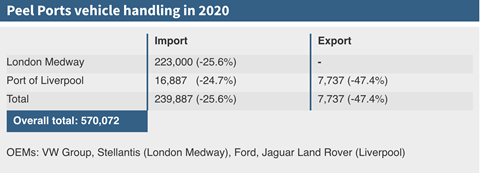

Peel Ports, meanwhile, also saw declines at its locations at the port of Liverpool and at its London Medway terminal, the latter of which handles the majority of the finished vehicle traffic (see table).

Safe handling

Despite the declines and variability thrown up by the pressures of 2020, vehicle handling ports around the UK remained operational throughout.

“ABP’s ports have continued to be open for business and have kept the supply chain moving,” says its spokesperson. “The company has been working closely with OEMs to assist in their transition towards new systems such as click and collect, and has introduced Covid-safe practices to keep its workforce and customers safe.”

Those safe working practices complied with UK government guidelines. There was not a significant impact on operations because of them, though limits on the number of people allowed to travel in one vehicle at the same time meant transport to port facilities took longer.

GBA’s managing director, Cale Judah, acknowledged that the severity of the first lockdown in the UK on port activity because of the slowdowns or complete stops that hit car manufacturing. Nevertheless, GBA continued to service all vessels and manage its terminals and technical centres throughout the lockdown.

GBA’s critical mass allowed for agile re-deployment of skilled labour between operations, and in multiple circumstances, allowed us the ability to assist customers where peer providers had been unable to respond to such pressures – Cale Judah, GBA Group

“New finished vehicle logistics providers such as GBA were amongst the first to recognise the approaching logistical strain given the advancement of the epidemic across Europe – with rolling impacts on factory production, parts movement and FVL flow,” says Judah.

He says GBA’s main focus at all times was to maintain the health and wellbeing of its 750+ employees.

“Preparing a response to this became the focus in February and early March, and upon formal lockdown, GBA needed to ensure all operations and individuals were safe and secure, whilst managing high levels of uncertainty from across its stakeholder base.”

In terms of safety, Judah says that adapting to the changing guidance and protocols surrounding Covid-19 required daily assessment amongst the management teams to ensure compliance. Additional health and safety protocols were required, which meant changes to processes and procedures and that impacted operational productivity.

“GBA worked to ensure suitable and safe scaling up of their operational teams and supporting infrastructure in order to achieve the same net effect of capacity output when such demand was required by its customer base,” says Judah.

That impact on operational productivity was something The Bristol Port Company also had to deal with. “We reduced the number of drivers in crew buses, which reduced our productivity,” says Tony Dent, director of automotive trade at the company. “We also introduced staggered start times and breaks to avoid crowded mess rooms.”

The main focus for Peel Ports in the first half of 2020 was reacting and adapting to government guidelines on health and safety for the workforce while at the same time ensuring operations continued as efficiently as possible.

“Adhering to government guidelines meant reducing the number of operatives working at our ports at one time to allow for social distancing, and resulted in some operations taking longer and requiring additional planning,” says a spokesperson for the port operator.

The company quickly adapted, and working with its third-party labour provider, it created working bubbles – where groups of employees stayed in one working group rather than mixed – to minimise the impact of positive Covid cases among the workforce on its customers.

Room to move

In the second half of the year assembly at the UK’s vehicle assembly plants was maintained, which improved flow and throughput for exports out of the vehicle handling ports, though it did also create a greater demand for storage space. Port operators were able to respond flexibly by providing additional space both on and off the port terminals. However, that demand for additional space was also affected by an increase in contingency stockpiling ahead of the Brexit deadline.

“Fortunately, over the past years, ABP has continued to invest in its vehicle storage facilities in Southampton and the Humber, which means it has been able to cope with increased volumes, and traffic at its terminals has not been adversely affected,” says its spokesperson.

Peel Ports says OEM customers did bring more volumes into its London Medway terminal prior to the deadline but that overall it found that previous Brexit deadlines (of which there were three) had more of an impact on traffic than the final one.

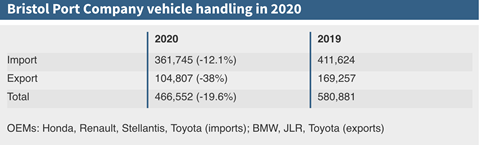

At Bristol, the increase in traffic caused by the Brexit deadline put the port close to full capacity over its almost 220 hectares of car compounds, but overall the transition went relatively smoothly according to Dent. Looking ahead to the future prospects for trade, Dent says the ability to provide the best service at the right cost will continue to be the driver.

At GBA, Judah says that the second half of 2020 was very different to the first half of the year. There was a clearer picture of the parameters imposed by the pandemic helping the company to better mitigate the impact of the disruption on operations.

“GBA high-volume operations re-commenced in June, and whilst volume management remained highly volatile owing to differing states of OEM supply chains pre-lockdown, throughput/demand presented no significant issue to GBA,” he explains.

The key differentiator in the second half of the year, according to Judah, was an intensified demand on active labour management given the control measures put on the workplace.

“GBA’s critical mass allowed for agile re-deployment of skilled labour between operations, and in multiple circumstances, allowed us the ability to assist customers where peer providers had been unable to respond to such pressures,” he says.

As far as the Brexit transition went, Judah says that volume increases were a factor in December last year but that OEMs that had well-established and technically robust plans to deal with changes in the customs requirement from January this year, including VW Group, Toyota, Porsche and Mazda, did not need to accelerate imports to the UK.

Now that the UK has left the European Union the long-term prospects for vehicle trade through the country’s port locations under new trading arrangements may be more vulnerable to market dynamics. While ABP only expects there to be minimal impact for vehicle imports it says exports are more likely to be affected.

“UK vehicle manufacturing requires UK battery production to safeguard and maintain current volumes,” says its spokesperson. “ABP is working closely with government and other stakeholders to better understand the risks and support its automotive customers in this dynamic environment.”

Digital support

As mentioned by ABP above, the use of online digital tools to facilitate sales during the pandemic has helped to keep volumes moving.

“One of the major impacts of Covid-19 has been the imposition of social distancing measures, which have transformed consumer behaviour and accelerated the transition towards digital tools such as click and collect,” says ABP.

The ports have also been using digital solutions to maintain vehicle handling operations, and ABP says it has been inspired over the 12 months of 2020 to explore new digital tools for use in the future. Furthermore, ABP will be announcing “a series of exciting upgrades when it comes to IT infrastructure” in 2021.

It kicked those upgrades off with the announcement in April this year that it is working with Verizon Business and Nokia to deploy a private 5G network at the port of Southampton. The network is on the Nokia Digital Automation Cloud, an application platform providing high-bandwidth, low-latency, hyper-fast private wireless connectivity and local edge computing.

“Businesses such as ABP are coming under more pressure to evolve their services at tremendous speeds in order to take advantage of new commercial opportunities,” says Tami Erwin, CEO of Verizon Business. “Along with Nokia, we have been able to equip ABP to take advantage of the immediate benefits private 5G offers, and most importantly prepare the port of Southampton to take full advantage of new technology applications and real-time analytics, which will digitally transform its services in the future.”

At GBA, Judah says the industry is not new to volatility and while development was not required to build a response to operational volatility, 2020 did provide the company with an opportunity to accelerate investment into the digital offering for its customer base. This now includes an end-to-end control tower suite of applications and the recently launched GBA eCustoms platform.

At Bristol, meanwhile, the port operator has introduced a new communication tool to provide instant information to the workforce’s smartphones about Covid updates and shift changes, amongst other things.

Investment in infrastructure

The disruptions caused by Covid-19 and the uncertainty over future export trade have not curtailed investments in automotive port facilities or services.

Peel Ports continued to drive forward planned investment in capacity in 2020 at both Medway and Liverpool as it prepared for Brexit and beyond.

“We’ve increased storage availability to support smooth operations for our customers and enabled the re-utilisation of warehouse space,” says its spokesperson. “The port of Liverpool has an extensive land footprint and space availability to enable the storage of goods.”

Ahead of 2020 Peel Ports had created 9.3 hectares of additional space for vehicle storage at the Thamesteel site at the port of Sheerness. In 2019 it also invested £5.5m ($7.6m) to replace the Royal Bridge Pontoon to increase overall throughput capacity at the port. Both moves helped to handle additional volumes and longer dwells last year.

Recent investments at ABP include £50m in new vehicle handling facilities at Southampton, which has increased vehicle storage capacity, as well as investment in infrastructure to handle larger vessels, such as the £26m Grimsby River Terminal.

“We have introduced a vehicle management and preparation service over the past year, which has led to enhanced vehicle handling capability,” says ABP’s spokesperson. “In addition, we have also introduced a port customer handover process and facilities, which has helped facilitate a seamless way for customers to pick up their vehicles during the pandemic.”

ABP Southampton has also recently invested £300,000 in a new rail service to move between 600 and 800 Minis per week from the plant in Oxford to the port, in collaboration with rail freight provider DB Cargo UK and Southampton Cargo Handling (SCH), which discharges the vehicles at the port. It is the first automotive rail service to operate in the Southampton port’s western docks.

Given Bristol’s unique position to cater for deep-sea and short-sea vessels, together with land capacity and excellent inland connectivity, we are well placed to meet the challenges of the future – Tony Dent, The Bristol Port Company

The Bristol Port Company has also invested in infrastructure during 2020, with two new pre-delivery inspection (PDI) facilities built and an increase in capacity for car storage. One of the problems at Portbury docks during the first half of the year was a lack of space, according to Dent. “With very few import cars being delivered and ships continuing to arrive, there was considerable pressure on space at Portbury,” he says.

By the second half of the year, however, there had been a great improvement in managing dwell time at the port and throughput times were reduced on previous years. With extra storage capacity (more of which will be added in 2021) and additional processing facilities, the docks were able to cope with the increased import volumes resulting from the Brexit deadline and are now well equipped to cope with any future volatility.

Meanwhile, GBA built and launched its High Performance Centre (HPC) at the Sheerness port terminal, which provides pre-delivery inspection (PDI) and technical repair services for the premium and luxury car segment.

Additionally, in Grimsby, GBA launched its Automotive Technical Centre (ATC), which includes a volume PDI centre, with specialised services for electric and hybrid vehicles, and a body shop able to handle commercial vehicle services.

“[The] ATC will also be the home to GBA’s upcoming EV Apprenticeship Academy; with the introduction of its EV Training Centre,” says Judah, adding that the facility is also home to the aforementioned eCustoms unit and control tower, which operate under its GBA Technologies business.

Freeport fortunes

The UK government has created eight so-called freeports (similar to free trade zones) to support trade post-Brexit. Normal tax and custom rules are waived at the freeports and imports can enter with simplified customs documentation and without paying tariffs. The establishment of freeports is designed to specifically encourage businesses that import, process and then re-export goods.

According to ABP the move promises to unlock billions of pounds of investment. Four of the freeports include ABP facilities on the Humber, and in Southampton, Garston and Plymouth.

“The freeports policy presents an opportunity to grow UK trade and exports by attracting further investment in the UK’s thriving ports sector, helping to create jobs and boost manufacturing in port locations,” says ABP.

Furthermore, ABP says it has expanded its automotive team, not only to meet the requirements of customers throughout the pandemic, but also to support them through what it calls the “forthcoming evolution in the automotive industry”, a major part of which is the electrification of passenger cars.

Electric future

ABP is in fact proving itself to be ahead in preparing for the increased volumes of EVs. Additionally, it is an early adopter of EVs for port services itself. The company already has a sizeable fleet of EVs being used for port services at its locations and a number of charging points to support them, on which it will build for customer traffic.

“This investment has not only helped reduce the carbon footprint of our own operations but also those of our customers,” says ABP’s spokesperson.” There are currently around 100 EV charging pedestals across ABP’s estate and we are working with OEMs to provide charging capability and ensure that the energy used comes from renewable sources. Our ambition for the port of Grimsby is that it will ultimately become a carbon neutral port in future.”

Peel Ports is also promoting the electrification of its fleet of port vehicles and intends to have 50% of the fleet electric by the end of this year, helping to reduce emissions and improve air quality across its port network. At the London Medway facility it has also invested in training for all staff on handling EVs and is on an ongoing initiative to install EV charging points.

At GBA, Judah says that the next two years are exciting ones for the company – despite the difficult macro-economic situation – as it will be investing in infrastructure to support the increasing demand for EV shipments.

“Whilst 2021 will undoubtedly represent a challenging period from a volume perspective, complexity in a post-Brexit, Covid-aware, EV-fixated and disruptor-attracting world presents ample and exciting opportunity to forward thinking finished vehicle logistics innovators such as GBA,” he says.

ABP, meanwhile, has also introduced modelling tools to make the movements and distance travelled by vehicles more efficient, which it says has helped reduce CO2 emissions and is having a positive effect on reducing costs.

“We have also introduced [vehicle] photo booths, a port customer handover process and facilities along with consolidation of vehicle storage sites across different locations,” says its spokesperson.

Looking ahead, ABP says it expects a stronger growth in finished vehicle handling in the latter half of 2021, something that will be helped by the introduction of new vehicle management tools and IT solutions, which will increase its capacity and capability to handle additional volumes across its port locations.

What the port operators will also be taking forward are strategies and techniques for handling volatility, lessons that have been learned through the disruption caused by the Covid pandemic and the variance caused by pre-Brexit uncertainty and preparation.

Some of the areas ABP has been focused on include improving storage options and flexibility, and making strategic investments in upgrading IT infrastructure to support operations and increase productivity.

As seen on the European continent, a diverse mix of cargoes has helped to offset deficits to automotive volumes caused by the coronavirus pandemic, something that all the major UK port operators recognise as an advantage.

More features from the spring edition of AL FVL magazine are available here

No comments yet