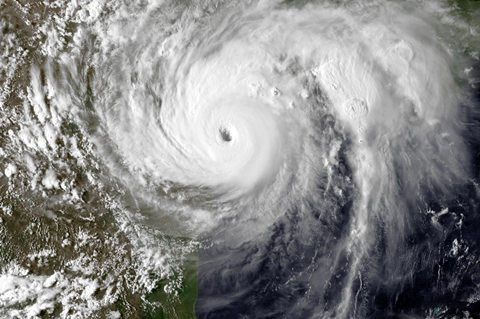

With 2019 set to be one of the hottest years on record, for the shipping sector the issue of climate change is becoming a concern. But how great is the danger to vessels, their crews and cargo? And could there be any upside to global geographical changes?

Summer temperatures in the southern hemisphere have already passed multiple historical highs. And as the world warms up, many long-term forecasts suggest that there will be an increase in extreme weather incidents across the globe, leaving the strategic outlook for shippers, logistics companies and their customers certain to change over the next decade.

“The next three to five years will be a crucial period for the development of policy details against which shipowners, operators and customers can then start to strategise how best to modify their investments and decision-making,” says Tristan Smith, reader in energy and shipping at the Bartlett School of the Environment, Energy & Resources.

Rising costs

Petra Löw, head of NatCatService Climate at German reinsurance specialist Munich Re, says 2018 was the fourth most expensive year since 1980 in terms of insured losses, with weather-related events costing the global insurance sector an estimated $160 billion. She further cites a “long-term trend towards a greater number of storms and floods”.

The firm estimates that storms accounted for 42% of these losses, while floods, flash floods and landslides caused 46%, and a further 7% were the result of heat, cold and wildfire. With incidences of all of these expected to rise as a result of global warming, such costs are likely to increase.

Munich Re goes on to note that 43% of insured losses were in Asia, 20% in North America, 14% in Europe and 13% in Africa – and only 50% of global macroeconomic losses from natural catastrophes in 2018 were insured.

Meanwhile, 2017 was the most expensive natural disaster year on record, claims Petteri Taalas, secretary general of the World Meteorological Organization (WMO). “Worldwide, we incurred losses of $330 billion, two-thirds of which were related to the Caribbean hurricane season. The most financially devastating event was the flooding in Houston, US,” says Taalas.

It is not just the direct effects of such extreme weather events that add to costs for automotive logistics operations. For shippers operating in already congested ports, for instance, delays can add significant costs and disruption. Backlogs or port closures can seriously impact on schedules far beyond the vessels directly caught up in storms.

For shipping lines operating via the port of Houston, Hurricane Harvey in 2017 had a much wider impact than just the lost cargo: damage to infrastructure meant a backlog of weeks in processing cargo and the port’s position as a refining hub also meant fuel prices increased by 4%.

The capacity of extreme weather events to change the relative dynamics of regions may also lead to some changes in routes, though for now, most operators do not see any need to make permanent alterations to their schedules.

“We do not foresee a significant change in the impact from the physical aspects of climate change over the next five to ten years,” comments Roger Strevens, vice-president for global sustainability at Wallenius Wilhelmsen.

“Even if storms become more severe, our ability to avoid them is good. It is an inevitability that a fleet in global operation will encounter heavy weather from time to time… however, with the adoption of sophisticated route optimisation technology across the fleet, the frequency with which vessels are exposed to the worst of such conditions has decreased.”

For Norwegian shipping group Höegh Autoliners, too, the increase in natural disasters is regarded as part and parcel of normal business, with climate change part of a global evolution of the group’s strategy and planning for extreme weather now the norm.

“Weather is something we expect when running vessels in global trade networks and we have well-developed mechanisms that ensure we are well informed of the upcoming weather on a route. We always lash our cargo as if the vessel was going into a storm. Cargo lashing is something we take very seriously and we continuously follow developments in the market to ensure we have the best products available. In addition, we are continuously in dialogue with OEMs on what is the safest lashing for their specific cargo,” says Höegh spokeswoman, Gabriela Stojicevic.

Regulatory influence

Beyond the direct effect of changing weather patterns, climate change is also forcing change on shipping lines as the International Maritime Organization (IMO) seeks to implement stricter emissions regulations, adding complexity to the planning of global routes.

“For now, policies related to climate change have had a relatively minor impact on operations [but] over the next ten years and further, we will probably see the stringency of these policies gradually increase in order to drive the necessary change,” Tristan Smith notes.

As evidence grows about the impact of climate change, Smith predicts “the generally slow response globally” will pick up and that such policy implementation will increase “very rapidly”. Should this happen, logistics firms may face a regulatory cliff-edge as governments rush to make up lost ground and implement strict legislation to limit greenhouse gas emissions, he adds.

The upcoming IMO global sulphur cap change due to come into force in 2020 is already adding a cost burden and could be followed by a rash of further rules, he warns.

Shipping services consultancy Clarksons says that with a global car carrier fleet totalling 836 vessels offering an aggregate car capacity of 4m units, even minor retrofitting requirements will add significant costs.

Policies related to climate change have had a relatively minor impact on operations [but] over the next ten years and further, we will probably see the stringency of these policies gradually increase in order to drive the necessary change – Tristan Smith, Bartlett School of the Environment, Energy & Resources

“We estimate around 22.3m cars (excluding intra-EU trade) were transported in 2018,” says Stephen Gordon, MD of Clarkson Research Services. He adds that the new IMO rules in 2020 may drive “volatility in freight costs as, in addition to the higher cost of fuel or cost of fitting a scrubber, we are likely to see some off-hire time while vessels have a scrubber fitted, and the potential for slow-steaming,”

That view is backed up by Smith, who expects a general cost increase as car carriers are forced to move from current low-grade fossil fuels towards zero-emission fuels. But, he notes, this cost is likely to reduce over time as the technologies for zero-emission propulsion become less expensive and the supply of related fuels becomes more widespread, benefitting from both greater competition and economies of scale.

At the moment, the traditional fuel oil price would need to rise substantially to make alternative fuels competitive, he points out. “Current estimates of the carbon price required to sufficiently close the price differential vary from $50-$300-plus per tonne, depending on the scenario and assumptions used. This could increase fuel/energy costs by about 30-200%,” Smith says.

Roger Strevens of Wallenius Wilhelmsen concurs. “It seems safe to say that the transitional effects of climate change will be enormous in coming decades… It is a certainty that the IMO will introduce regulation to drive progress toward GHG [greenhouse gas] reduction targets. However, it is still impossible to know what form they may take.”

Production shifts

A further potential impact of regulation may be increased differential between regional regulatory frameworks, something that could incentivise shifts in production or different forms of multimodal transport.

“Regulation related to climate change could create shifts in production… however, it is not clear that the strengths of the incentives will be significant relative to all the other political, social and economic drivers that already affect location decisions,” Smith says.

With fragmented adoption of controls in disparate regions, such as the introduction of Emission Control Areas in only some parts of Europe, it may make sense for shipments to move to different ports in future, with final transport completed by land, while regulation on manufacturing may see production shift away from certain countries. At this stage, however, most shipping lines expect it to be business as usual.

“Demand is affected by myriad factors among which climate change is just one. It is not to be assumed that climate change would even be the dominant factor in demand change. So, while it is possible to imagine scenarios whereby climate change could affect demand (and by extension trade lanes), whether such scenarios are likely to materialise is presently unknowable,” Strevens comments.

Software and prediction

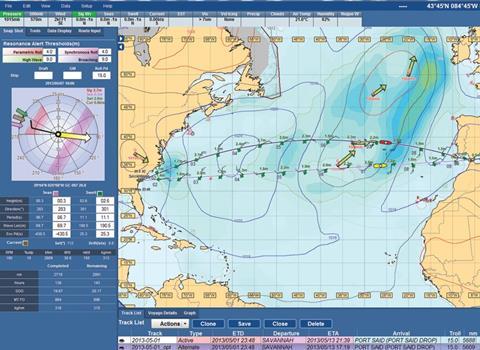

One key element in any strategy to tackle the impacts of climate change is the development of improved forecasting software, tied to tools that can help automotive logistics firms with planning, modelling and preventative measures.

For Höegh, the development of new software and technology to monitor and predict weather patterns will be central to supporting its global fleet, says Stojicevic.

“We are working closely with weather routing. [At] Höegh, it is important for us to work with the best suppliers of weather routing and, going forward, we expect that these will have even more advanced data collection and analysis capabilities, as new and improved digital products emerge,” she states.

At Wallenius Wilhelmsen, route optimisation software is also central to growth. Strevens says the group already uses state-of-the-art route optimisation for all its voyages.

“This software determines the quickest, safest and most fuel-efficient route between two points, which is often not a straight line. After consideration of weather and currents, some degree of deviation from the shortest route will frequently be worthwhile in terms of time required, fuel needed and/or reduced exposure to severe weather,” he says.

“As a further enhancement, on our fleet the route optimisation tool is connected to the vessels’ motion reference units (MRUs). That gives officers predictions for vessel motion, enabling them to take countermeasures to avoid excessive movement/accelerations during severe weather which might otherwise be dangerous, both to crew and cargo.”

Warming to new skill sets

As forecasting and planning software complexity increases, crew and ground staff will be required to understand the flow of data, with more detailed simulation training providing experience of a wider range of atypical weather conditions.

“Höegh’s Masters and Officers are trained in weather routing and have 24/7 weather routing support. We also ensure our crew is trained and assessed in handling bad weather [including] simulation training,” says Gabriela Stojicevic.

New training programmes may also be tied into the evolution of power systems, as shipping lines are forced to move away from fossil fuels and the introduction of alternative power sources brings additional risks and challenges.

For instance, while LNG or hydrogen are less polluting than marine fuel oil, they both require careful storage at ultra-low temperature in pressurised tanks, raising technical difficulties for storage and handling, and producing significant risks in an extreme weather event.

“The sector will have to move away from its use of fossil fuels in the mid-term. [This] will require different fuel and machinery systems, increasing use of electrification and maybe handling of cryogenic liquids (like hydrogen) – which create a requirement for a very different skill set to the ships of today,” notes Tristan Smith.

Route optimisation can also identify opportunities to favourably exploit variations in weather during any given voyage, he says. Often, he explains, it can be better to run at higher speeds in good conditions and take more time in poorer ones, in order to use less energy.

The central role of software in planning for change is something Bjorn Svenningsen, director of sales and marketing at ro-ro shipping line UECC, expects to have multiple benefits.

“In day-to-day operations, it might help us in a similar way as weather forecasts and route planning are doing today [while] in the longer term, it might help us in the design of future vessels,” he says.

Using data to plan operations and inform vessel design offers advantages for shippers beyond the building of more robust ships, as more granular data collection is also expected to lead to more efficient vessels.

“There are many applications of software for optimising a system and enabling energy efficiency improvements. It is most effective if coupled with high-quality measurements of energy use and the drivers of energy use, which are increasingly becoming available,” Smith says.

“There is also a great need for different organisations within the value chain to obtain data on carbon emissions associated with the services they are purchasing, so that they can enter a dialogue with the shipping service providers to explore how they could achieve lower carbon footprints. Software can help enable a more transparent discussion on this topic and be highly effective at driving change, as we wait for regulation to be put in place.”

Taalas of the WMO reinforces the need for investment, outlining the background against which decisions must be made. “If we are not able to reduce emissions by 80% by 2050, then we will see more than two degrees of global warming, which means a growing number of disasters… This 30-year window is now open and without private sector investments, we are not going to be successful in reaching these targets,” he warns.

Building in resilience

Given the difficulty in predicting climate patterns, even over the short term, the approach of shipping providers for now is one of building ever better resilience into global fleets.

“It’s difficult to say whether a single extreme event is due to climate change or just weather [but] regardless of whether conditions today are an effect of climate change or not, vessels have had to be able to contend with severe storms since time immemorial,” states Roger Strevens of Wallenius Willhelmsen. “Critically, our fleet now has sophisticated route optimisation technology at its disposal, which means it is much better able to foresee and avoid such conditions in the first place.”

This strategy of adaptation and investment in technology to accommodate the impact of climate change is likely to be of increasing importance to automotive shipping in the decades to come.

“Companies who have thought ahead and anticipated their strategy for managing foreseeable changes, such as how to reconfigure to operate on zero-emission propulsion, will be in a much stronger position,” Smith states.

Climate change: The upside

Climate change may come with many downside risks but there are also some potential upsides for the automotive sector – not least the possibility of new, shorter shipping routes opening up via the Arctic.

Previously inaccessible due to year-round sea-ice, higher temperatures combined with new technology have begun to raise the possibility of shipments via the Northern Sea Route, running along the Russian Arctic coast from the Kara Sea to the Bering Strait.

“It does appear that routes across the Arctic have the potential, in the latter parts of this century, to reduce the distance and time taken to connect certain regions, for example East Asia and Europe. If the more alarming estimated rates of Arctic temperature change occur, this could be as soon as coming decades,” Tristan Smith states.

However, he continues: “It may be that the overall opportunity and cost changes are marginal until the Arctic is very substantially ice-free.

“The environmental and ecosystem sensitivities of the Arctic also mean that it could be a region with more stringent environmental regulation than other routes, further reducing the benefits of it being used as a shortcut.”

“To operate in waters where ice is even a risk means stronger hulls and ruggedised props and steering gear, which would make the vessel uncompetitive when it is not operating in icy waters,” adds Roger Strevens. “Also, ro-ro trade lanes tend to involve multiple ports of load and discharge. There are not so many ports along the northern routes, which could further strain the business case.”

For Wallenius Wilhelmsen, says Strevens, the upside opportunity of climate change lies not so much in new routes as in the possibility of new investment and growth, as technologies and solutions proliferate.

The group has taken a three-pronged approach to the challenges posed by climate change as it aims for the longer-term goal of decarbonisation. “Firstly, we seek to partner with innovators to trial new technologies and we are willing to invest in what proves to make both environmental and economic sense,” he says. “Secondly, we seek to attract innovators to our industry. Finally, we seek to engage in the regulatory process to achieve progressive yet pragmatic outcomes.”

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet