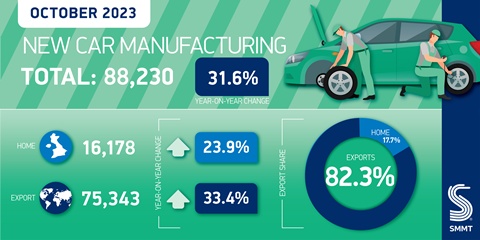

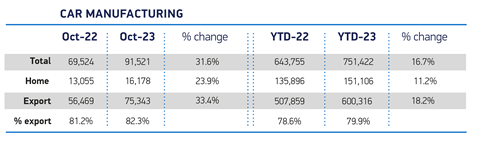

UK passenger car production increased by nearly 32% in October to just over 91,500, according to the Society of Motor Manufacturers and Traders (SMMT). The increase was driven by further growth in exports, which accounted for more than 82% of production.

Vehicle shipments to the EU were up 58.5%, accounting for two-thirds of exports (65.2%). The second biggest market for cars made in the UK was the US, followed by Turkey, China and Japan. Production for the home market in October rose by almost 24%.

UK production of battery electric (BEV), plug-in hybrid (Phev) and hybrid (HEV) vehicles also grew by just over 52% to represent 40% of all cars made in the month. The SMMT said that UK factories have turned out more than 287,400 EVs in the first ten months of the year, up 59% on the same period in 2022, helping to push overall car production up 16.7% to more than 751,400 units.

UK investment

The figures follow recent announcements of automotive investment in the UK, including a £2 billion ($2.5 billion) government funded Advanced Manufacturing Plan that includes a £50m of funding for the EV battery supply chain, as well as private investment by carmakers and battery makers.

“These figures, coming on the back of a series of significant investment announcements, signpost a bright 2024 for the UK automotive sector. Government and industry are committing billions to transform the industry for a decarbonised future,” said Mike Hawes, chief executive of the SMMT. “Last week’s publication of an Advanced Manufacturing Plan and Battery Strategy, the announcement of permanent full expensing in the Chancellor’s Autumn Statement and the £2 billion commitment Government has made to advanced automotive manufacturing, underscore the increasing competitiveness of the UK. Automotive remains one of the country’s most critical industries, delivering jobs, productivity and economic growth across the country.”

Based on the growth trend Auto Analysis forecasts that UK vehicle makers will produce 1.008m cars and light vans in 2023, up 18% on last year, with further growth anticipated in 2024.

However, the SMMT said that a workable solution to the EU-UK rules of origin requirement for batteries was needed to maintain export-led production. The Brexit trade deal will be updated on January 1, 2024 and could lead to tariffs on EVs traded between the UK and EU. Electric vehicles will need to have 45% EU or UK content from 2024, with 50-60% requirement for battery cells and packs. If they do not an import tariff of 10% will be applied.

![Global[1]](https://d3n5uof8vony13.cloudfront.net/Pictures/web/a/d/s/global1_726550.svgz)

No comments yet